Humans are the same. Americans. Nigerians. Indians. We’re just the same. What differs is our environment. And that environment shapes how we act, making it look like we’re different. Like I have written many times, there is a liberation that comes when you land in Lagos from Europe or the Americas. The Lagos police officer stops you but you know that he wants some “goodies” knowing that a brother or sister is making into the country. Statistically, he knows you are 99.99% unarmed on the streets of Lagos, and he does not worry about that risk to his life.

Silicon Valley Bank is no more. The FDIC seized the assets of the bank, a fixture of the VC world and a prolific lender to the tech and life sciences sectors, on Friday, marking the largest bank failure since the height of the 2008 financial crisis.

Silicon Valley’s clubby world of venture capital investors and entrepreneurs plunged into panic on Thursday amid fast-spreading reports of financial trouble at one of the startup industry’s most important banks.

SVB announced a day earlier that it was selling off securities and seeking to raise billions in a public share sale to cover steep losses on its balance sheet. Shares of Silicon Valley Bank crashed by roughly 60% in regular trading on Thursday, while the bank’s tech clients scrambled to figure out whether to withdraw their deposits, sparking concerns of an old-fashioned bank run. (Fortune newsletter)

Less than 24 hours later, bank regulators stepped in to take control, and investors and founders alike are scrambling to figure out the best next move.

But in the United States with as many guns as burgers in a day, the police officer assumes you’re armed, and with that mindset, how he engages is transformed. Look deeper, the Lagos police officer has a more nuanced use of force because his risk model is well mitigated.

Register for Tekedia Mini-MBA edition 19 (Feb 9 – May 2, 2026): big discounts for early bird.

Tekedia AI in Business Masterclass opens registrations.

Join Tekedia Capital Syndicate and co-invest in great global startups.

Register for Tekedia AI Lab: From Technical Design to Deployment (next edition begins Jan 24 2026).

Why this? The collapse of a US tech-focused bank, Silicon Valley Bank, reminds me that we’re all the same. When Silicon Valley millionaires heard that the bank had a minor problem, they triggered a bank-run, and within hours the bank collapsed: “Within 48 hours, a panic induced by the very venture capital community that SVB had served and nurtured ended the bank’s 40-year run.”

Looking deep, if the bank had not carelessly disclosed that statement of capital inadequacy, it would still be here. Ideally, it had done the right thing by raising capital to cushion its liquidity. But it assumed that Silicon Valley founders, entrepreneurs and millionaires would understand its point: we raised small funds by diluting existing investors to clean our balance sheet; a really sensible call for a bank.

Like what an akara and corn seller will do in Lagos on bank rumours, when the startups heard that news, they went to the bank and said: “give me my money”. And the bank login froze; none could get in – and that was it.

Mark disclosed that even though the bank announced that they were selling long-term investments at a loss and investing in higher-yield investments to improve their financial metrics, he took that at face value, and strongly believes that they would get things sorted out, but unfortunately, it has been followed by the widespread panic which led to the collapse of the bank.

Within 48 hours, a panic induced by the very venture capital community that SVB had served and nurtured ended the bank’s 40-year run.

[…]

@btc_banker wrote, “Businesses withdrawing their deposits are behaving rationally, given the hysteria. Nobody wants to be the calm one holding the bag.”

@robertmclaws wrote, “If you have more than $250k at any single bank then your money is at risk if the bank goes south. SVB is a bank for VCs, not for startups. I would question ANY VC that is not advising their companies to minimize their risk and protect their runway.”

@MalibuAlex wrote, “The biggest risk to any company is running out of cash.Not having access to money is the same as running out, which could happen if there’s a run.Since it’s easy to move the cash out of SVB – and that lessens whatever unknown risk there is, why not do that?”.

Comment on Feed

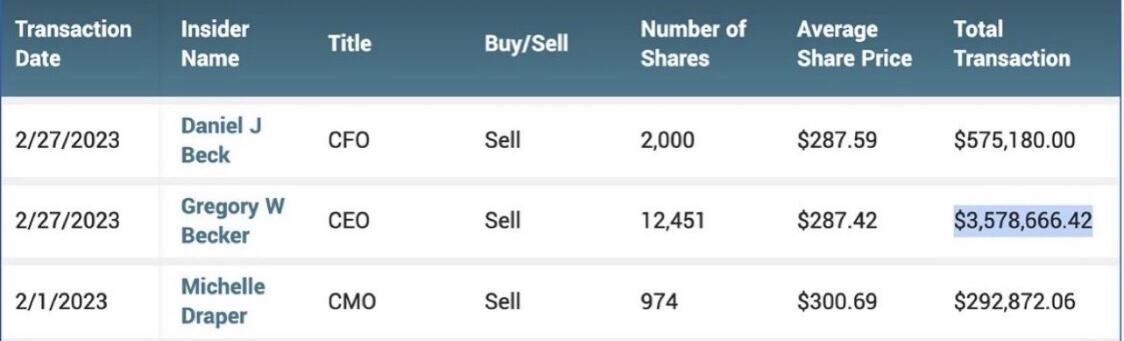

Comment: Perhaps someone figured out their top three were cashing-out last month and spread the news that everything was not all sunshine at SVB.

My Response: That may not be a problem. Most publicly traded companies are required to have share sales planned weeks ahead, for executives. In other words, if you work at Apple, as an executive, and you want to sell, there is a window you can only do that. The compliance team will schedule the sale. The goal is to avoid timing the market. I am hoping that was what happened here. Of course, they will explain that in the court as the trial lawyers are gathering!

---

Connect via my

LinkedIn |

Facebook |

X |

TikTok |

Instagram |

YouTube

Yes, we are the same only in name, every other thing is a moving target. How do you compare the US and Nigeria when it comes to committing financial heist? We are saints here then.

What is really true about this land called America? This question needs to be asked forcefully, because when we use beautiful and harmless words to lace heinous things the US has committed throughout history, we fail to pass the right judgments.

What is clear is that Nigeria doesn’t get enough credit for how it manages complex things, probably because the country is a walking crisis. Can the US withstand the sort of cash crunch that has been going on in Nigeria for the past seven weeks? But here, people simply groan and moan, and the system is still standing…

The trio of FBN, Union and Skye (Polaris) have tethered on the brink of collapse, but our almighty CBN managed to pull a hat each time from the drawer, without raising much alarm, and we all keep trudging forward as usual.

What did they tell us that it’s our life expectancy again? We were told and we accepted that our life expectancy is under 60, while the US lays claim to something around 80, until you look deeper.

More surprises in both heaven and hell, so prepare your mind before you die.