From Mastercard data, out of $301 billion consumer transactions in Nigeria, about 98% were done with cash as at 2018. Simply, digitizing financial services is the gold rush as we enter a decade of application utility in Nigeria. That is why fintech is hot in Nigeria, and investors are deploying capital in the sector. If you win, glory awaits, massively.

That would take you to the primary source, Mastercard.com, where it notes “According to research done by The Fletcher School and Mastercard Center for Inclusive Growth, of the $301 billion of funds flows from consumers to businesses in Nigeria, 98 percent is still based on cash.”

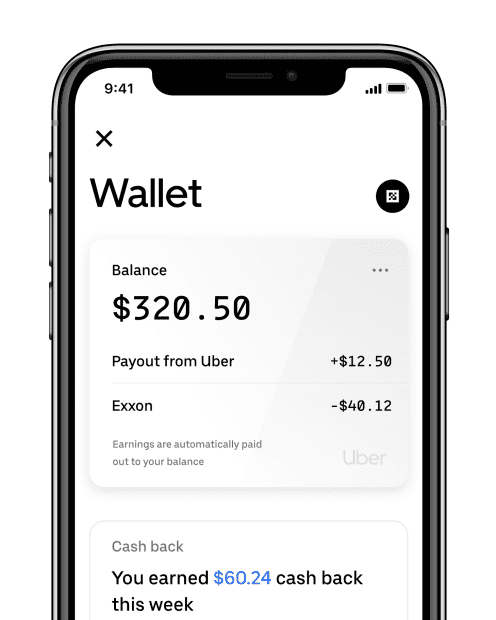

When OPay executed a massive unification with OBus, ORide, etc, all linked to a payment system, a double play strategy was made evident. Other companies are learning fast, and Uber is in the game; “Uber Money provides financial products that help you access, manage, and grow your money, putting opportunities you want within reach”.

Uber Nigeria has the following products:

Tekedia Mini-MBA edition 16 (Feb 10 – May 3, 2025) opens registrations; register today for early bird discounts.

Tekedia AI in Business Masterclass opens registrations here.

Join Tekedia Capital Syndicate and invest in Africa’s finest startups here.

- Uber Debit Card: Access earnings after every trip, and grow your money with real-time cash-back savings.

- Uber Cash: Get more for your money when you plan ahead and prepay for rides, JUMP, and Uber Eats orders.

- Uber Pay: Uber Pay lets partners integrate seamlessly with our platform.

No matter how you see this, Uber wants transaction volume which can help on profitability once commissions are taken. Combining logistics, a money making sector with pay and carry framework, with fintech, will unlock more domains and territories for Uber. I expect these designs from most digital firms as we move to 2022 when the era of application utility begins.

---

Register for Tekedia Mini-MBA (Feb 10 - May 3, 2025), and join Prof Ndubuisi Ekekwe and our global faculty; click here.