Last week, I deleted a post here on this matter when I posited that if Nigeria refuses to offer Dangote Refinery a new Naira deal on crude oil, it could impose a USD-denominated transaction in the local market, especially for aviation-related products. I got a note from a minister’s office and I deleted; too much extrapolative modelling. (In the midst of technical analysis, I do delete when it could cause trouble for the economy.)

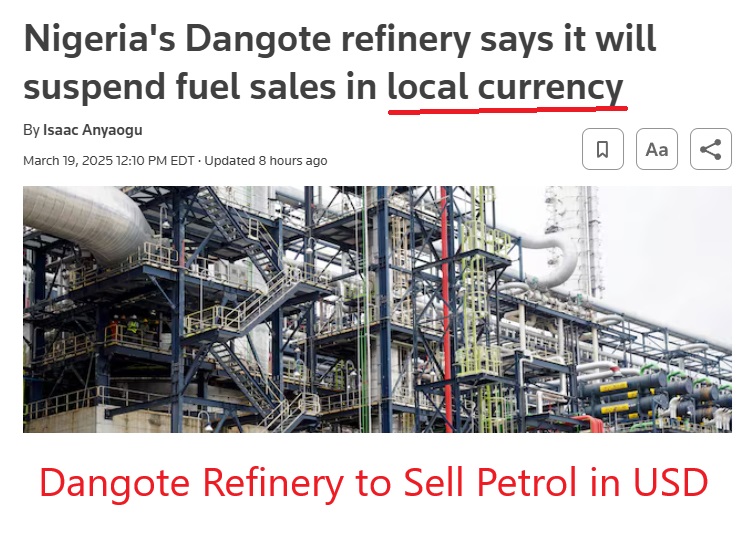

But today, we are reading that what I posited has happened: ‘Nigeria’s huge Dangote Petroleum Refinery announced on Wednesday that it was temporarily suspending fuel sales in the local naira currency to avoid a mismatch between sales in naira and purchases of crude in dollars….”To date, our sales of petroleum products in Naira has exceeded the value of Naira-denominated crude we have received. As a result, we must temporarily adjust our sales currency to align with our crude procurement currency” the company said in a statement.’ – Reuters

My position remains that Nigeria does not have the capacity to float its currency, and in the way we have it, someone must still subsidize the Naira against currencies like US dollars. It used to be the government. But the nation has moved it to companies like MTN, MultiChoice, and manufacturers which have lost billions of Naira over this.

Register for Tekedia Mini-MBA edition 19 (Feb 9 – May 2, 2026): big discounts for early bird.

Tekedia AI in Business Masterclass opens registrations.

Join Tekedia Capital Syndicate and co-invest in great global startups.

Register for Tekedia AI Lab: From Technical Design to Deployment (next edition begins Jan 24 2026).

On the Dangote Refinery one, the refinery does not want to absorb the cost, and is taking a drastic position which could rattle the economy. Indeed, it cannot pay USD and sell in Naira at a loss thereby subsidizing Naira! The Naira floating policy is transferring the subsidy to private companies but here we are seeing a category-king company at a solid positioning rejecting it.

Expected conclusion: the government will enter a new deal to sell in Naira to Dangote Refinery, and by doing that, it is subsidizing Naira, not via the central bank, but via petrol pumps! When a bird flies from the ground to perch on an anti-hill, it is still on the ground!

---

Connect via my

LinkedIn |

Facebook |

X |

TikTok |

Instagram |

YouTube

Dangote Refinery didn’t just wake up and decide to stop naira bulk sales of refined products. We are not dealing with the fundamental problem if we think it’s just about naira crude swap and selling refined products in naira. This is a country where a company dropped around $20 billion to set up a massive refinery, and how did Nigerians and their government respond? The government was still issuing import license to marketers who don’t own a refinery to bring petrol into Nigeria!

The yammering about ‘competition’ and avoiding ‘monopoly’ can be described as jaundiced ignorance at best. You don’t talk about competition when rules are not same. How can imported product be competing with local product and you think you have an economy? Competition can only become part of the conversation when BUA Refinery comes on stream, and other small refineries in the land producing. Dangote Refinery has consistently said it has enough to satisfy the market, but our economic bandits and hitmen ignore that, preferring to put the naira in further distress. They import with dollars, why should Dangote Refinery now sell in naira? Think about it.

The political power holders are busy playing ostriches, as if they are not the architects of everything.