In a move that has been closely watched by economists and consumers alike, the Federal Reserve has decided to maintain the benchmark interest rate at a range of 5.25% to 5.50%. This decision comes after a period of aggressive rate hikes aimed at curbing inflation, which had reached levels not seen in over a decade.

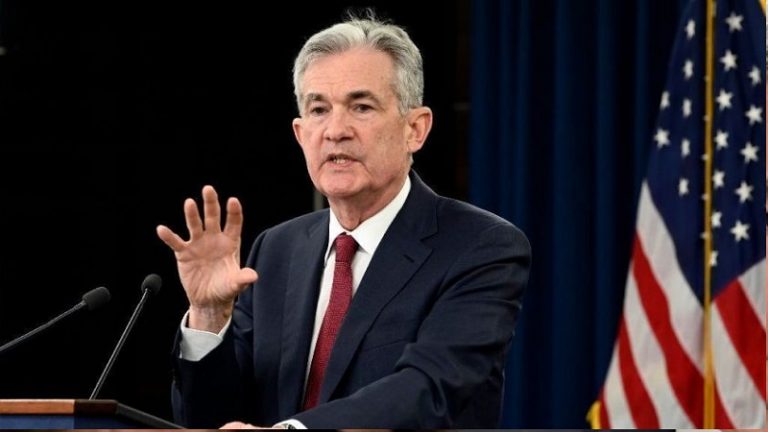

The Federal Reserve, under the leadership of Chair Jerome Powell, has been at the forefront of the fight against inflation, a battle that has seen interest rates rise to their highest levels since the early 2000s. The decision to pause rate hikes is indicative of a complex economic landscape where inflationary pressures continue to persist, yet there are signs of a potential slowdown in price growth.

The current rate, which is the highest it has been since July 2023, reflects the Fed’s cautious approach to ensuring that inflation rates come closer to the 2% target. The consumer price index, a key indicator of inflation, showed a 3.5% increase on an annual basis, driven by factors such as rising housing costs and insurance rates, particularly auto insurance.

Register for Tekedia Mini-MBA edition 19 (Feb 9 – May 2, 2026): big discounts for early bird.

Tekedia AI in Business Masterclass opens registrations.

Join Tekedia Capital Syndicate and co-invest in great global startups.

Register for Tekedia AI Lab: From Technical Design to Deployment (next edition begins Jan 24 2026).

The Federal Reserve’s strategy has been to make borrowing more expensive, thereby reducing demand for goods and services and, in turn, slowing the rate of price increases. This has had a mixed impact, with inflation rates falling from over 9% in the summer of 2022 to current levels of between 3% and 4%. However, the decline has plateaued, and the Fed acknowledges that many elements influencing inflation may be beyond its control.

The decision to hold rates steady has implications for consumers and businesses alike. For consumers, it means that borrowing costs for items such as car loans and mortgages will remain high, potentially affecting purchasing decisions and financial planning. Businesses face similar challenges, with the cost of borrowing impacting everything from expansion plans to inventory management.

Despite these challenges, most analysts agree that the likelihood of a recession remains low. The economy has shown resilience, with spending on services experiencing robust growth. This suggests that while the job market may be cooling, consumer spending, which is a critical driver of economic activity, remains strong.

As the Federal Reserve continues to navigate the uncertain economic waters, its decisions will have far-reaching effects on the global financial landscape. The pause in rate hikes is a response to a complex set of economic conditions, and it underscores the delicate balance the Fed must strike between fostering economic growth and controlling inflation.