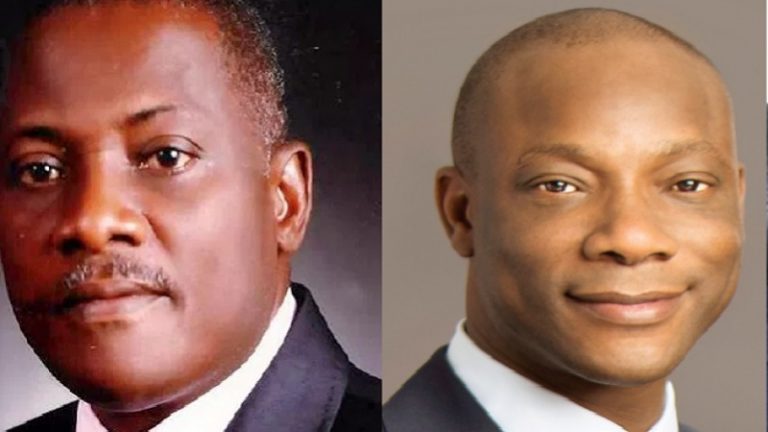

The Innoson Vehicles Manufacturers (IVM) vs Guaranty Trust Bank (GTB) legal tussle has taken a new turn following the decision of the supreme court of Nigeria to revisit the case.

The Supreme Court in a fresh ruling has overturned its previous decision which dismissed an appeal by GTB (now a subsidiary of Guaranty Trust Holdings Company plc, GTCO). A Federal High Court in Ibadan had awarded N2.4 billion (700,000,000 plus accrued 22% interest per annum until the final liquidation) in favor of Innoson against the Nigerian Custom Service in 2010, ordering the bank to release NCS’ fund in its care to Innoson by way of garnishee order.

A garnishee order is one of the options open to a judgment creditor to enforce a judgment made in its favor.

Register for Tekedia Mini-MBA edition 19 (Feb 9 – May 2, 2026): big discounts for early bird.

Tekedia AI in Business Masterclass opens registrations.

Join Tekedia Capital Syndicate and co-invest in great global startups.

Register for Tekedia AI Lab: From Technical Design to Deployment (next edition begins Jan 24 2026).

GTB did not accept the judgment and appealed. Consequently, on February 27, 2019, in a judgment marked SC/694/2014, the Supreme Court, however, dismissed GTB’s appeal and affirmed the judgment of the Federal High Court. And again, the bank filed an application seeking the re-listing of the appeal on the grounds that it was wrongly dismissed.

In the new turn of events, a five-member panel led by Justice Olukayode Ariwoola, on Friday, delivered a unanimous judgment which admitted that the Supreme Court erred its ruling that dismissed GTB’s appeal.

In the lead judgment written by Tijani Abubakar but read by Abdu Aboki, the court held that it was misled by its registry, who failed to promptly bring to the notice of the panel that sat on the case on February 27, 2019, that GTB had already filed its appellant’s brief of argument.

The Supreme Court stated that if the panel hearing the case on February 27, 2019, had been informed of the availability of the appellant’s brief of argument, the judgment would not have been issued.

Relying on Order 8 Rules 16 of the Supreme Court Rules, the apex court held that it has the power to set aside its decision in certain circumstances, like any other court. The Court cited circumstances that may warrant reversing its decision, including when the parties obtained judgment by fraud, default or deceit; where such a decision is a nullity or where it is obvious that the court was misled into giving a decision.

Thus, Justice Tijani held that the circumstances of the GTB case fall into the category of the rare cases where the Supreme Court could amend or alter its own order on the grounds that the said order or judgment did not present what it intended to record.

“I am convinced that at the material time that the appellant’s appeal was inadvertently dismissed by this court, there was in place, a valid and subsisting brief of argument filed by the applicant.

“It will be unjust to visit the sin of the court’s Registry on an innocent, vigilant, proactive and diligent litigant.

“It is obvious from the material before us, that there were errors committed by the Registry of this court, having failed to bring to the notice of the panel of Justices that sat in chambers on the 27th February 2019 that the appellant had indeed filed its brief of argument.

“This is a case deserving of positive consideration by this court.

“Having gone through all the materials in this application, therefore, I am satisfied that the appellant/applicant’s brief of argument was filed before the order of this court made on the 27th of February 2019 dismissing the applicant’s appeal.

“The order dismissing the appeal was therefore made in error. It ought not to have been made if all materials were disclosed. The application is, therefore, meritorious and hereby succeeds,” Justice Tijani said.

Therefore, the court set aside its previous ruling and ordered that the appeal marked: SC/694/2014 “be relisted to constitute an integral part of the business of this court until its hearing and determination on the merit.”

The Innoson Vs Nigerian Custom Service and GTB legal saga has lingered for over a decade. This new development means it may take many more years to reach conclusion. And with 22% yearly accrued interest tied to the litigation, which has now surpassed N32 billion, the prolongation of the case may cause the bank more financial harm.