In 1776, Scottish economist and philosopher, Adam Smith wrote his classic – ‘The Wealth of Nations’. That book became one of the most important works in understanding the nature and causes of the wealth of nations. From Milton Friedman to Maynard Keynes and my favorite, Joseph Schumpeter, scholars have pursued the noble course to understand the economic mechanics of nations.

Clayton M. Christensen’s upcoming book, The Prosperity Paradox, has posited that strong corporations build better public institutions because for all government policies, companies have to fund them, through taxes and fees. So, Nigeria’s inability to build enduring corporations would continuously hurt Nigeria’s capacity to improve our public institutions. Yes, if MTN, Glo, Airtel and 9Mobile do not make money, NITDA (National Information Technology Development Agency) will not have money to fund its mandate. And if Nigerian corporations are not profitable, the education tax (TETFUND) would struggle. And interestingly, you do not need governments to be perfect before great companies can be created. Before Central Bank of Nigeria Owerri office, First Bank of Nigeria was partly acting like the bank of last resort in eastern Nigeria, clearing cheques for other banks!

Applying the rigorous and theory-driven analysis he is known for, Christensen suggests a better way. The right kind of innovation not only builds companies—but also builds countries. The Prosperity Paradox identifies the limits of common economic development models, which tend to be top-down efforts, and offers a new framework for economic growth based on entrepreneurship and market-creating innovation. Christensen, Ojomo, and Dillon use successful examples from America’s own economic development, including Ford, Eastman Kodak, and Singer Sewing Machines, and shows how similar models have worked in other regions such as Japan, South Korea, Nigeria, Rwanda, India, Argentina, and Mexico.

Good People, we need to have new operational manifestos in Nigeria. Can we have a Center for Corporate Longevity in each region, hosted by regional leading universities? These centers would focus on understanding the root causes of our industrial paralyses (like the fading of Diamond Bank) which continue to undermine a once virtuoso pragmatic economy.

Register for Tekedia Mini-MBA edition 19 (Feb 9 – May 2, 2026): big discounts for early bird.

Tekedia AI in Business Masterclass opens registrations.

Join Tekedia Capital Syndicate and co-invest in great global startups.

Register for Tekedia AI Lab: From Technical Design to Deployment (next edition begins Jan 24 2026).

Nigeria’s Access Bank Plc agreed to take over struggling local rival Diamond Bank Plc in a deal worth about $200 million that would create the nation’s biggest lender by assets. Both companies’ shares rose.

Access will buy Diamond for 3.13 naira a share, with almost a third of that, or about $64 million, being paid for in cash and the rest in shares, the Lagos-based lenders said in statements to the Nigerian stock exchange on Monday. That’s more than triple Diamond’s previous closing price.

Our regulators have not fixed these issues and it seems our companies do not have the capacities to save themselves. As I have noted before, finding enduring companies in Nigeria is hard:” In short, if you sort companies by “40th birthday” in the Nigerian Stock Exchange, and carefully remove entities with international origins, you may struggle for two dozen.”

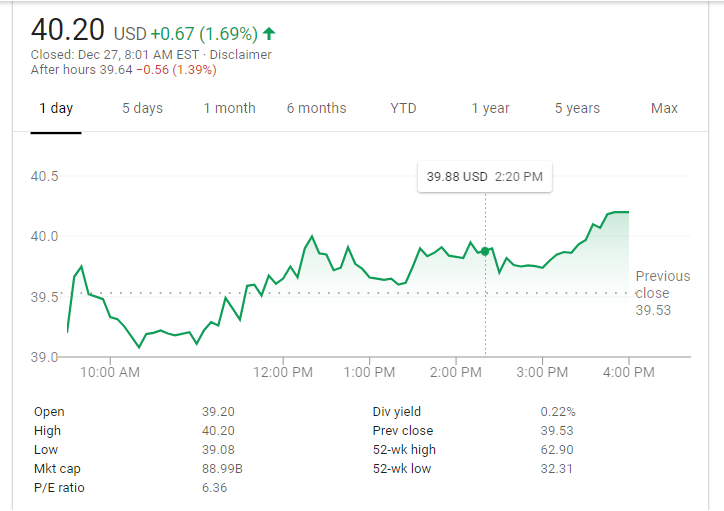

I was shocked that after 260% premium, Diamond Bank went for $200 million. Think about it – that is one of the nation’s leading companies. In South Africa, one company, Naspers can buy all the companies in Nigerian Stock Exchange with less than 50% of its market value: the Nigerian Stock Exchange total market cap is about $34 billion while one South Africa firm commands $89 billion.

Naspers cap today is about $89 billion while the whole of Nigerian Stock Exchange is about $34 billionThere is a reason why our equities are priced the ways they are: investors do not have the long-game plan in Nigeria. And only Nigeria can change that perception. We need to deepen capabilities to make sure we have long-view corporate institutions.

To our emerging technology hubs, incubators and accelerators, we need to add components that deal with corporate longevity and succession. And it is very important for our universities to spend efforts to have centers that can help our corporations understand these issues. This is no more a regulatory challenge – it is a national problem which must be fixed. Because our firms are not dying because of creative destruction, we need to investigate and discover new roadmaps on the corporate longevity in Nigeria.

---

Connect via my

LinkedIn |

Facebook |

X |

TikTok |

Instagram |

YouTube

The founding fathers of NASPERS include some of the major forerunners and supporters of systematic racial segregation (apartheid) in South Africa, namely, Botha, Hofmeyr, Marais, and Hertzog, the founder of the Far right, National Party in South Africa.

NASPERS grew fat from the policies of institutionalized white supremacy and supported the human rights violators of the era, financially and otherwise.Some may argue that it should have been nationalized in the 1990s.

The company tried to reinvent itself in recent years with some shrewd investments in ecommerce etc, but we should note how it initially accumulated its capital . It is still dominated by Dutch (Afrikaner/Boer) descendants such as van Dijk (CEO), Bekker, etc and has shrugged off accusations of racism.

Actually, I just know the firm as a great investing firm. Of course many challenging things happened in South Africa.

A very beautiful concept you have brought to the fore again!

In reality, the failing of Diamond bank, for example, is not a misfortune. Acquisitions is one of modern business dynamics that is saving and elongating the interest of all major stakeholders of business organizations, the alternative would be death like Savannah and the likes in the 1990s.

It may appear as though the business organization is dead or dying, but don’t forget the sole purpose of creating a business organization is to serve and prosper the owners, this is not being jeopardized.

Though I did not have Diamond Bank as a case here. But note that if the basis is “someone paid for it” and that means it is all good, there would not be any issue to debate. The fact remains that we know when companies enter M&A on strength. Just ten years ago, Diamond Bank was worth more than N200b in market cap. That you sold it N62B should not be celebrated as part of the working of market and creative destruction. It is from that context that you look at value and longevity.