Great comments on my postulation that Nigeria should tax real estate (i.e. property tax) across the nation: urban and rural. Many of our community members posit that Nigeria should not go there on the construct that Nigeria has money! I do not buy that since even rich America taxes properties including primary residence. The average rate is 1% of the value and you pay that yearly. It is through property tax that America separates cities and communities.

How? If you are growing up in a poor neighbourhood, you will likely attend poor performing schools since schools are funded from taxes on properties. The tax collected in Potomac will be used to fund world-class basic education in Potomac even as schools in Baltimore underperform; both are in the same state.

The argument is this: you can live in a mansion and the government should not tax it as you may not be cash rich even though you are asset-rich. Nigerian leaders are to be blamed for that mindset: no one has told us that we are relatively “severely” poor, and exceedingly underperforming as a nation. Nigeria does not have an excess spending problem – the fact remains that Nigeria does not even have enough to spend (sure, we need to improve on how we use the little we have).

Register for Tekedia Mini-MBA edition 19 (Feb 9 – May 2, 2026): big discounts for early bird.

Tekedia AI in Business Masterclass opens registrations.

Join Tekedia Capital Syndicate and co-invest in great global startups.

Register for Tekedia AI Lab: From Technical Design to Deployment (next edition begins Jan 24 2026).

Nigeria’s national budget is $42 billion when South Africa will do more than $120 billion even though Nigeria’s population is more than 3 times South Africa’s. Yes, no matter how efficient you manage that $42b, you cannot deliver better value than South Africa on its people.

When a poor nation is seen by the citizens as being super-rich, it calls for a new generation of leaders to fix that mindset so that the nation can get to work. Until then, most will think this country has so much that it does not need help.

Yet, as CBN goes after the small marginal boost on tax revenue, I challenge the apex bank and the government to go after the real deal: real estate tax. Nigeria is a place where rich people do not pay taxes. They build mansions and pay zero taxes. That is the reason why South Africa budgets more than $120 billion when Nigeria can muster $42 billion yearly. In South Africa, the government has the money; in Nigeria, the money stays with the citizens. The problem though is this: with no public funds, the government cannot fund initiatives to help many who need help!

If Nigeria implements an effective real estate tax policy, our national budget will hit at least $80 billion. You may ask why can’t this be done? Answer: real estate tax will affect the 1% who unfortunately have the power to influence who makes it to the government houses. They cannot fund you (the politician) only for you to make them less whole!

But if CBN wants to fix Nigeria, that is the real deal. If you tax all the mansions in your village as the Americans do (real estate tax funds basic education), your local school will have resources to make it a top-grade primary and secondary school system. Magically, the local government will have real budgets, out of the resources on its land.

Comment on Feed

Comment: South Africans enjoy the dividends of true nationhood. They enjoy stable power supply, good roads and security. What has the Nigerian government done with the tax we have been paying to merit more taxes from the real estate? I don’t think we have a government. They should all go home.

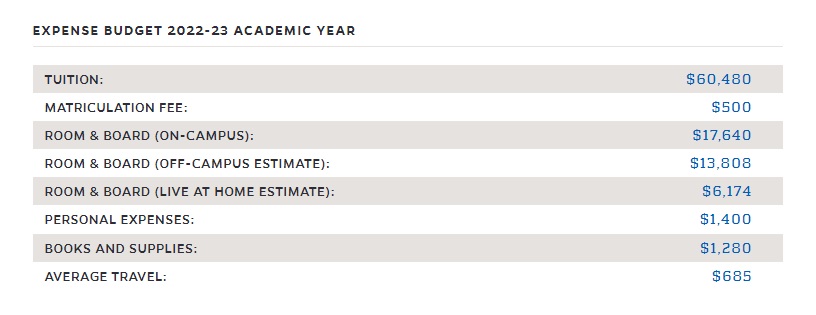

My Response: SopuruChukwu Nwadi It is the chicken and egg thing. You want it but you do not want to fund it. Just like a general without an army, a governor without funds cannot do magic. The budget of Harvard University is more than 3x the total education budget of Nigeria. Then you want to have a Harvard level education? We need to be realistic. I studied in Johns Hopkins University where students spend close to $80,000 per year on school fees and board (I went on scholarship). Someone in FUTO will ask for the same standard on a $500 expense. Good soup needs money! Nigeria needs funds, instead of hope. A new leader must discover that so that we can improve service and quality.

Comment 1b: Ndubuisi Ekekwe our leaders should account for the one we have given them first before asking for another one. They tax us to death and use the proceeds to fund their ostentatious lifestyle and drive all intelligent and able bodied youths away from the country in search of hopes

My Response: “our leaders should account for the one we have given them first before asking for another one.” – I noted that when I wrote “(sure, we need to improve on how we use the little we have).” But a bad school does not shut down to open when it can improve. What happens, the school stays in operations and keeps improving. If you think all FEDERAL schools and ministry of education will get better by spending 30% of Harvard University budget, think again. You either fund them or they remain mediocre,

Comment 2: I once had the same mindset that Nigeria is very rich, probably based on hearsay, until I realised just a school, for example, Purdue West Lafayette campus budgeted over 2 billion dollars in an academic year.

Probably, Nigeria may be rich in people, natural resources but not monetary. Mining the resources to money and spending it optimally is a pressing call for a shift we desire!

My Response: Harvard University spends at least 3x the whole of Nigeria’s ministry of education budget.

Comment: If the Property Tax was at work in Nigeria, people won’t be building or owning up to 5 houses upadan as you will pay tax for each.

More painful for them is that some of these properties may have been abandoned by their owners but they must pay tax whether you frequent there or not.

But Prof. Ndubuisi Ekekwe , could you explain further on Tenement rate as I thought it should suffice for Property Tax. Thank you

My Response: It is possible to have any law in the books. The issue is implementation and execution. Tenement rate has that “occupied” component and many “abandoned” mansions can claim to be unoccupied. But a direct property tax will apply, occupied or otherwise. In US, if you do not pay, government takes over the property!

---

Connect via my

LinkedIn |

Facebook |

X |

TikTok |

Instagram |

YouTube

I disagree with you on the taxes of properties in Nigeria. The Land use Act vested all the land in the state in the hands of the Governor of the state. I don’t really trust the Governor of the state itself

How do you educate a people who have resolutely determined to be ignorant? With all the 1 2 3 they counted from nursery to primary school, your compatriots know nothing about numbers!

People who believe that N21 trillion is a lot of money in country of over 200 million people and landmass of 923k km²? Until you ask them to tell you the cost of generating and distributing just 10GW of electricity, then they start stammering.

We don’t have enough policemen, not enough soldiers, not enough universities, not enough primary and secondary schools, not even power, not enough roads, nothing on rail, nothing nothing; yet people who live in alternate universe believe that Nigeria’s problem is just about stopping thieves from stealing? $300 billion annual budget for the next ten years isn’t even enough to bring us to middle income country, yet we are debating on how to live a great life with less than $50 billion, for real?

I will suggest that we empty the $42 billion budget on Education alone, we are too ignorant as a people to even spend a kobo on roads or power. Let’s have some decent education first, so that we can start thinking and dreaming like proper humans.

Education or nothing!