In your business, do not do “herding” where everyone does the same thing. As I noted in Tekedia [had a long piece on that in Harvard Business Review print around 2011], when you do that, a new entrant has only one strategy to annihilate your industry. Yes, since everyone is doing the same thing, conquering the market is easier by a newcomer.

The same analogy above applies in many modern industries. Companies increasingly congregate in their competitive strategies. They tend to do similar things in order to self preserve themselves. In the era of Yahoo and AOL, they provided similar services. Cell phone companies provide services and pricing models that are largely the same. Everyone wants to eat from the same pot and let the help offer assured preservation or total destruction whichever flips.

Even the network televisions are not spared this effect. From casinos to airline industry, we can see an ordered communality across industries. They mutually agreed, though never admitting it, to move in features, services and prices alike. The airline industry was notorious for it about fifteen years ago. In most developing markets where Internet has not penetrated deep enough, the media empires move in tandem on their stories, prices and distribution networks.

I call this communal competitive strategy because it simply means that these firms in their respective industries form communal ties and agree to provide services that will preserve them with lesser disruption to their industries. They may not band together because that could be illegal but the outcome shows they watch one another. Many have called this win-win strategy. It has also been seen as co-opetition where, especially in banks, they cooperate though competing against one other in other to keep the industry healthy

This applies to how we grow wealth. When it seems like everyone is making profit with no apparent bleeding for some, it is probably MMM and will turn out bad. And when everyone seems to believe it will be all parties for everyone, hello cryptocurrency and Bitcoin.

Simply, any business or sector where there is no obvious risk of loss or gain by different participants in short term, it is probably not based on sound economics. If MMM says everyone would win, that is against the laws of markets. When Bitcoin promises same, it is an illusion.

Register for Tekedia Mini-MBA edition 19 (Feb 9 – May 2, 2026): big discounts for early bird.

Tekedia AI in Business Masterclass opens registrations.

Join Tekedia Capital Syndicate and co-invest in great global startups.

Register for Tekedia AI Lab: From Technical Design to Deployment (next edition begins Jan 24 2026).

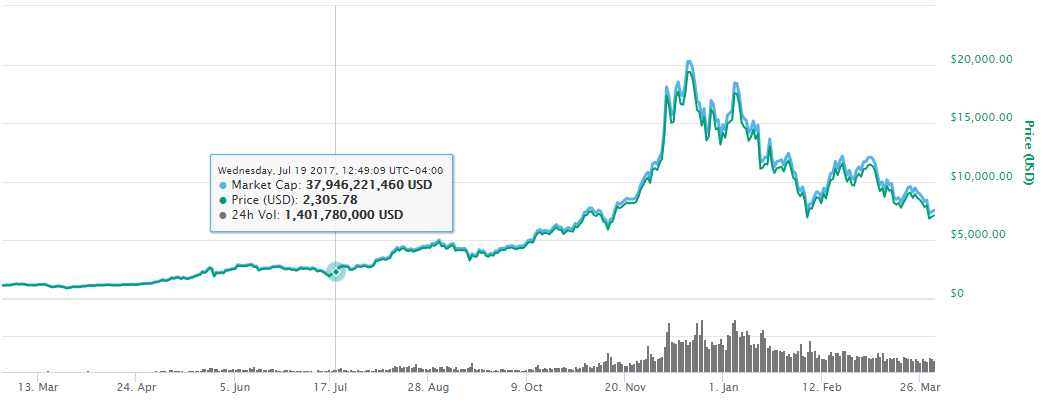

This is the Bitcoin price today (see the plot below): around $8,000. From Google to Facebook to Twitter, they are caging it. Now, the fraternity that did not want government is asking for government to come and regulate it. It wants legitimacy because the ICT utilities are indeed regulating it.

If you are banned by Facebook, Google and Twitter, you probably do not belong in this world. You are irrelevant. If you do not reverse it, the only destination is oblivion. You can see that from the price of Bitcoin. (Advertising on crypto-related products including ICO (initial coin offering) are banned by these ICT utilities. Simply, the ICT utilities have decided that they are not important for the real economies).

All Together

Just hope you did not buy Bitcoin at $22k because unless government can regulate it, it may be in deep trouble. Facebook, Google and Twitter are banning adverts on it. If you are banned from the ICT utilities, you do not belong in this world.

---

Connect via my

LinkedIn |

Facebook |

X |

TikTok |

Instagram |

YouTube