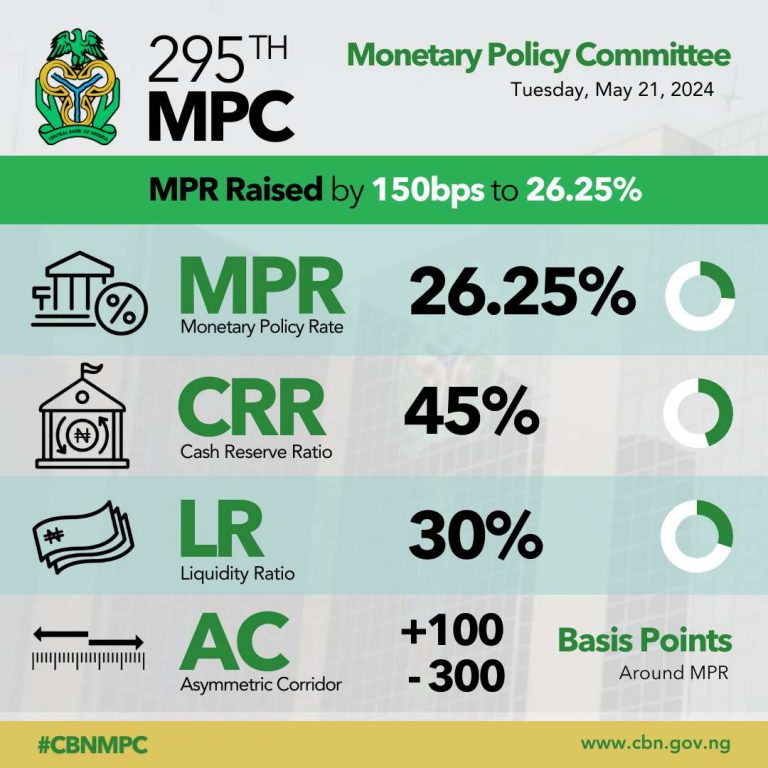

A big hike:” The Central Bank of Nigeria (CBN) has increased its key interest rate by 150 basis points to 26.25% in an effort to combat persistent inflation and stabilize the nation’s currency…Despite the rate increase, there are concerns about the effectiveness of monetary policy in addressing supply-side and structural issues driving inflation.”

According to government data, more than 95% of Naira in circulation is outside the banking system, meaning that whatever rate policy the apex bank is formulating has minimal impact on consumer demand: “Nigerians have increased their hoarding of cash, with as much as 94% of the currency in circulation held outside banks by March 2024”. This is very important, using basic economics: if demand remains the same when supply is reduced, price will go up, ceteris paribus.

By the central bank increasing the rate, the demand side is marginally impacted since consumer credit in Nigeria is largely insignificant and cash remains king, outside the influence of the monetary rate policy. But what the apex bank is doing does affect something, and that is SUPPLY.

Register for Tekedia Mini-MBA edition 19 (Feb 9 – May 2, 2026): big discounts for early bird.

Tekedia AI in Business Masterclass opens registrations.

Join Tekedia Capital Syndicate and co-invest in great global startups.

Register for Tekedia AI Lab: From Technical Design to Deployment (next edition begins Jan 24 2026).

So, when we increase the rate, we further reduce supply of goods and services since only corporate borrowers are largely affected, and when prime rates go up, bank borrowing interest rates follow, and companies pause expansion since the cost of capital is high. But you need high supply, from companies, to reduce price, and if you process that, you will agree that the apex bank’s trajectory will NEVER stop inflation since it is a clear vicious loop where more rate hikes will lead to reduced supply and more inflation in the economy.

Furthermore, as cash is king in Nigeria and people rarely save since they do not have a lot, the SAVING side benefit of rate hike, typical in most western nations do not apply. So, even if you increase rates, people suddenly will not start saving because they do not have the funds: “As of May 3, 2024, the Nigeria Deposit Insurance Corporation (NDIC) covers 98.98% of depositors in Deposit Money Banks (DMBs) with a maximum deposit insurance coverage of N5 million. This is an increase from the previous coverage of N500,000, which covered 89.20% of depositors.”

As you fight inflation, look at the FX component where the exchange rate is now N1,480/$. That the Naira is losing steam now is an indication that we still have structural challenges, and that whatever improved the Naira (draining the foreign exchange) a few weeks ago was transient. I did note that Nigeria could win any battle including taking the Naira up to N800/$, but to win the WAR it has to do things differently. Indeed, financializing Nigeria’s economy has a limitation; we need to go back to building things.

Winning the war for Naira begins with 24/7 electricity, security in the land, improved rule of law, a mindset of innovation and making things in Nigeria.

In the first quarter of 2024, Nigeria spent $1.12 billion on foreign debt service payments. In Q1 2023, it spent $801.36 million for the same service. That is another friction in the management of the nation’s scarce resources.

And companies are impacted: “Airtel Africa reported a $1.7 billion loss due to currency devaluations in Nigeria and Malawi for fiscal year 2024, despite a 20.9% growth in service revenues in constant currency.” Cadbury was not spared “Cadbury Nigeria Plc has reported a net foreign exchange loss of N11.5 billion for the first quarter, which plunged it into a loss of N7.3 billion for the quarter.” This has fueled a pessimistic view which can affect investment: from a PwC survey: “51% of CEOs in West Africa expect their local economy to decline compared to global CEOs (37%).” That is a huge problem.

---

Connect via my

LinkedIn |

Facebook |

X |

TikTok |

Instagram |

YouTube

Nigeria seems to be the easiest country to rule, because you don’t really need to do any deep thinking or hard stuff. If you need funds, just look for where to borrow; if borrowing looks difficult, just introduce new levy; if levy can’t do it, increase tax or reintroduce the ones suspended. This is what has been happening, but somehow some think we need to commend people for doing the very things almost all humans can do. Amazing.

What exactly distinguishes a leader from ordinary citizens in Nigeria? We sort of praise people for making things worse, just because they cannot make them better. Once you capture power, you are guaranteed a full tenure, you don’t really need to perform.

You were told that petrol subsidy benefited the rich and was lopsided, and therefore needed to go, so you were plunged into what neither benefits the rich nor the poor. You were also told that defending the naira benefited few people who go on to become billionaires via round-tripping, and in order not to make few billionaires you rather make everyone poor. This is how communism operates, only to scale misery.

Why exactly are we doing what we are doing and what is the end goal? If inflation refuses to come down, at what point do you admit failure?