The background of Fractionalization in Blockchain

Non blockchain fractional ownership in art started at the same time as the financial crisis. Between 2008 and 2012, the Chinese art market rapidly grew, driving government policies that set the cultural industry as one of the key drivers of economic growth.

I first wrote about fractional ownership through blockchain tokenization in 2021.

Register for Tekedia Mini-MBA edition 19 (Feb 9 – May 2, 2026): big discounts for early bird.

Tekedia AI in Business Masterclass opens registrations.

Join Tekedia Capital Syndicate and co-invest in great global startups.

Register for Tekedia AI Lab: From Technical Design to Deployment (next edition begins Jan 24 2026).

In a Tekedia article, I was debating the future trajectory of digital assets in the global marketplace, and speculating on how Nigeria and some other African countries could benefit through remote access.

Curiously, the concept began with ‘bricks-and-mortar’ art galleries looking for innovative ways to fund themselves without having to purchase expensive works or pay fees to exhibit them.

The idea was, that they would divide the purchase price of a targeted artwork into an ‘affordable’ equal investment fractions for allocation. The atomic units that represent a portion of ownership would be minted to a blockchain and a token would represent each unit. Members of the global public could buy any number of the tokens as they wish.

The gallery would retain the artwork, while the ‘fractional owners’ would retain their token(s) as their proof of ownership. Token ownership would allow them free access to the gallery within agreed terms.

These terms, and the gallerys’ entitlement for to admit non token holders at a cost, varied according to the implementation model and tokenomics (if any).

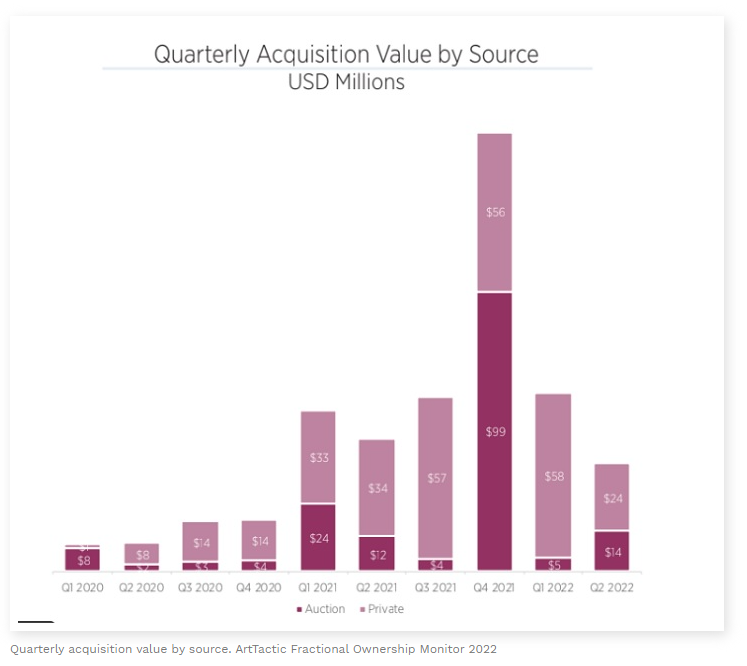

From late 2020 forward, several variations on a theme began to appear promoting services involving fractional art ownership.

On October 5, 2021, Masterworks, which was already an up-and-running gallery with fractional owners, raised $110 million in Series A funding at a valuation north of $1 billion.

The confusion that arose around ‘Fractionalization’ and ‘NFTs’

The advent of fractionalization caused a stir in digital tokenization discussions at the time, around what can be considered ‘Fungible’ or ‘Non-Fungible’.

Some argued that since the fractionalization resulted in a subsidiary unit to the whole work, that unit was in itself atomic. Pundits make similar arguments about ‘Satoshis’ the ‘minor currency’ to a Bitcoin.

This really isn’t important. Fungibility (or the lack thereof) rests on the ability to trade and exchange at arbitrary decimal fractions of a unit. That it has an atomic unit is irrelevant. Even all FIATs have an atomic unit.

Both FIATs and Cryptocurrencies are considered ‘Fungible’

Whether tokens themselves are considered NFTs or not, that is not down to the asset at all, and is down to the intent and execution of the Token Protocol used in token minting. I’ll discuss that in my next article on ‘Ordinal’

Back to the latest news, and our Feature Image of Rhianna

A ‘portion’ of Rhiana’s song, “Bitch Better Have My Money”, had been fractionalized, and sold as 300 equi-valued tokens on the Ethereum ecosystem.

Each token is more than just a deed to a collectable such as a Bored Ape, because it can earn royalties. It therefore has what is called ‘utility’.

OpenSea, the biggest blockchain asset sale platform by volume, yesterday halted secondary sales of the token collection.

Secondary Markets are the only practical way owners can dispose of such digital assets after whatever initial offering, or acquisition process.

The collections’ creation is down to one Jamil Pierre who co-produced the song in 2015 and owns a share of it as a result of the production contract. There is no evidence that Rhianna was involved in the tokenization project, or even knows about it.

An independent statement said OpenSea has a policy which does not allow NFTs that “appear to be promising fractional ownership and future profit based on that ownership.”

This could be the thin edge of a wedge which cuts off a very useful option in digital and blockchain investment opportunities, particularly if other digital token marketplaces follow suit.

Crowdfunding for example is particularly amenable to being executed through the sale of blockchain tokens representing fractional units of assets, either real or virtual.

Indeed, 9ja Cosmos is already looking at Crowdfunding through fractionalization and blockchain tokens as a means of raising future funds.

9ja Cosmos is here…

Get your .9jacom and .9javerse Web 3 domains for $2 at:

All reference sites accessed between 15-16/02/2003

luxuo.com/culture/art/a-new-fractional-way-to-own-artworks.html

decrypt.co/121410/opensea-halts-trading-rihanna-music-nfts

yieldstreet.com/investing-in-art/

fractional.art/

techcrunch.com/2021/10/05/masterworks-raises-110m-to-push-fractional-shares-of-physical-art-not-nfts-into-investor-portfolios/?guccounter=1

widewalls.ch/magazine/fractional-ownership-art