Is there any reason to think that Bitcoin and its cousins will survive the high voltage assault from US and Canadian regulators. In the past, I had written that while cryptos could be decentralized (debatable though since mining is largely concentrated under few lords), the centralization of major exchanges implies that governments are still in control since exchanges need bank accounts to operate, and banks can only give those accounts, to only legally incorporated companies.

Interestingly, only governments give business licenses and permits. In other words, via exchanges, governments can influence and “quasi-regulate” cryptos.

That playbook is what we’re witnessing right now. The Canadian government has unleashed high voltages and many players are being burnt. Binance is under the crosshairs of the United States government. And just like that, the gyrations continue.

Register for Tekedia Mini-MBA edition 19 (Feb 9 – May 2, 2026): big discounts for early bird.

Tekedia AI in Business Masterclass opens registrations.

Join Tekedia Capital Syndicate and co-invest in great global startups.

Register for Tekedia AI Lab: From Technical Design to Deployment (next edition begins Jan 24 2026).

Good People, do you think Bitcoin has a future in the land of dollars?

Bitcoin Sell-Off + Record Liquidations commentary by Leverage Trading

- The recent crypto sell-off, which saw Bitcoin plummet from $26,809 to $25,388 in just over four hours, has resulted in a record number of leveraged traders being liquidated and incurring substantial losses.

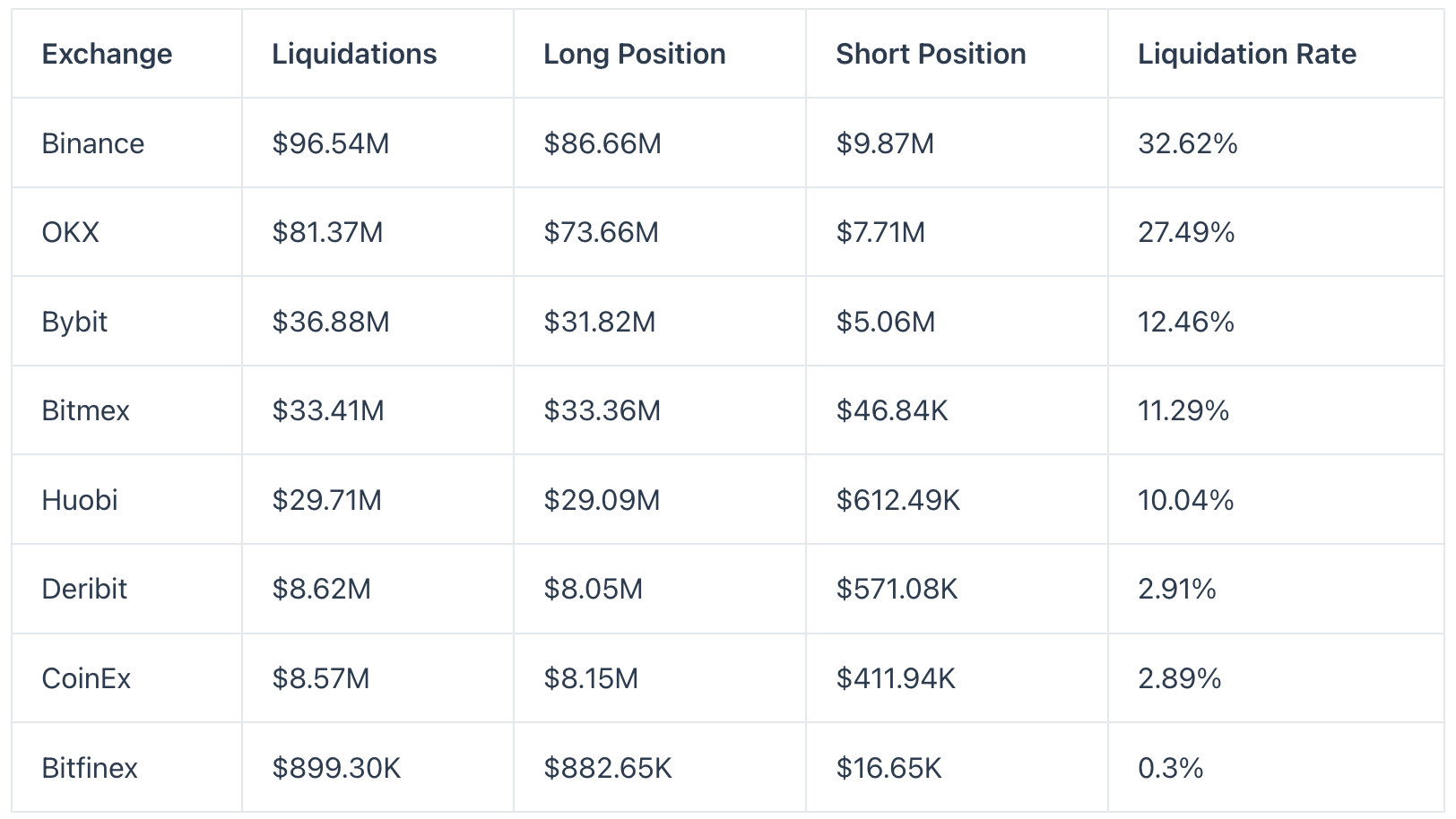

- During the past 24 hours, a staggering 108,997 traders have been liquidated, with a total liquidation value of $295.98 million.

- One of the most notable liquidation events occurred on Bitmex, where a single order valued at $9.94 million was liquidated.

- This sell-off marks the largest number of liquidated traders during a 24-hour period this year.

- The crypto community sold their positions in panic after the United States Securities and Exchange Commission (SEC) sued Binance exchange and its CEO, Changpeng “CZ” Zhao on a 13-count charge for violating securities laws.

- Those traders who suffered liquidations were trading highly leveraged derivatives contracts called perpetual swaps.

The impact was felt across various exchanges, as illustrated in the table below:

---

Connect via my

LinkedIn |

Facebook |

X |

TikTok |

Instagram |

YouTube

Does Bitcoin have sovereignty? If yes, what economic and political ideology does it advance, capitalism, communism, socialism, or decentralization? Does it have independent courts and law enforcers? A constitution without enforcement arm is worthless.

There are number of things that make up a nation state, and if you don’t have them, you remain under attacks, and at the mercy of more organized and formidable forces.

You can be treated nicely until you are seen as a threat, and then everything will change…