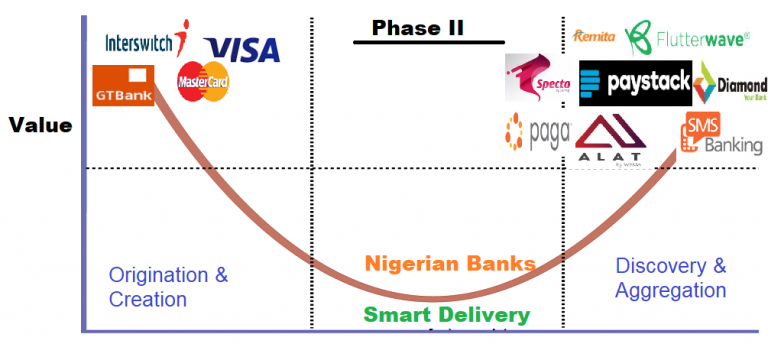

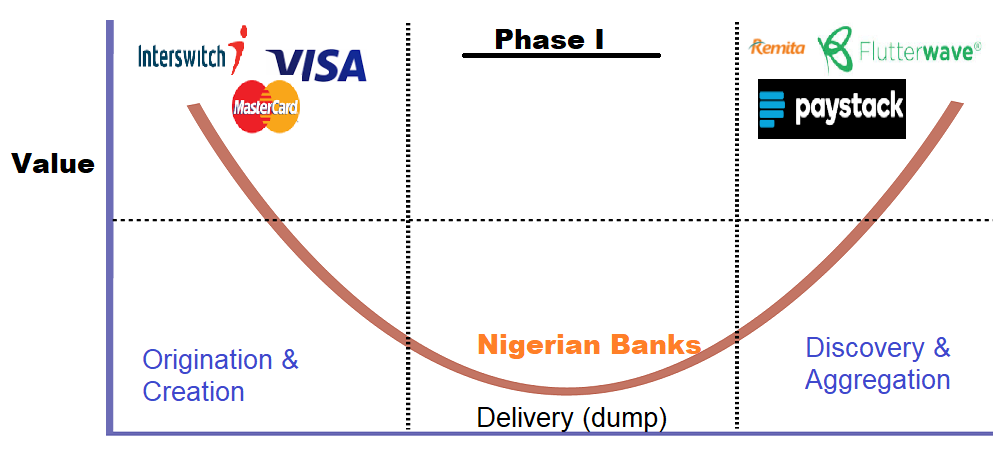

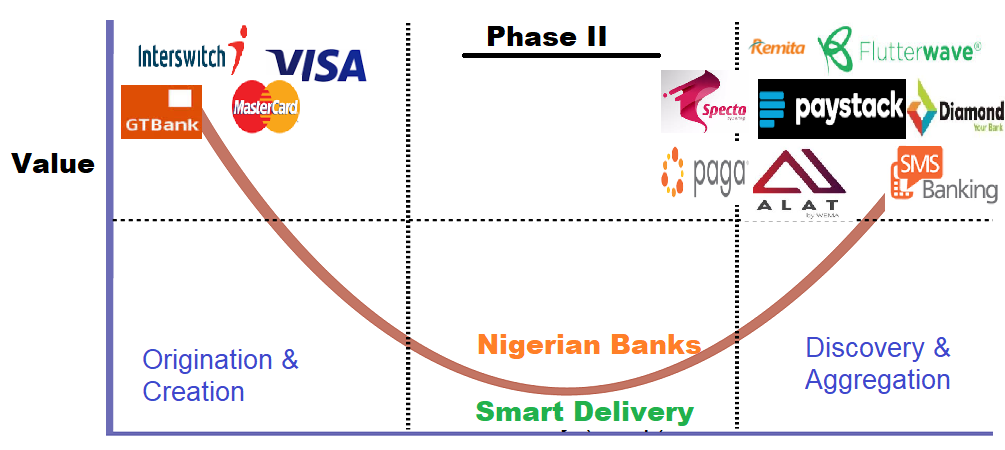

In 2015, I made a presentation to a Nigerian Bank Board. I used the Smiling Curves to explain the challenge before our banks as amalgam of fintechs were emerging. Today, I can say that Nigerian banks have evolved. They are indeed the best fintechs in the nation. If ALAT is a startup, it would be a category-king company. If the newly unveiled Specta is also one, we would debate the massive war chest of N10 billion for retail lending that takes less than 5 minutes. From UBA to GTBank all the way to Ecobank (yes, Togo), we are witnessing a total redesign in the banking sector. Here, I explain how these banks have moved form the centers of the smiling curves to the edges while retaining those center pipes.

As we learnt from Mitt Romney, a U.S. politician, you can build a business so that head, you win and tail, you also win. There is no fintech that will thrive in Nigeria that would not be paying “taxes” to the banks. Remita is a partner just like Paystack. And if you want to enter the fray, you would be normalized: the edges are sealed and the center is controlled. People, glory awaits and the banks are declaring profits because the more fintechs work, the better the banks collect taxes from the edges to the center.

The challenge for the fintechs is that banks may even decide to cut them off. I am not sure the Central Bank of Nigeria worries over that!

Register for Tekedia Mini-MBA edition 19 (Feb 9 – May 2, 2026): big discounts for early bird.

Tekedia AI in Business Masterclass opens registrations.

Join Tekedia Capital Syndicate and co-invest in great global startups.

Register for Tekedia AI Lab: From Technical Design to Deployment (next edition begins Jan 24 2026).

---

Connect via my

LinkedIn |

Facebook |

X |

TikTok |

Instagram |

YouTube