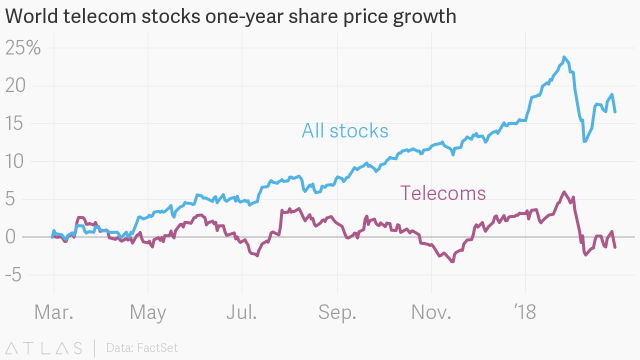

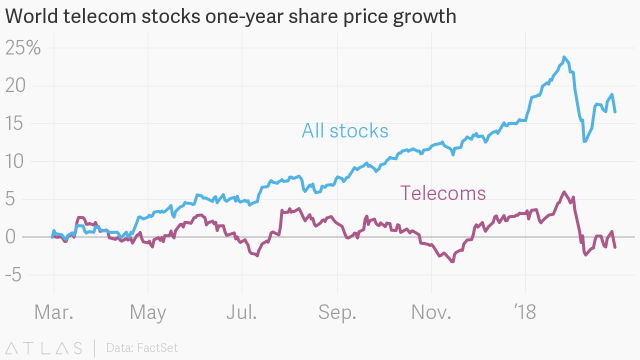

MTN Nigeria now enjoys a market cap of N2.636 trillion ($8.5 billion), clearly more than 20% of the total value of the Nigerian Stock Exchange. This is simply amazing because the global average of telecom stocks is actually below water, according to data compiled by Quartz. Yes, despite the largely boom stock era in the developed world, the telecoms have struggled. In the developed world, telcos have been normalized – dead pipes powering modern commerce. Yes, they are stuck at the center of that smiling curve.

But in the developing world, they remain the promise to get us into modern commerce. This shift is huge, and the reason to understand that it is getting easier to become a millionaire in developing world than in the developed world. Have that in mind because more wealth will be created in the developing world than anywhere on earth over the next three decades. But that does not mean that the indigenes of the developing world will be the custodian of that wealth!

Africa has a promise for the telecom sector even as the developed world flattens.

Register for Tekedia Mini-MBA edition 19 (Feb 9 – May 2, 2026): big discounts for early bird.

Tekedia AI in Business Masterclass opens registrations.

Join Tekedia Capital Syndicate and co-invest in great global startups.

Register for Tekedia AI Lab: From Technical Design to Deployment (next edition begins Jan 24 2026).

---

Connect via my

LinkedIn |

Facebook |

X |

TikTok |

Instagram |

YouTube

How many sectors are actually active/functional in our market? To class what is obtainable in Nigeria as an economy could be confusing and misleading, sometimes.

I see Nigeria more like a ‘trade route’, depending on what you trade on, you could make a kill or collapse without a trace…

The closing line is key, more wealth could be created in the developing world than developed world, but the owners? Likely not those from the developing countries. People who own the capital also own the wealth, nothing is a given.

” People who own the capital also own the wealth, nothing is a given.” That is the painful thing especially now we are not investing to seed that growth