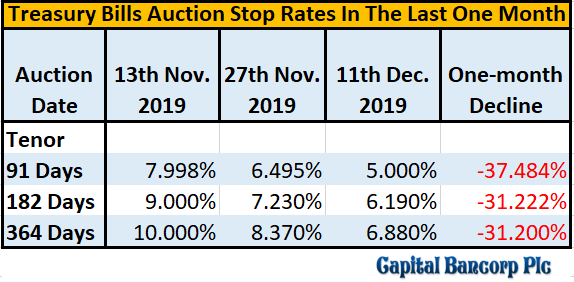

I have a tough call – most fintech startups in saving sub-sector in Nigeria will collapse in 2020! The reason is simple: the Central Bank of Nigeria (CBN) has done a coup. Yes, with the treasury bills (TB) rate now 5% for a 90-day tenor, I expect massive dislocation in the ecosystem. These startups have accepted savings, promising “investors” and “savers” north of 10.5% annual interest rates, hoping the high TB rate party would continue; the TB rate was projected by some to stay above 14% in coming quarters.

As if the low yields on T-Bills aren’t enough, CBN Director, Banking Supervision Department, Mr. Hassan Bello mentioned that The Central Bank of Nigeria will increase banks’ Loan to Deposit Ratio to 70% by 2020, he gave this hint during the week while speaking at the 2019 workshop for Finance Correspondents and Business Editors.

The Monetary Policy Committee (MPC) had noted in November an increase of N1.17 trillion in absolute gross credit between May and October, this was attributed to the adjusted LDR for deposit money banks. Manufacturing was the largest beneficiary, accounting for N460 billion of the increase. Consumer loans shared N360 billion from the total.

But now the government has made TB 5%, these startups would not just lose money, paying the 10.5% rate, they would be exposed to take more risks by putting that money they’ve collected via short-term savings, on safe long-term investments. In Nigeria, few of such safe investments are available: TB was the best deals in town, but now it is gone.

More so, the lending fintechs would also be forced to reduce rates as all lending rates would drop with the dropping of TB. The implication is that some of the rates they have quoted for investors as they raised capital may not be feasible anymore. Yet, this may be a good thing: if rates are low, more customers can come to patronize them. But they have to readjust to take advantage of the new opportunities.

Register for Tekedia Mini-MBA edition 19 (Feb 9 – May 2, 2026): big discounts for early bird.

Tekedia AI in Business Masterclass opens registrations.

Join Tekedia Capital Syndicate and co-invest in great global startups.

Register for Tekedia AI Lab: From Technical Design to Deployment (next edition begins Jan 24 2026).

Similarly, I expect many banks to see stress as they open their books to move from extremely low risks on TB to new investments by putting money in companies.The target CBN is giving them on LDR (loan deposit ratio) is mind-blowing, and most will have to revise their playbooks to thrive.

Here are ways this new policy on TB will play out:

- Banks are going to see positive movements of their stocks. With the option of TB gone, equities would be a key option. Banks are usually the most preferred in Nigeria as the banking sector remains the most developed and liquid in the Nigerian Stock Exchange. Yet, investors would be watching on how banks would manage the risks associated by putting capital on small and large companies, hoping the loan default rates stay low.

- Borrowing would become easier for companies. Typically, most rates were benchmarked with TB. Now the TB is lower, it means debts will become cheaper. In other words, if a company was to borrow from a bank, and with the option of TB not being a good option (very low at 5%), banks have limited options to put capital. The implication is that companies can easily negotiate better loan terms since the other key option for banks was 5%. When you know that is the case, getting a loan at below 15% from a bank becomes easier.

- Servicing government debts will be cheaper. Interestingly, this low TB rate would make it easier for government to borrow and service its debts. Nigeria at both federal and local levels would be servicing tons of debts, and this low rate regime would make things easier.

- CBN lending rates to bank remain important. Though CBN has cut TB rates, another important metric to examine is the rate banks are getting capital from CBN. If banks get at 11%, the impact of TB would be muted. If a bank gets funds from CBN at 11%, I expect 1% to cover insurance for the funds. By the time they add operational costs with small profits, 17% becomes the floor to lend. So, despite the reduction in TB, what will drive lower rates in lending in Nigeria is the rate CBN is lending to banks – today, it is about 13.5%. (I explained this deeper here).

See it this way: if a bank gets capital from CBN at 14% (the current rate) and has to keep 1% to meet required ratios from NDIC (the deposit insurance commission), by the time it takes care of operating expenses, it cannot practically lend below 17%. Then imagine if the bank has started with 2.5%, you will then experience lending interest rate of say 5% in Nigeria.

All Together

The low TB rates would do one thing: it would put pressure on banks to deploy capital in riskier investments like lending to SMEs (small and medium scale) companies in Nigeria. That is a good thing as lack of growth capital remains a major challenge in the Nigerian economy.

---

Connect via my

LinkedIn |

Facebook |

X |

TikTok |

Instagram |

YouTube

The rise and fall of TB has become more or less like printing paper money with no economic value; now someone can sit somewhere and be fiddling with percentages, a financial scam of some sort…

On another note, I never liked the idea of high rates on TB, because it’s anti productivity, and an enabler for laziness across board. So whatever that encourages productivity is a welcome development, money needs to be put into productive ventures, not safe havens and artificial wealth creation reservoirs.

Since the CBN can change gears at will, when is it going to change its own lending rates to bank to 5%? The excuse of inflation being above that won’t cut it, many things appear rigged already, so let the ‘rigging’ benefit both the rich and poor.

But we need to show semblance of predictability here, investors put money when it’s possible to model growth trajectory and profitability, not just waking up one money only to hear that everything is under water.

A nation in motion.

This TB rate and new LDR could distort any fund strategist

Excellent piece Mr Ekekwe,you basically touched on all the issues around the impact of T-bills rate drop.I have a different opinion on a few points.

1.FUND DEPLOYMENT

The assumption that start-up savings Fintechs put fund received in T-bills or were benchmarking against it,that might not be entirely correct because most actually put the funds to use in the real sector and the above average interest rates to attract investors target a few basis points above inflation not T-bills only.

2.HIGHER PATRONAGE FOR BANKING SHARES

With the exception of top “A” & a few “B” rated banks the sector might not witness the projected inflow, even though the capital market will hit higher unprecedented Market Capitalisation it will be benefit a minor cross section across several industries.

3 CBN LENDING TO BANKS

Even though the CBN has temporarily succeeded in lowering T-bills rate and by inference reduced FGN and its cost of servicing debts ,it has not tinkered with the a asymmetric corridor around the MPR .The SLF ) Standing Lending Facility – the rate at which CBN lends to banks is always above MPR by a few basis points. So while tweaking with the T-bills rates ,the MPC needs to consciously reduce the MPR to achieve a more balanced & sustainable regime.

4 INCREASE IN LENDING (especially to the manufacturing sector) This is good but the FGN needs to deal with the “Elephant in the room.” INFRASTRUCTURE – power ,roads and transportation in particular. Every sector Financial, Manufacturing etc expend a minimum of 35% -40% of their over heads on POWER, so increased lending will give some relief but invariably mask the decaying infrastructure deficits whose cost of goods & services still lands heavily on the final consumer.

1. Sure, I expect many to do that but some do use TB because of its low risk

2. Two years ago, excluding 2 banks, GTBank had more market caps than all local banks. It is always the A-rated banks

3. I noted same in my piece.

4. Good point