In 2024, Nigerian users have access to various virtual dollar cards designed to facilitate international transactions. These cards are tailored for online purchases and subscriptions on platforms like PayPal, Netflix and Amazon, offering convenience and security.

Here are the top five virtual dollar cards available in Nigeria.

1. Ultima Card by PSTNET

PSTNET is a financial platform that enables users to issue cards for various purposes, including media buying and online payments. The platform’s most popular dollar cards, known as Ultima, are suitable for services like PayPal, Steam, Spotify, Netflix, Patreon, Unity 3D, and app stores including Google Play, Apple App Store, Microsoft Store, PlayStation Store, and Epic Games Store. PSTNET cards are supported by Visa and Mastercard and can be used anywhere these payment systems are accepted. There are no limits on spending and top-ups.

The cards do not incur fees for transactions, withdrawals or operations involving declined or blocked payments.

An additional benefit of the Ultima cards is the 3D Secure technology, which ensures the security of financial transactions.

Key Features:

- Multiple Top-Up Options: Users can fund their cards using cryptocurrencies like USDT TRC20, BTC (and over 15 other coins), SWIFT and SEPA bank transfers or any other Visa/Mastercard.

- Simple Fund Withdrawal: Funds can be easily withdrawn in USDT without additional costs.

- Quick Registration: To obtain a card, users can register on the platform in 1-2 minutes without data verification or document submission. Registration can be done using Google, Telegram, WhatsApp, or Apple accounts.

- Functional Telegram Bot: A Telegram bot is available for receiving 3DS codes and notifications.

Users can choose a service plan that suits their needs, such as paying $7 per week or opting for an annual plan at $99, which currently includes a 48% discount.

PSTNET provides a versatile and secure financial platform for card issuance, catering to various online payment needs. Its wide range of top-up options, lack of transaction fees, and quick registration process make it a convenient choice for users worldwide.

2. ALAT Cards by Wema Bank

Wema Bank has introduced the Virtual Card ALAT, a fully functional digital bank card. This prepaid VISA card offers users a choice of three levels: Classic, Gold, or Platinum, each catering to various needs and usage scenarios.

The ALAT Dollar Card is specifically designed for international transactions, making it ideal for online shopping and subscription services, including media buying on platforms like Facebook Ads and Google Ads. However, it is important to note that the card cannot be used at ATMs, POS terminals, or websites requiring 3D Secure authentication.

For those looking to use the card for international shopping, an additional activation step is required. This precaution is necessary to avoid potential issues with processing payments from Nigeria.

Key Features:

- Top up Balance: Users can top up their ALAT cards through transfers from local banks such as UBA, Zenith, and GTBank. Additionally, cash deposits can be made physically at any Wema Bank branch.

- Free Registration: Registration for the card is free of charge. Users will need to obtain a USSD code on their mobile phone and follow the provided instructions.

- Transaction Limits: It’s important to be aware of the operational limits. For instance, the maximum amount per transaction is 1,000,000 NGN (approximately $860), and the maximum daily limit is 5,000,000 NGN (approximately $4,300).

This comprehensive digital banking solution by Wema Bank provides users with a versatile and accessible option for managing their finances both locally and internationally.

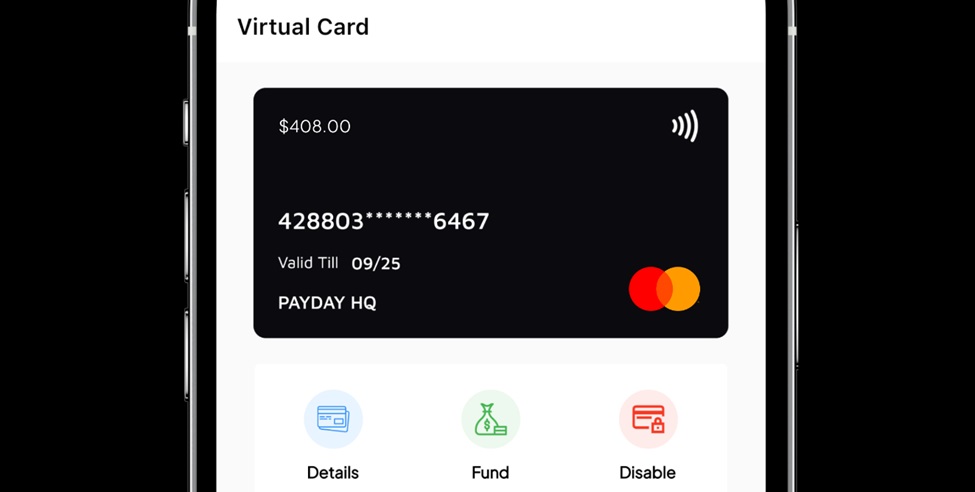

3. PayDay Cards

PayDay is a multifunctional financial platform offering virtual cards, physical debit cards and virtual wallets. Users’ funds are stored in the PayDay wallet account and can be accessed through their cards. These cards support payment systems like VISA, MasterCard and Verve International.

PayDay cards allow users to receive international transfers from any country (e.g., salary from a foreign employer), transfer money to individuals in Rwanda and Nigeria and shop on international online platforms such as Amazon, Netflix and Apple. Bill payment is also available through the service.

Key Features:

- Top-Up Balance via PayDay Wallet: Users can top up their balance using their NGN account and convert the currency to USD in their personal account. Once converted, the funds can be credited to their dollar card.

- The platform imposes a system of limits. For example, the limit for a single transfer is the equivalent of 1,000,000 NGN or 1,000,000 RWF per day, or $1,333 per day or per transfer. For VISA cards, the maximum spending limit is $3,000 per month, while for MasterCard, it is $10,000 per month.

- Withdrawal Options: Funds can be withdrawn through the wallet to any local Nigerian bank or to a MOMO account in Rwanda.

- Easy Registration: Users can download the PayDay app from the AppStore/PlayStore and complete the verification process. Verification in Nigeria requires a BVN and a selfie, while in Rwanda, it requires a national ID and a selfie.

PayDay provides users with a versatile and convenient solution for managing their finances across different regions and platforms.

4. Chipper Cards

Chipper Cash is a financial service that offers cards tailored for various purposes. It includes a virtual dollar Chipper card supported by the VISA payment system, alongside local cards for Nigeria, Uganda, and Ghana, which are not suitable for international purchases.

With the Chipper USD card, users can send and receive money in Nigeria, Uganda, Rwanda, South Africa, the USA, and the UK. These cards are specifically designed for online shopping and can be used anywhere Visa is accepted. They are ideal for payments on services like Netflix, Apple, Spotify, Google, AliExpress and other popular platforms. However, it is recommended to check the vendor’s category on the website before making an international transaction to ensure compatibility. This also supports a blank invoice receipt template.

Key Features:

- Top-Up Balance via Chipper Cash: Users can add funds to their card by selecting their NGN account in their personal account and topping up. The balance on the card will be in dollars.

- Spending Limits: There are daily and monthly spending limits on the cards. Users can spend up to $1,000 per day and up to $4,000 per month.

- Registration takes no more than two business days.

To obtain a card, users need to download the app and complete the verification process by providing the necessary documents. Verification includes submitting a BVN and a selfie (instructions on how to take a selfie are provided). Users must also confirm their address and phone number.

Chipper Cash offers a convenient and efficient financial solution for managing and transferring money across multiple countries and platforms, making it a valuable tool for international transactions and online shopping.

5. Barter Cards by Flutterwave

Flutterwave is a financial service provider, offers users the ability to create virtual Barter Cards for seamless online transactions from Nigeria. These cards, available as virtual Mastercard and VISA options, are designed for international purchases and subscriptions. They also facilitate global money transfers and allow users to receive funds from abroad. The cards can be customized for various payments, including popular services like Netflix, Spotify, and Apple Music.

Key Features:

- Easy Top-Up: Users can fund their Barter Cards through their local bank accounts or existing debit and credit cards, ensuring flexibility and convenience.

- Spending Limits: The cards come with a spending cap of up to $1,000 per day and a maximum of $4,000 per month, providing users with substantial transactional freedom.

- Easy Card Acquisition: To obtain a Barter Card, users need to download the Barter app, available on both Google Play Store and Apple App Store. The registration process involves creating an account and filling in personal details such as full name, date of birth, email address, and phone number. Verification requires the submission of a Bank Verification Number (BVN) and a selfie for identity confirmation. Once verified, users can create and activate their virtual dollar cards directly within the app. Note that there is a small fee for card issuance.

However, it is important to note that the Barter Card service is currently unavailable. Flutterwave has announced that the service will resume soon, and users can join the waitlist to be notified when it becomes available again.

Conclusion

As digital financial transactions continue to grow, virtual dollar cards have become essential tools for users in Nigeria looking to make international payments. The Ultima Card by PSTNET stands out with its flexibility, absence of transaction fees, and quick registration process. Alongside other offerings from platforms like ALAT by Wema Bank, PayDay, Chipper Cash, and Barter by Flutterwave, these cards provide secure and efficient solutions for online purchases and global money transfers. By evaluating key features such as top-up options, spending limits, and ease of registration, users can choose the card that best fits their financial needs and ensures seamless international transactions.