Wormhole, a decentralized protocol that enables cross-chain communication and asset transfer, has announced that it has raised $250 million in a Series A funding round led by Coinbase Ventures, the investment arm of the leading cryptocurrency exchange. The round also saw participation from other prominent investors, such as Polychain Capital, Alameda Research, Multicoin Capital, and Paradigm.

Wormhole aims to bridge the gap between different blockchains and enable interoperability among various ecosystems. The protocol leverages a network of validators that run specialized nodes to relay data and assets across chains. Wormhole currently supports Ethereum, Solana, Terra, and Binance Smart Chain, and plans to add more chains in the future.

The protocol has seen significant adoption since its launch in August 2021, with over $1 billion worth of assets transferred across chains using Wormhole. Some of the popular applications that use Wormhole include Saber, a cross-chain liquidity network on Solana, and Mirror Protocol, a synthetic asset platform on Terra.

Register for Tekedia Mini-MBA edition 17 (June 9 – Sept 6, 2025) today for early bird discounts. Do annual for access to Blucera.com.

Tekedia AI in Business Masterclass opens registrations.

Join Tekedia Capital Syndicate and co-invest in great global startups.

Register to become a better CEO or Director with Tekedia CEO & Director Program.

With the new funding, Wormhole plans to expand its team, develop new features, and grow its community. The protocol also intends to launch its own governance token, WHOLE, which will be used to incentivize validators and users, as well as to enable decentralized decision-making.

Coinbase Ventures, the lead investor in the round, expressed its confidence in Wormhole’s vision and potential. “We believe that Wormhole is building a critical piece of infrastructure for the future of crypto.

By enabling seamless cross-chain communication and asset transfer, Wormhole is unlocking new possibilities for innovation and collaboration across different ecosystems. We are excited to support Wormhole as they continue to grow and scale their protocol,” said Shan Aggarwal, Head of Coinbase Ventures.

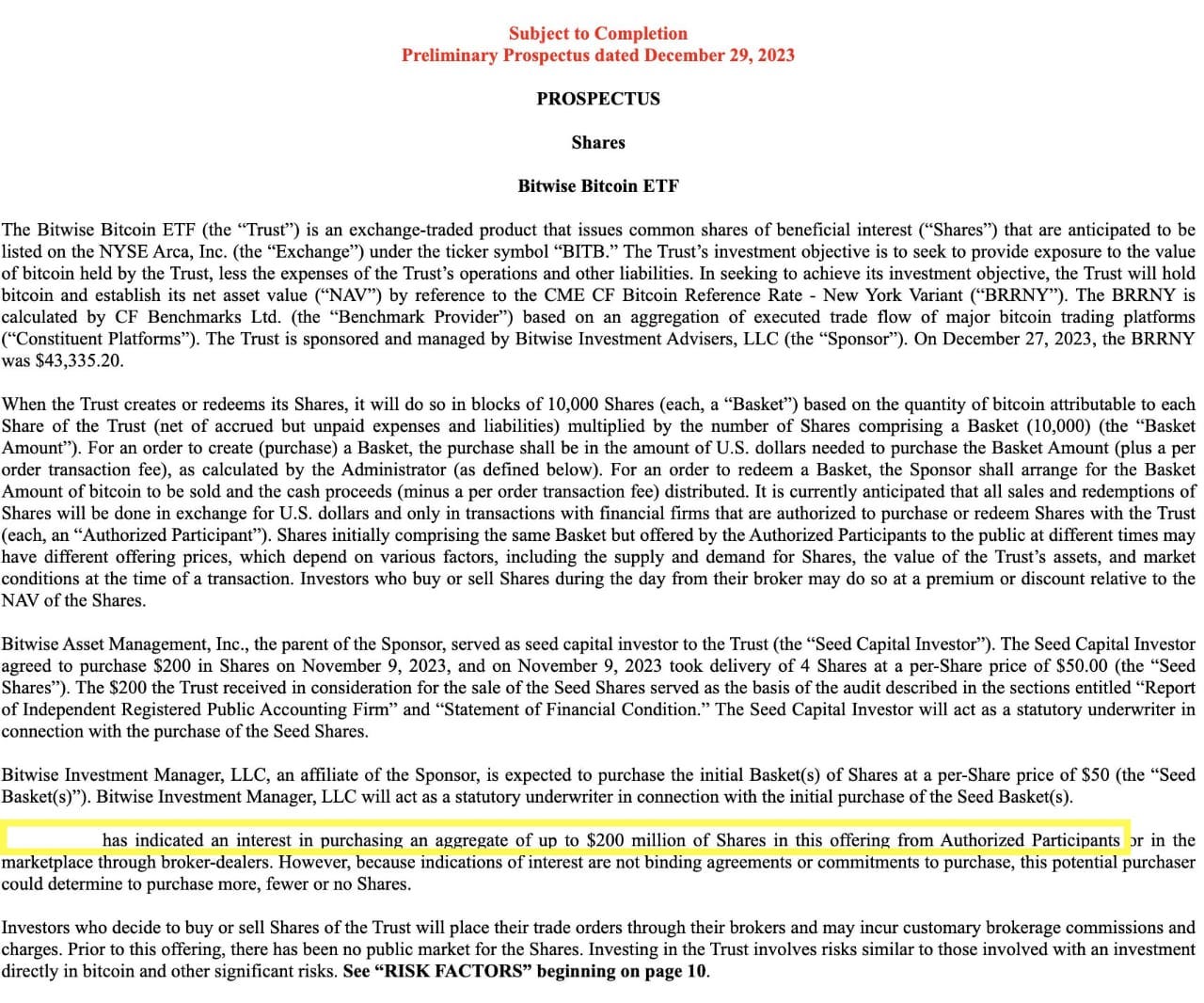

Bitwise S-1

The crypto world is buzzing with the news that Bitwise, a leading provider of index funds and ETFs for digital assets, has filed its S-1 registration statement with the SEC. This is a big step towards launching the first U.S.-listed bitcoin ETF, which could open the doors for more institutional and retail investors to access the crypto market.

But what’s even more interesting is the revelation that someone (we have a pretty good guess who) is planning to invest a whopping $200 million in the Bitwise Bitcoin Trust (BITB), the fund that will track the performance of the Bitwise Bitcoin Index. This is a huge vote of confidence in Bitwise and its index methodology, which aims to provide the most accurate and transparent representation of bitcoin’s value.

To put this in perspective, the largest investment in a crypto ETF so far was made by BlackRock, the world’s biggest asset manager, which bought $10 million worth of shares in the Canadian Purpose Bitcoin ETF earlier this year. That was already a significant milestone, but Bitwise’s potential investor is taking it to a whole new level.

Who could this mystery investor be? Well, we don’t know for sure, but we have some clues. The S-1 filing states that the investor is an “accredited investor” who has entered into an agreement with Bitwise to purchase BITB shares at the NAV (net asset value) per share on the date of issuance. The agreement also stipulates that the investor will not sell or transfer any of the shares for at least six months after the purchase.

This sounds like someone who has a long-term vision for bitcoin and Bitwise, and who is not afraid to make a bold move in anticipation of the ETF approval. It also sounds like someone who has a lot of money and influence in the crypto space. Could it be one of the well-known bitcoin billionaires, such as Michael Saylor, Jack Dorsey, or the Winklevoss twins? Or could it be a large institutional player, such as MicroStrategy, Square, or Tesla?

We may never find out for sure, but one thing is clear: whoever this investor is, they are making a strong statement about the future of bitcoin and Bitwise. And they are giving us all a reason to be excited about what’s coming next.