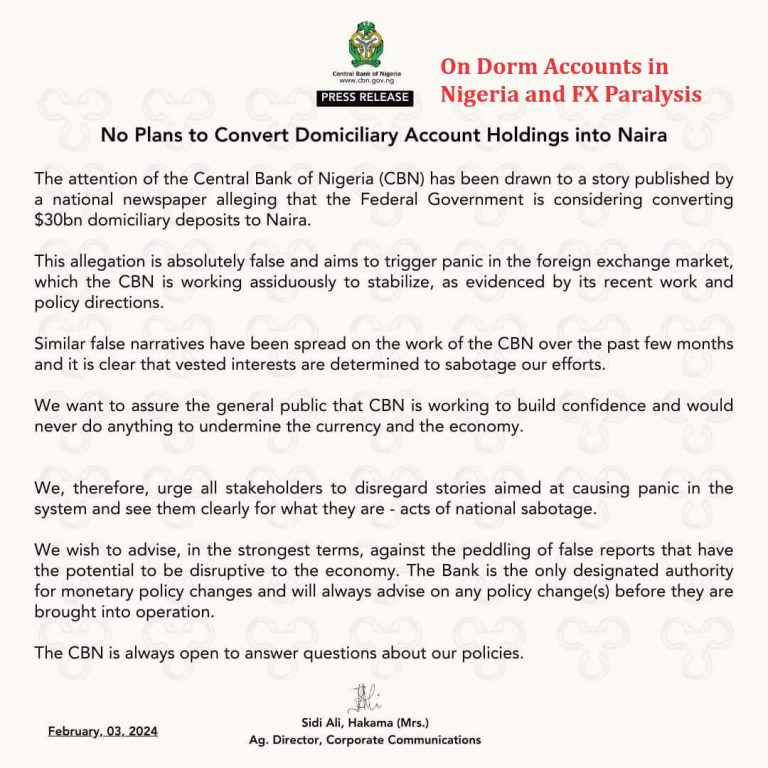

The big rumour: “There are strong indications that the Federal Government is mulling a policy that will result in the conversion of foreign currencies in domiciliary accounts of citizens to naira to stabilise the national currency”.

My Response: There is no basis to convert USD to Naira and no government can do that. If that should happen, Nigeria will become like Zimbabwe. Even if you convert USD to Naira, that does not solve the problem since most of these dollars are not in Nigerian bank vaults. I worked in the banking sector. Yes, you may not have access to USD in cash or other means to fix the forex challenges.

Typically, they keep a few percent of FX holdings and warehouse the rest with their correspondent banks across the globe. That is why they may not have $200 to give you in cash even though they can do a wire of $20,000 for you on the same day. Why? No physical cash is in Nigeria – they’re in New York, London, etc.

Register for Tekedia Mini-MBA edition 19 (Feb 9 – May 2, 2026): big discounts for early bird.

Tekedia AI in Business Masterclass opens registrations.

Join Tekedia Capital Syndicate and co-invest in great global startups.

Register for Tekedia AI Lab: From Technical Design to Deployment (next edition begins Jan 24 2026).

So, if you think Nigeria can convert say $1 billion in a bank’s book and have access to $1 billion in US dollar cash, you are dreaming. I worked in the bank as a young graduate and in the Systems Automation Unit, the most privileged unit in any bank in the world. I used to open the doors for the Treasury FX team to enter to have access to the FX vault area.

If you visit all the banks in Nigeria, their FX vaults do not have enough cash to cover up a percent of their dollar deposits. It makes sense since keeping physical dollars increases costs of insurance due to fire, theft, fraud, etc. So, the smart thing is to avoid that.

So, anyone who tells you that Nigeria can convert the balance in your dorm account and exchange for Naira, and have access to your US dollar has not worked in banking. Banking is an industry where money is assumed to be everywhere but look deeper, they have transmuted that money to capital, and few money is everywhere, physically.

You can have a $1 billion USD deposit but the vault cannot accommodate $5 million in cash, and that fund is not with the central bank but scattered across the world in the form of capital since banks are designed to take money and build capital to make money. The $30 billion you may see in bank books in Nigeria could be with MTN, Unilever, Dangote Group, Airtel, etc as foreign denominated loans. That said, consult your senator as he/she is the best person to calm you down; I am just a village boy enjoying myself in this nice world.

Yet, Nigeria needs to innovate. If we have $30 billion in the dorm accounts, it does mean that Nigeria has not provided reasons for people to invest in the country. That is why I praise people like Dangote who despite all things take risks by building companies over warehousing funds in banks. The question is this: what can Nigeria do to make it exciting for people to invest those billions which are sitting idly in bank vaults? Many nations have answered that question and transitioned from invention to innovation economies.

The big rumour: “There are strong indications that Nigeria is mulling a policy that will result in the conversion of foreign currencies in domiciliary accounts of citizens to naira to stabilise the national currency”.

My Response: There is no basis to convert USD to Naira and no… pic.twitter.com/4nYQYCP438

— Ndubuisi Ekekwe (@ndekekwe) February 3, 2024

Comment on LinkedIn Feed

Comment 1: What’s the difference between capital and money in this context?

I know I could have googled, but I’ve done so before and gotten different definitions.

My Response: You give a bank N1m in deposit as money. They invest that in a real estate project while making sure there’s liquidity in case you need your money. Specifically, that your money (N1m) is not idly in a bank vault. The bank believes on the faith that all depositors cannot come at the same time for their funds. So, it can keep just 20% of the money and convert the rest into capital via loans, investments, TB, bonds, etc.

That real estate firm can have a moneyman come to buy those loans, repackage them as debt assets and resell to investors, marking the percentages. Those investors are fund managers who represent family offices, etc. In an efficient system, you see N1m in your bank wallet but that money is now in real estate, debt buyers, etc. Simply, the bank has converted the N1m money into capital, unlocking massive opportunities along the way.

Money is a subset of Capital, and companies and nations which allow Money to rule over them underperform. Money does one thing: means to exchange goods and services. In short, the unit of Capital is money (i.e capital is measured in monetary terms). I explained further here

---

Connect via my

LinkedIn |

Facebook |

X |

TikTok |

Instagram |

YouTube

The rumour keeps coming around every few months, and the CBN keeps issuing statements; it will not still end with this one, until naira starts winning consistently. Speculation is a common thing here, both from the government and the people, both parties are regularly testing the waters to see if either party is still awake or has dozed off.

Trust is grossly lacking in the system, it’s the key reason why naira keeps taking a beating. Everyone is out to profit at the expense of Nigeria, but the blame is always shifted to the next person. Strange people.