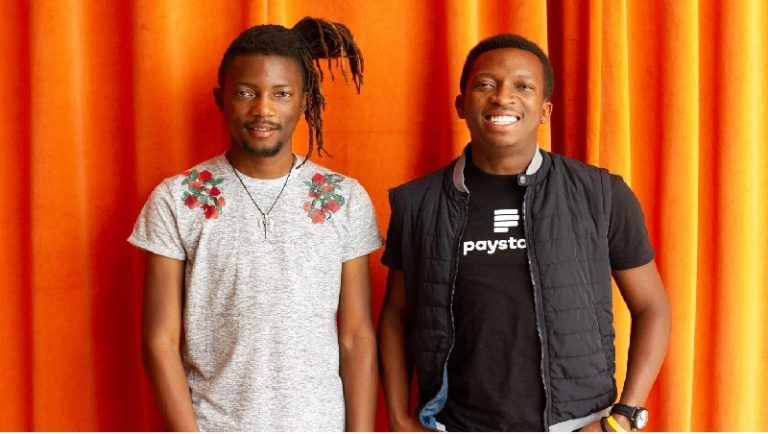

Stripe acquires Nigeria’s Paystack for more than $200 Million. When Stripe invested in Paystack a few years ago, many noted that it was certainly a way to understand the market. I did speak and exchanged emails with the co-founder of Stripe, John Collison, during that time. Now, Stripe has understood well enough, and now wants to buy-out the whole company, creating multi-millionaires in Nigeria overnight.

Nigeria, this is a good news because across the nation, a new club has just been formed: those with extra money to support emerging companies. To Paystack boys, well done. Both have served Nigeria and Africa in great ways.

Now, Flutterwave needs to step up its game as Stripe has just landed in Lagos!

Register for Tekedia Mini-MBA edition 19 (Feb 9 – May 2, 2026): big discounts for early bird.

Tekedia AI in Business Masterclass opens registrations.

Join Tekedia Capital Syndicate and co-invest in great global startups.

Register for Tekedia AI Lab: From Technical Design to Deployment (next edition begins Jan 24 2026).

Stripe is acquiring Paystack, a startup out of Lagos, Nigeria that, like Stripe, provides a quick way to integrate payments services into an online or offline transaction by way of an API. (We and others have referred to it in the past as “the Stripe of Africa.”)

Paystack currently has around 60,000 customers, including small businesses, larger corporates, fintechs, educational institutions, and online betting companies, and the plan will be for it to continue operating independently, the companies said.

Just like that, Paystack is worth more than Unity Bank, FCMB Group Plc and Wema Bank combined. Wema Bank began life in the 1940s. Just looking at its market cap, it is evident that ALAT, its digital bank, has struggled as it has not delivered multiples which are evident. FCMB Group Plc has many entities besides the bank, FCMB Bank.

But via an API, Paystack has created more value than all of them combined. That is the power of operating at the edges of the smiling curve, instead of the center. Paystack operates at the edges and has unlocked multiples.

---

Connect via my

LinkedIn |

Facebook |

X |

TikTok |

Instagram |

YouTube

More of a mixed feeling. On the one hand, I feel good that Nigerians created a product of such value, that young folks gave a very good account of themselves; on the other hand, it feels like something is being taken away from us. It is tough to reconcile both feelings, but again, you cannot tell owners what to do with their own creation, it’s their call to make.

I still feel and believe that we deserve to own a billion dollars start-up here, to fly our flag among the big guys, it could be the greatest legacy some of us would aim to leave behind.

Our business schools, what kind of case studies are being built for Nigeria’s start-up ecosystems: where innovative brands are built with the intention of selling, once they gain traction; or where foreign companies circle to get a small pie of the success story? India seems to be on the second part presently, I cannot say same for Nigeria.

We will get there, someday…

Great article. I do share your mixed feelings. I however recall that paystack gained traction through YC, and the stripe initial investment. So I can easily understand these youngsters dilemmas.

The good news is that hopefully our people with money will start to take seed investing seriously. Otherwise, we will get more cases like this.

We still a lots to build, so there will many more great companies to come along.

It is indeed impressive to see a business of less than a decade outgrow businesses of many decades. This just confirmed what value creation can do more faster and better than imitations.