My model is that only about 30 million Nigerians earn income to buy products and services which are not food items, medicine and other core essential necessities. I have called these 30 million the Precious Nigerians – those with money to buy things for themselves and support others. You can read the analysis here and here.

In most of my analyses when it comes to people that actually have money to spend or pay for (technology) solutions in Nigeria, I use 30 million people. Yes, despite 198 million human population, the effective addressable market in Nigeria is less than 30 million people. In Fasmicro Group model, these are people with decent incomes for anyone to craft solutions to their personal and business-related frictions. The remaining 168 million people are opportunities, nevertheless [they have to eat, shower, etc]. But we see them from the track of the core 30 million people who have the money to pay for tech things. For most technology solutions (think gaming, apps purchase & digital subscriptions and the platforms like smartphones, computers and connectivity required for them) where the buyers are usually the direct beneficiaries, the 30 million is rock solid. (Of course, on largely non-tech areas like food where everyone has to eat, the 198 million people become the addressable market.)

When the Covid-19 lockdown began, I told our community members selling digital products not to retreat because even though the market conditions looked bad, people had limited things to spend money on, and the paralysis could provide opportunities to serve some customers uncontested. Yes, for those earning income, the money had been piling up in the bank accounts with nothing to spend it on. With schools closed, roads blocked, many Nigerians were forced into “unplanned saving”. In other words, people saved money which typically would have been spent. More so, some saved to hedge the risks of circumstances like loss of jobs. But money was saved!

Indeed, while there were job losses, those with jobs were saving. That explains why you should not freeze your marketing thinking markets are on pure cold ice. I do believe that if you provide good value, people have money to spend, right now. Using that insight, we decided to move the promotion of the second edition of Tekedia Mini-MBA by 6 weeks, right at the peak of the pandemic, knowing that the savings had minimal ways to be used: no transportation, no outside dining, no makeup shopping, etc. The lack of ways to spend did not stop some from still receiving income!

Register for Tekedia Mini-MBA edition 19 (Feb 9 – May 2, 2026): big discounts for early bird.

Tekedia AI in Business Masterclass opens registrations.

Join Tekedia Capital Syndicate and co-invest in great global startups.

Register for Tekedia AI Lab: From Technical Design to Deployment (next edition begins Jan 24 2026).

This is the summary: if you go back to most bank accounts in Nigeria, the level of saving is possibly more than last year, at the same period. This money would be spent in the next coming weeks. I tell you that if you provide them something that has value, there is a decent war chest across most bank accounts of these 30 millions Nigerians to party with you.

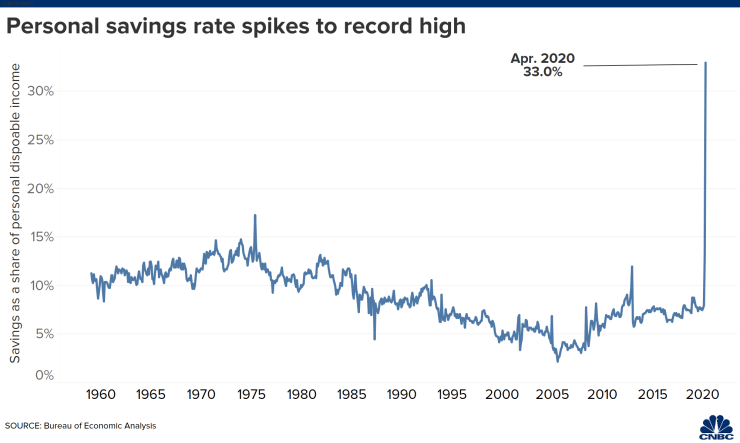

Update: there is data from U.S. showing this trajectory: “The personal savings rate hit a historic 33% in April, the U.S. Bureau of Economic Analysis said Friday…The increase in savings came as spending declined by a record 13.6% for the month.”

The coronavirus crisis has Americans hoarding more money than ever as widespread fear paralyzes consumer spending habits.

The personal savings rate hit a historic 33% in April, the U.S. Bureau of Economic Analysis said Friday. This rate — how much people save as a percentage of their disposable income — is by far the highest since the department started tracking in the 1960s. April’s mark is up from 12.7% in March.

Nigeria’s Addressable Core Market – The Magic “30 Million People”

---

Connect via my

LinkedIn |

Facebook |

X |

TikTok |

Instagram |

YouTube

It’s a tricky one, sure there are those with increased savings in their accounts, for lack of incentives to spend, the real challenge is figuring out where this category of people can be found.

We have those with more money, but aren’t interested in digital products, while some significant portion of those who enjoy digital products might have their savings depleted, as a result of spending more on essentials and supporting family members, while some earned lesser income than this time last year. In other words, they didn’t spend much, but the income was even far little.

It’s an interesting time to be bold when making business decisions. There are indices and parameters that tell me if people have become poorer, none of those things have really shifted much, it is largely the same endangered group that remain vulnerable.

Just create value and deliver, people will pay; some are even ready to spend more…