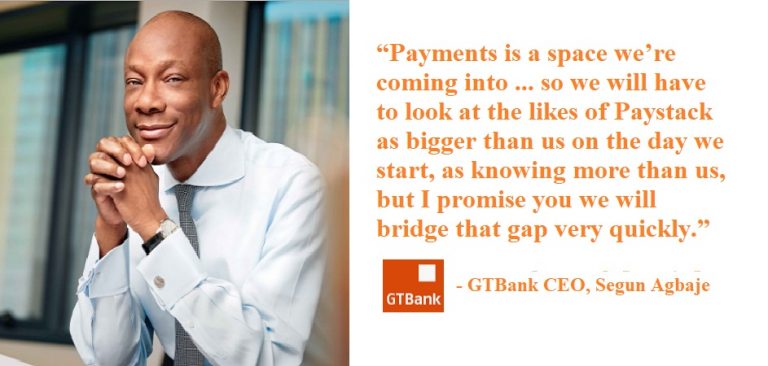

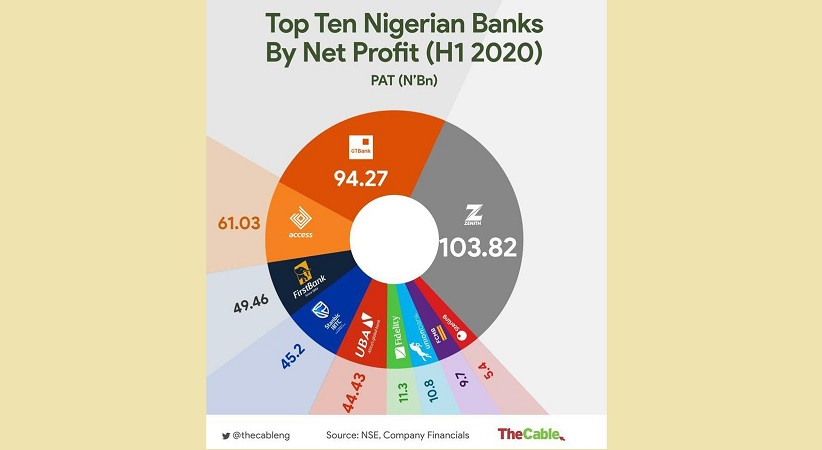

Until recently, GTBank was Nigeria’s money rainer. Zenith Bank holds that title now. But GTBank is not letting go. The CEO, Segun Agbaje, thinks it can fight back to get back to the castle. Of course, his final tenure expires next year, to complete the ten years the regulations allow any bank CEO to stay as the big boss. Do not expect him to go – GTbank will possibly become a holding company. That means it can hire a CEO for GTBank while he manages the holding company. Yes, indirectly, he will continue to run the bank.

For the work he has done in GTBank, no one can argue against Agbaje. He is a brilliant manager and understands the time. His next playbook is to build a great fintech company, specifically paytech. It makes sense as that is where the money is: any transaction goes with a tax-commission. So, there is nothing like it is not working since fees are guaranteed on day one!

With GTPay which provides API to help you collect money on your digital platforms, it has Flutterwave-like already. It has the ecommerce and app business, Habari, which has struggled despite the publicity and efforts. There is also QuickCredit which companies like Carbon (Paylater) have challenged in the lending space. The GTCollections is a unifier to aggregate payments. Then, as a bank, it does the typical things of treasury services, money transfers, remittance, correspondent banking, etc.

Register for Tekedia Mini-MBA edition 19 (Feb 9 – May 2, 2026): big discounts for early bird.

Tekedia AI in Business Masterclass opens registrations.

Join Tekedia Capital Syndicate and co-invest in great global startups.

Register for Tekedia AI Lab: From Technical Design to Deployment (next edition begins Jan 24 2026).

As I noted on Wema’s ALAT, no bank in Nigeria can compete very well against the fintechs if most of their new services are warehoused inside the bank. Had ALAT been outside Wema, it might have been one of the emerging digital banks in Nigeria by now. So, the best path for GTBank would be to acquire a fintech (most are already expensive, though), or simply build a new business which is far from GTBank.

This is the real deal: “According to research done by The Fletcher School and Mastercard Center for Inclusive Growth, of the $301 billion of funds flows from consumers to businesses in Nigeria, 98 percent is still based on cash.” GTBank wants to be part of the digitizer and also part of those who will collect the commissions on this huge 98%. This makes it a big fintech challenger.

---

Connect via my

LinkedIn |

Facebook |

X |

TikTok |

Instagram |

YouTube

Is the purpose of setting up fintechs here just to eat from the ‘commission pot’, or to expand and improve financial services? Can we have a fintech that can bring fresh twenty million people into the financial system, or have we concluded that only around forty million people here deserve to utilise modern financial systems?

Almost all the fintechs are doing the same thing, with the same cut throat commission they collect. Nobody has explained why the place they charge N100 can’t be N10, and the ones who command over one percent commission per transaction, until you hit a certain bar, should remain so. I thought innovation and competition should make offerings cheaper? Nothing is cheaper in our financial services space; we are not helping anyone, if we continue this way.

GTbank already have these services within, all it needs is to decouple and allow same to fly, while leveraging its brand equity to scale. But these things don’t inspire or hold much hope for ordinary people, other than fattening the pockets of the very oversized folks we have in the land.

We need fresh air please!

I couldn’t agree more. True innovation in the fintech space would be driven by genuine empathy instead of profiteering..

It is only an innovative and creative Fintech company that will be sustained by the present drive in the African financial services industry.