South Africa is going through an economic redesign. The mining sector is seeing new changes. Over the last few years, more than 70,000 jobs have been lost in the mining industry. Thirty years ago, mining accounted for 20% of the country’s economy.Today, it is about 7.3%.

But beneath these challenges, South Africans are changing their countries. Services are up and they are leading Africa with great companies like Stanbic Bank, DSTv, MTN and Shoprite. They innovate, ferociously. Owing largely to better infrastructures, e-commerce is one area South African companies are finding values.

Few years ago, I wrote in the Harvard Business Review on the challenges of e-commerce in Africa. In that piece, I mentioned the struggle of one of South African companies, Kalahari, which had largely pioneered e-commerce in Africa.

Register for Tekedia Mini-MBA edition 19 (Feb 9 – May 2, 2026): big discounts for early bird.

Tekedia AI in Business Masterclass opens registrations.

Join Tekedia Capital Syndicate and co-invest in great global startups.

Register for Tekedia AI Lab: From Technical Design to Deployment (next edition begins Jan 24 2026).

We were not alone. Old local giants like the e-commerce business Kalahari, the advertising firm InMobi, and e-classified site Mocality retrenched, reorganized, or closed down. In closing some of their e-commerce properties, Naspers, a media and internet empire, noted that it was a “sad day for e-commerce” in Africa and cited “unprofitability” as a reason.

The fact was Kalahari retrenched because it could not compete. But over the last few years, that company has redesigned itself to find ways to compete, at least in South Africa. The Naspers-owned digital company merged with another firm, Takealot. Takealot had started operations in 2011, after it bought Take2, through funding support of Tiger Global and Kim Reid. This strengthening has deepened Takealot capabilities, making it the biggest South African digital firms.

Naspers is Africa’s leading company and the most valued. It is traded in the Johannesburg Stock Exchange. The firm failed in its efforts on Kalahari. But then has been plotting how to win in the e-commerce market. It s common knowledge that e-commerce is a promising sector, in Africa.

One thing Naspers figured out was the need for scale in the business. And that was the strategy it had adopted. Naspers had since signed agreements to take controlling stake (53.6%) of Takealot, valued at $73 million, pending regulatory approvals.

In April 2017 the group signed an agreement to acquire a controlling stake in its associate Takealot Online (RF) Proprietary Limited (Takealot) for approximately R960m (US$73m). Following the investment, the group will consolidate Takealot as a subsidiary and will hold a fully diluted interest of 53.6%. The transaction is subject to

regulatory approval.

South Africa’s E-commerce Sector

With this new re-positing, Naspers suddenly becomes an important element in the e-commerce sector, in South Africa, overtaking Amazon and eBay.

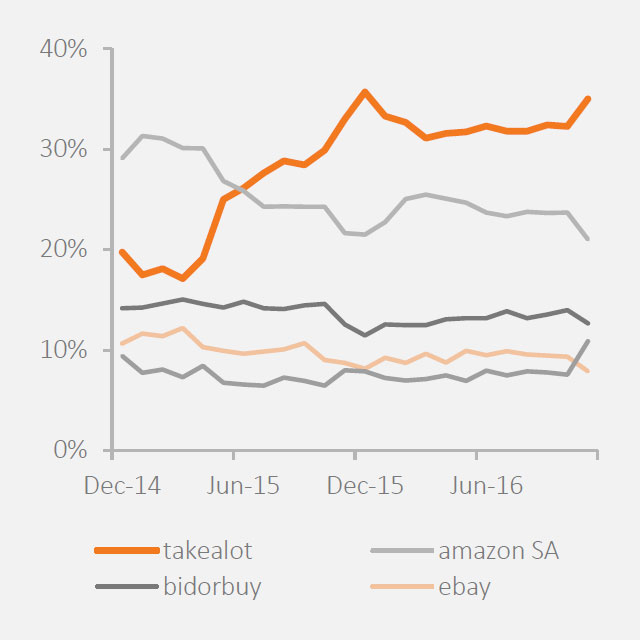

The investments and Takealot’s merging with Kalahari has made it the biggest eCommerce platform in South Africa. When Takealot was founded, its vision was to be the largest, simplest, most customer-centric online shopping destination in Africa. Naspers’ financial results show that Takealot has achieved its goal of being the largest online shopping destination in SA.It is much larger than its local competitor Bidorbuy, and is bigger than Amazon and eBay in South Africa.

The plot below presents the market share with Takealot doing far better than Amazon and eBay.

Source: Naspers, Broadband.co.za

Lessons for E-Commerce African Entrepreneurs

E-commerce is not an asset-light business. To do well, scale is very critical. The pockets of many e-commerce startups across Nigeria can do better, if they find ways, to come together. Nigerians do not like mergers and acquisitions as we do not like to own parts, we like to own 100%. But in a business like e-commerce, that is what is necessary.

The lesson is that Takealot can take up Amazon SA and others by coming together with Kalahari. This dominant position is what will give them opportunities to compete. Going it alone will be challenging because of some of the factors I noted in the HBR post (referred above).

Note that it is irrelevant that this is Amazon SA or eBay SA. The fact remains that it is Amazon or ebay. South Africa’s economy is largely matured and sizable enough to be a big U.S. state. So losing in South Africa means Amazon and eBay are losing in one strategic state in U.S. Should they decide to venture into Nigeria, banging together by pulling resources will provide the best opportunity to challenge them competitively. From Uber to legions of foreign competitors across African capitals, we lose because of fragmentation which denies us scale, to hold our turfs.

Rounding Up

I am looking for the day when Nigerian e-commerce entrepreneurs will come together instead of everyone becoming a CEO. That will help them pull ideas, resources, and energies together to get meaningful scale that will give them traction and success. As seen by Takealot strategy, scale is critical. Amazon or eBay or indeed any foreign brand, can be competitively defeated, in Africa.

---

Connect via my

LinkedIn |

Facebook |

X |

TikTok |

Instagram |

YouTube