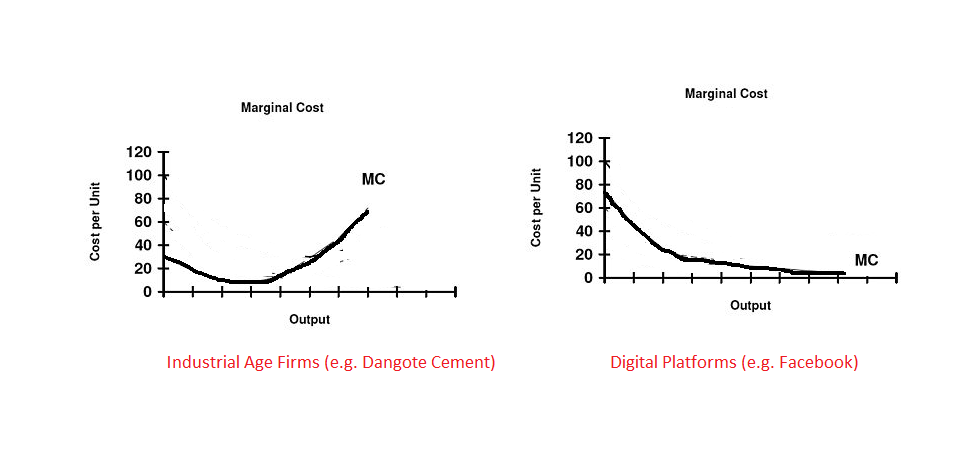

WeWork gets up to $8 billion new capital injection from SoftBank, and now the Japanese investor is on the path to own 80% of the company. This simply settles what everyone has been saying: WeWork (yes, We Company) is not a technology company. Simply, WeWork does not see improved marginal cost with scale, and when that happens, growth does not necessarily become leverageable. If growth is not leverageable, scalable advantage stalls, and the company cannot claim to be (overly) in the technology species. Sure, there are uncommon cases when one can achieve that type of growth, but count real estate out!

The We Company and SoftBank Group have agreed to a new capital infusion, which will see SoftBank committing $5 billion in new financing and issuing a tender offer for another $3 billion in buybacks for shareholders.

After the closing and the tender offer, SoftBank will own approximately 80% of The We Company, according to a statement. However, it will not hold a majority of voting rights, thanks to WeWork’s convoluted ownership structure.

---

Connect via my

LinkedIn |

Facebook |

X |

TikTok |

Instagram |

YouTube

As always, the king of loss making businesses – Softbank has come to the rescue, it can only be Softbank…

Apparently the only thing tech about WeWork is the app, everything else requires that you Keep writing fat cheques, of all places – real estate business!

When you operate in an economy where an entity can grant a bailout of this magnitude, with no clear path to profitability in the near future, just know that your ancestors did a terrific job while they were around.

Unbelievable. That is 33% of Nigerian budget for this year!