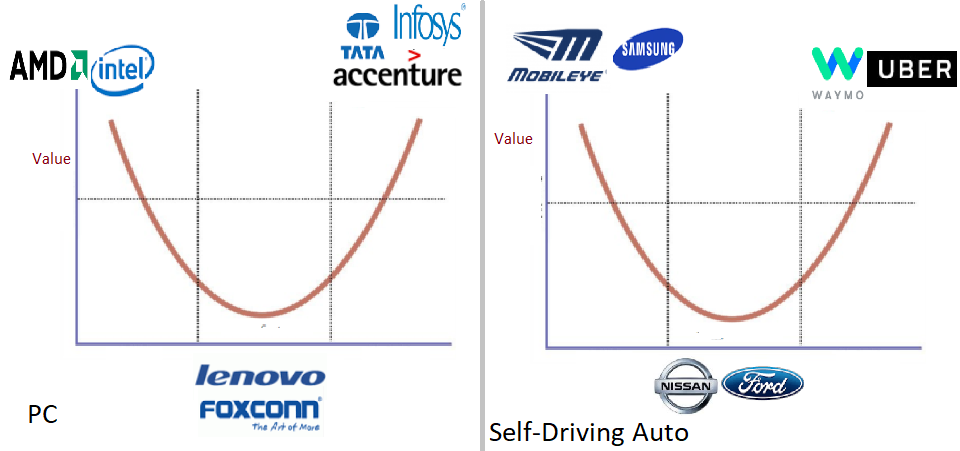

In this video, I explain how value is shifting from the traditional car manufacturers to the companies which are “retrofitting” cars to become driver-less vehicles. When Uber and Waymo receive cars from companies like Nissan and Ford, they take them through engineering processes, turning them into driver-less cars. Systematically, the value now moves from Nissan and Ford to the final products made by Uber and Waymo (this applies even as Uber and Waymo are not selling the cars to the mass market).

If the traditional car companies do not evolve, they will become like PC manufacturers who saw their margins tumble even as chip suppliers like Intel, and IT services firms like Accenture continue to improve margins. Simply, when Toyota Yaris leaves Toyota garage, it could be worth $10,000. But when it has been converted into an autonomous driving car in say Apple facility, it could leave garage at $15,000. Apple could have bought it at $10,000 delivering a margin of say $1,000 to Toyota while it has created an extra value of $5,000 from which it commands a margin of $3,000. The implication is that value has shifted from Toyota to Apple, just as we experiencing in the PC market.

Smiling Curves (PC and Autonomous Auto)

Register for Tekedia Mini-MBA edition 19 (Feb 9 – May 2, 2026): big discounts for early bird.

Tekedia AI in Business Masterclass opens registrations.

Join Tekedia Capital Syndicate and co-invest in great global startups.

Register for Tekedia AI Lab: From Technical Design to Deployment (next edition begins Jan 24 2026).

The capacity to do this transformation, by the traditional car companies, cannot be easily captured in typical ranking by management think tanks that look at systematic order in management processes. The Drucker Institute released one ranking few days ago, and it ranked companies like GE and P&G high up there. GE is in a mess right now, but the old management system may still be working. However, Uber may be off the chart, in the ranking, but that does not change where the value is being created at the moment. In other words, being run very well may not be enough, entrepreneurial vision will be necessary, as Jack Ma noted this week. Fortune Newsletter said it brilliantly, thus:

The Drucker Institute, set up to advance the thought of management guru Peter F. Drucker, put Amazon at the top of its inaugural list of the U.S.’s most effectively managed companies. The methodology is based on 37 different rankings including patent registrations and employee reviews on Glassdoor, which explains why companies in the news for chronically falling revenues (IBM) or poor shareholder returns (P&G, GE) fare surprisingly well in the list.

---

Connect via my

LinkedIn |

Facebook |

X |

TikTok |

Instagram |

YouTube