In Nigeria’s fiscal landscape, the new tax bill has sparked debates about its potential to recalibrate the nation’s revenue streams and foster economic sustainability. In this piece, our analyst addresses some critical questions as the debate rages on. What problems does the bill claim to address, whose interests does it prioritize, and how does its framing influence public perception? Beyond its technical language, the tax bill carries profound implications for equity, governance, and social justice.

Framing the Problem: Revenue Dependency and Tax Evasion

At its core, the tax bill identifies Nigeria’s over-reliance on oil revenues and low tax compliance as critical fiscal challenges. By expanding the tax base to include emerging sectors, such as digital markets, and strengthening enforcement mechanisms, the bill seeks to address these issues. On the surface, these appear to be pragmatic solutions to fiscal instability.

Yet, this framing of the problem carries certain assumptions. It portrays fiscal deficits as primarily a technical issue of insufficient revenue collection rather than a systemic one rooted in governance deficits. Corruption, inefficiencies in tax administration, and lack of transparency—critical factors undermining public trust—are conspicuously absent from the policy’s narrative. By narrowly focusing on compliance, the bill risks perpetuating the view of taxation as an extractive tool rather than a collective investment in national development.

Register for Tekedia Mini-MBA edition 19 (Feb 9 – May 2, 2026): big discounts for early bird.

Tekedia AI in Business Masterclass opens registrations.

Join Tekedia Capital Syndicate and co-invest in great global startups.

Register for Tekedia AI Lab: From Technical Design to Deployment (next edition begins Jan 24 2026).

The Power Dynamics of Tax Policy

Taxation is inherently political, reflecting and reinforcing power dynamics within society. In this context, the bill elevates the state as the primary authority over economic activities while positioning taxpayers as subjects of compliance.

However, this dynamic reveals a trust deficit. Decades of mismanaged public funds have eroded citizens’ confidence in the government’s ability to utilize tax revenues effectively. Without addressing this trust deficit, efforts to expand compliance may encounter resistance, particularly from informal workers and small businesses already burdened by economic uncertainties.

Further, the bill aligns with global tax standards, such as curbing Base Erosion and Profit Shifting (BEPS) by multinational corporations. While this alignment is commendable, it largely serves the state’s interests in negotiating with large corporations. Meanwhile, local businesses—especially those in the informal sector—struggle with limited institutional support, placing them at a disadvantage in this new tax regime.

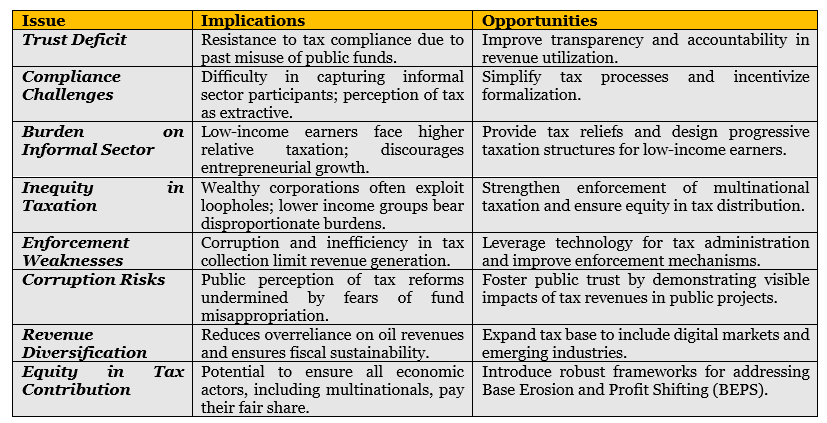

Exhibit 1: Issues and opportunities in the proposed bill

Language and Legitimization

The language of the tax bill is steeped in technical jargon, emphasizing modernization, compliance, and revenue diversification. This language conveys a sense of inevitability and progress, masking the political nature of taxation and its redistributive consequences.

For example, terms like “tax compliance” and “enforcement mechanisms” are presented as neutral tools for fiscal discipline. However, they carry implicit moral judgments, framing taxpayers as either cooperative citizens or deviants undermining national development. This binary framing risks alienating small businesses and informal workers, who may face systemic barriers to compliance rather than deliberate tax evasion.

Moreover, the bill’s language overlooks the socio-political realities of enforcement. Increased taxation without addressing systemic inefficiencies in tax collection could exacerbate the financial burden on marginalized groups while enabling elites to exploit legal loopholes.

Equity in Focus: Who Gains, Who Loses?

From a social justice perspective, the bill raises critical concerns about equity. Its emphasis on broadening the tax base may inadvertently burden low-income earners and small businesses, who already operate in a challenging economic environment. Without progressive measures—such as tax reliefs for low-income groups or incentives for small businesses—the reforms risk deepening existing inequalities.

Conversely, the bill’s provisions for addressing multinational corporations’ tax practices represent a potential win for equity. By ensuring that wealthier corporations contribute their fair share, the policy could reduce fiscal inequities. However, the effectiveness of these measures hinges on robust enforcement mechanisms and the government’s willingness to resist corporate lobbying.

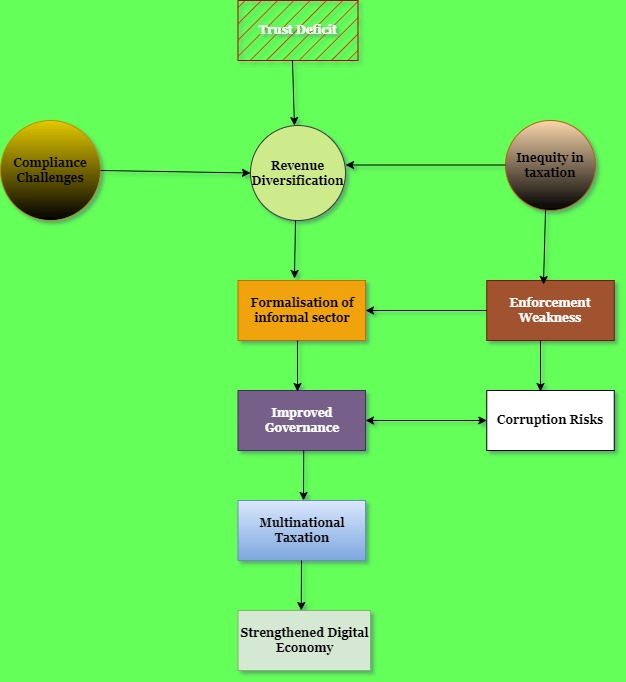

Exhibit 2: Network of issues and opportunities in the proposed tax bill

The Informal Economy: A Marginalized Stakeholder

The informal economy, which constitutes a significant portion of Nigeria’s GDP, is notably underrepresented in the bill’s narrative. While the policy seeks to integrate informal workers into the tax system, it provides little clarity on how systemic barriers—such as lack of financial inclusion or complex registration processes—will be addressed.

For many informal workers, taxation is not just a financial burden but also a bureaucratic challenge. Simplifying tax processes, providing incentives for formalization, and ensuring that tax revenues translate into tangible benefits are critical to fostering compliance and trust among this group.

Public Trust and Governance: The Missing Link

The success of any tax reform lies in its ability to foster public trust. Citizens are more likely to comply with tax obligations when they perceive that revenues are being utilized transparently and effectively. Unfortunately, Nigeria’s fiscal history is marred by allegations of corruption and mismanagement, undermining confidence in the tax system.

To bridge this trust gap, the government must adopt a participatory approach to tax reform. Engaging citizens in fiscal decision-making, enhancing transparency in public expenditure, and demonstrating accountability are crucial steps toward building a more inclusive and equitable tax system.

Toward a Just and Sustainable Fiscal Future

The Nigerian tax bill represents a significant step toward fiscal modernization and economic diversification. However, its potential benefits must be weighed against its social and political implications. By framing taxation as a neutral economic tool, the policy risks obscuring its redistributive effects and marginalizing vulnerable groups.

To ensure its success, the government must go beyond technical fixes and address the deeper systemic issues that undermine public trust. This includes tackling corruption, simplifying tax processes, and fostering a more inclusive dialogue on fiscal priorities. By aligning taxation with broader social and economic goals, Nigeria can create a tax system that not only generates revenue but also promotes equity, inclusion, and trust.

In the end, taxation is not merely about numbers; it is about building a fairer society where every citizen, regardless of income or status, contributes to and benefits from national development. Through a more equitable and transparent tax policy, Nigeria can lay the foundation for a just and sustainable fiscal future.