There was a massive panic in the startup world when Nigeria’s Corporate Affairs Commission (CAC) dropped a notice, telling the general public that companies with foreign participation must have a N100,000,000 (about US$100,000) minimum paid-up capital. First, for most startups and companies with foreign investors and shareholders, this is nothing. Of course, that is not where Nigeria is going; Nigeria is not going after the Delaware- and London-holding companies, but their Nigerian subsidiaries.

In other words, if you have a startup in Nigeria but have a holding company in Delaware, USA, the government expects that paid-up capital to be applied in the Nigerian subsidiary. Of course, when that is done, there is a stamp duty and other fees which can also help the economy.

Understand that most major startups are structured in such a way that Nigeria’s slow, opaque and unpredictable legal system will not derail them. In other words, most investors will not invest directly in the Nigerian entity because our legal system can make a dispute which Delaware can resolve in 3 months to run into a decade. And if you are a fund manager who must return money to your limited partners (investors in your fund), you have no luck with the Nigerian legal system if there is a disagreement. As a result of this, about 90% of all startups in Nigeria which have raised at least $1 million are headquartered in the US or UK.

Register for Tekedia Mini-MBA edition 19 (Feb 9 – May 2, 2026): big discounts for early bird.

Tekedia AI in Business Masterclass opens registrations.

Join Tekedia Capital Syndicate and co-invest in great global startups.

Register for Tekedia AI Lab: From Technical Design to Deployment (next edition begins Jan 24 2026).

This setup deprives Nigeria of huge foreign direct investment which ends up affecting the economy in many ways since most of the raised funds are left in American banks (not in Lagos). As I have noted previously, if the funds raised by Nigerian startups are kept in Nigerian banking, our FX paralysis will not be this severe.

Of course, you cannot blame the founders and the investors. He who pays the piper dictates the tune. If the investor does not want to wire $20m to a Lagos bank, because he is afraid of Nigeria’s legal system, you will likely agree to set up a company in Delaware, re-domicile, and then access that money, since no one is going to make-up in Lagos on that investment.

People, Nigeria has lost the next generation of its finest companies to America and England. Imagine if GTBank, Zenith Bank, etc of the 1990s were not Nigerians, possibly, we may not have them in the stock market today. By 2030 when we are expected to replenish our stock market with new species of companies, Nigeria will not have any because we have lost them already:

“Every ten years, something great happens in the Nigerian/African economy. In the 1990s, the new generation banks were established, and they used technology to create competitive advantages in markets. In the 2000s, the voice telephony era came at scale, led by MTN. The 2010s provided the mobile internet era as mobile phones connected to the internet, enabling new vistas of opportunities. Right now, in this decade of the 2020s, we’re in the application utility era where the power of cloud computing, mobile internet and software will redesign market sectors across territories in Africa. “

Yes, the 2020s belong to the application utility era which most of the digital startups fall under.

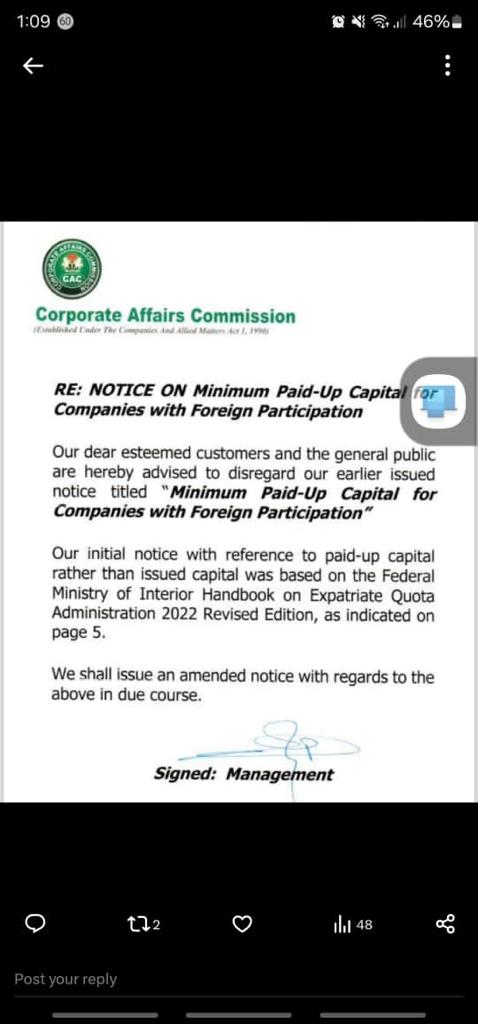

Back to the notice, the CAC has clarified that it was not “paid-up” but “issued capital” [issued share capital refers to the total shares that have been given to shareholders while paid-up share capital refers to the amount of issued share capital that has already been fully paid for]. Nonetheless, even if it did not clarify, that notice would not have affected many companies as many are well paid–up to in excess of $100k even locally. Also, the fee may not even be much (possibly less than N100,000 using recent guidance).

Nonetheless, Nigeria should focus on why its young people and its young companies are abandoning it even as it clarifies that it was “issued capital” and not “paid-up capital”.

---

Connect via my

LinkedIn |

Facebook |

X |

TikTok |

Instagram |

YouTube

Are we ready for this conversation as to why there’s a total disconnect between our economic prospects and the legal system that should power it? We have enough blames to go round, but again, blames don’t solve problems. We have westernized our thinking and even our value system; from where we believe quality education can be found to where we think our startups are secure.

We do a lot of self-sabotage here, both as government and citizens, but we are great at defending the most shameful things ever, and then find ways to rationalize and justify our faulty judgments. And after many years, we turn around to discuss what should have been, as though we were bewitched while making those choices.

Ladies and gentlemen, Nigeria pretty much does not have children or allies, all the fake love and deceitful sermons are simply what they are: fake and deceitful.

Anyone who’s really interested in fixing Nigeria should first come for a sacrifice and some cleansing exercise. I have read and seen enough of fake things from Nigerians about Nigeria, so not many people are taken seriously anymore.

There is a geographic space called Nigeria, what is not clear is whether those who claim to be from there are truly Nigerians, until we see proof…