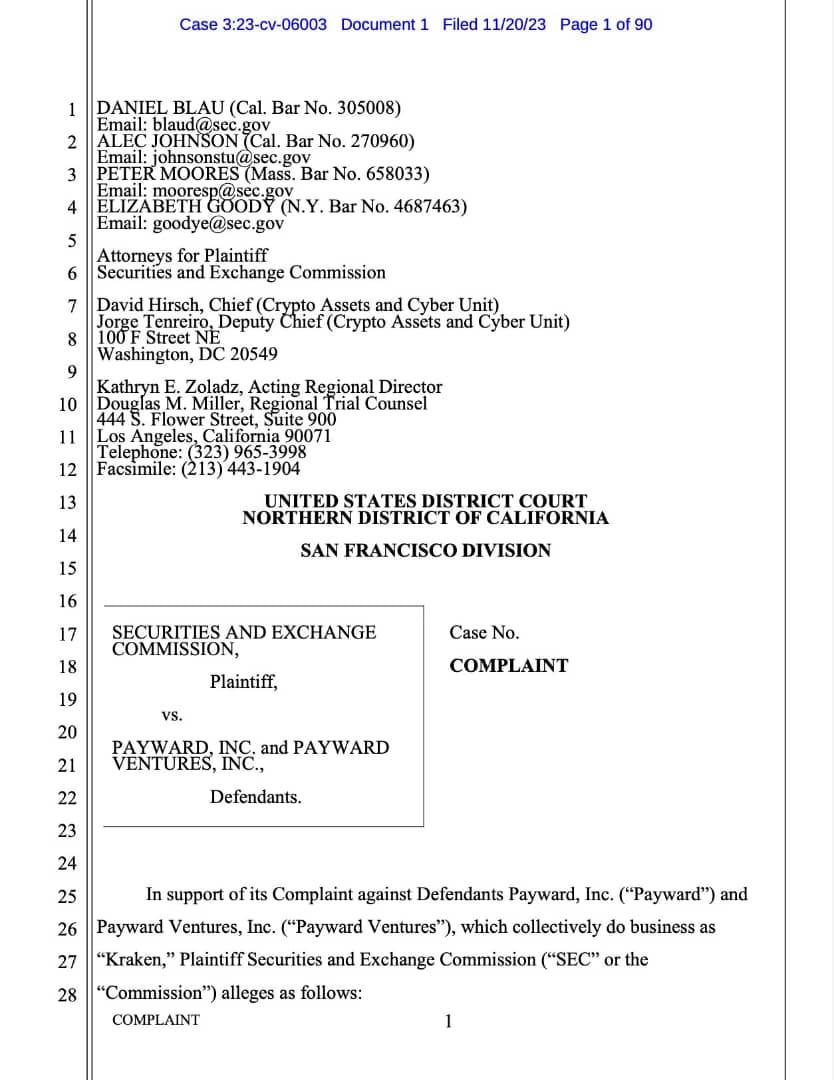

The Securities and Exchange Commission (SEC) has filed a lawsuit against Kraken, one of the largest cryptocurrency exchanges in the world, for allegedly violating federal securities laws. The SEC claims that Kraken operated as an unregistered securities exchange, broker, and dealer, and facilitated the trading of digital assets that are considered securities under the law.

According to the SEC’s complaint, Kraken offered trading services for more than 50 digital assets, including tokens that were issued through initial coin offerings (ICOs) and other fundraising schemes. The SEC alleges that some of these tokens were securities that required registration with the SEC or an exemption from registration. However, Kraken did not register as a securities exchange, broker, or dealer, nor did it seek an exemption or comply with any regulatory requirements.

The SEC also accuses Kraken of failing to implement adequate policies and procedures to prevent fraud, manipulation, and abuse in the digital asset market. The SEC alleges that Kraken did not conduct any due diligence on the digital assets it listed, nor did it verify the identity or suitability of its customers. The SEC claims that Kraken exposed investors to significant risks of losing their money and being defrauded by scammers and hackers.

Register for Tekedia Mini-MBA edition 19 (Feb 9 – May 2, 2026): big discounts for early bird.

Tekedia AI in Business Masterclass opens registrations.

Join Tekedia Capital Syndicate and co-invest in great global startups.

Register for Tekedia AI Lab: From Technical Design to Deployment (next edition begins Jan 24 2026).

The SEC is seeking a permanent injunction, disgorgement of ill-gotten gains, civil penalties, and other relief against Kraken and its owners and operators. The SEC warns investors to be cautious when dealing with unregistered platforms that offer trading services for digital assets.

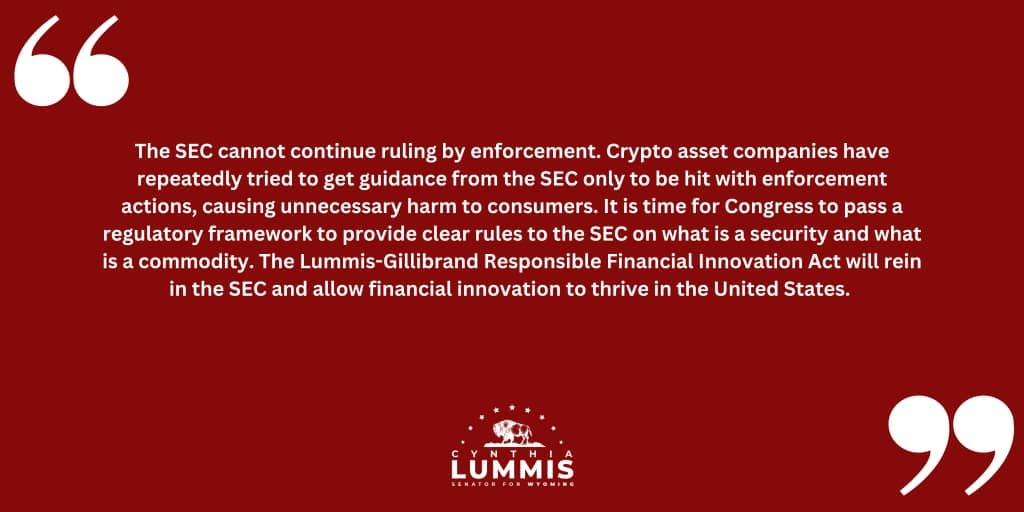

Senator Lummis wrote against Kraken’s suit by the SEC on X;

The Kraken lawsuit is a clear example of how the SEC is overstepping its authority and trying to regulate the crypto industry through intimidation and coercion. The SEC has no clear or consistent framework for determining what constitutes a security in the crypto space, and instead relies on vague and outdated guidance that does not reflect the innovation and diversity of this emerging sector. The SEC’s actions are harming not only the crypto companies and investors, but also the American economy and competitiveness.

As a senator and a crypto advocate, I strongly oppose the SEC’s approach and urge them to adopt a more constructive and collaborative attitude towards the crypto industry. The SEC should work with Congress and other stakeholders to develop a clear and sensible regulatory framework that fosters innovation, protects consumers, and respects the constitutional rights of all parties involved. The SEC should not use its enforcement powers to bully and harass the crypto industry, but rather to pursue actual fraud and misconduct.

The Kraken lawsuit is not only a legal battle, but also a political one. It is a test of whether the SEC will respect the will of the people and their elected representatives, or whether it will continue to act as an unelected and unaccountable bureaucracy that imposes its own agenda on the crypto industry. I stand with Kraken and the crypto community in this fight, and I will continue to use my voice and influence to defend our rights and freedoms in the face of the SEC’s overreach, Senator Lummis wrote.

The SEC claim its actions against Kraken Exchange is part of its ongoing efforts to protect investors and ensure compliance with the federal securities laws in the emerging and evolving digital asset space. The SEC has previously brought enforcement actions against other unregistered platforms that facilitated the trading of digital asset securities, such as Ether Delta, Bitqyck, BitConnect, and LBRY.

The Securities and Exchange Commission has charged the cryptocurrency firm Kraken with operating as an unregistered securities exchange, broker, dealer and clearing agency. It’s the latest suit in an SEC crackdown on crypto firms for violating U.S. securities laws. The agency has identified 16 tokens on the Kraken platform that it alleges are securities. It also accuses the company of mishandling customer funds, as well as inadequate internal controls and recordkeeping. Crypto exchanges have lobbiedfor industry-specific regulation, arguing that existing securities rules shouldn’t apply to cryptocurrencies.

Kraken’s chief legal officer said in a statement, “We disagree with the SEC’s complaint against Kraken, stand firm in our view that we do not list securities and plan to vigorously defend our position,” per Axios. The SEC has filed similar lawsuits against crypto trading giants Binance and Coinbase. Meanwhile, the Justice Department reportedly wants Binance to pay approximately $4 billion to resolve its probe into the world’s largest crypto exchange. (LinkedIn News)

Tokenized Real-world Assets Are More Than a Web3 Robinhood

If you are familiar with the concept of tokenization, you might think of it as a way to democratize access to financial markets and assets. By creating digital representations of real-world assets on the blockchain, tokenization allows anyone with an internet connection and a crypto wallet to invest in things like stocks, bonds, real estate, art, and more. This is similar to how platforms like Robinhood have enabled millions of retail investors to participate in the stock market with low fees and minimal barriers.

Tokenized real-world assets are digital representations of physical or intangible assets that are secured by blockchain technology. They allow for fractional ownership, increased liquidity, lower transaction costs, and greater transparency of the underlying assets. In this blog post, we will explore some of the benefits of tokenizing real-world assets and how they can create new opportunities for investors and asset owners.

However, tokenization is more than just a Web3 version of Robinhood. It is a paradigm shift that has the potential to transform the way we create, exchange, and manage value in the digital economy. Tokenization is not only about making existing assets more accessible and liquid, but also about creating new types of assets and value streams that were not possible before.

Tokenization enables the creation of fractional ownership rights for any asset, regardless of its size, value, or location. This means that investors can buy and sell fractions of an asset, rather than having to own it entirely. For example, someone could own a fraction of a painting by Picasso, a skyscraper in New York, or a share of Tesla, and benefit from its appreciation or income generation. Fractional ownership lowers the entry barriers for investors, increases the liquidity of assets, and creates more efficient markets.

Tokenization allows the embedding of smart contracts into the tokens that represent the assets. Smart contracts are self-executing agreements that can enforce the rules and conditions of the asset ownership and transfer. For example, a smart contract could automatically distribute dividends to token holders, execute buyback orders, or trigger payments based on certain events or milestones. Programmability adds functionality and flexibility to the assets and enables new business models and revenue streams.

Tokenization enables the integration and interoperability of different assets and platforms across the blockchain ecosystem. Tokens that follow common standards and protocols can be easily exchanged and composed with other tokens, creating new forms of value creation and exchange. For example, a tokenized real estate property could be used as collateral for a loan on a decentralized lending platform like Aave, or a tokenized art piece could be displayed in a virtual world or a metaverse like Decentraland.

Tokenization enhances the transparency and trustworthiness of the assets and their transactions. Tokens are recorded on a public and immutable ledger that can be verified by anyone at any time. This reduces the need for intermediaries and third-party verification services and eliminates fraud and manipulation.

Tokenization unlocks new possibilities for innovation and experimentation in the digital economy. By creating new types of assets and value streams, tokenization enables entrepreneurs and creators to explore new markets and niches, and to offer novel products and services to their customers.

What are the benefits of Tokenized real-world assets?

One of the main benefits of tokenizing real-world assets is that they enable fractional ownership, which means that an asset can be divided into smaller units or tokens that can be bought and sold by multiple investors. This lowers the barriers to entry for investing in high-value assets such as real estate, art, or collectibles, and allows for greater diversification and risk reduction. Fractional ownership also creates more liquidity in the market, as tokens can be traded more easily and quickly than traditional assets.

Another benefit of tokenizing real-world assets is that they reduce transaction costs and inefficiencies. By using smart contracts, which are self-executing agreements that are encoded on the blockchain, tokenized assets can automate the processes of verification, settlement, and compliance, eliminating the need for intermediaries such as brokers, lawyers, or regulators. This reduces the fees, delays, and errors that are often associated with transferring ownership of physical or intangible assets.

A third benefit of tokenizing real-world assets is that they increase transparency and trust among the parties involved. By using blockchain technology, which is a distributed ledger that records and verifies every transaction on the network, tokenized assets can provide a clear and immutable record of ownership, provenance, and performance of the underlying assets. This enhances the quality and reliability of the information available to investors and asset owners, and reduces the risks of fraud, manipulation, or disputes.

Tokenizing real-world assets can offer significant advantages over traditional forms of asset ownership and transfer. By enabling fractional ownership, increasing liquidity, lowering transaction costs, and improving transparency, tokenized real-world assets can create new possibilities for value creation and exchange in the digital economy. Tokenization also fosters collaboration and co-creation among different stakeholders in the blockchain space, as they can leverage each other’s assets and capabilities to create synergies and network effects.

Tokenization is more than a Web3 Robinhood. It is a powerful tool that can revolutionize the way we create, exchange, and manage value in the digital economy. Tokenization is not only about making existing assets more accessible and liquid, but also about creating new types of assets and value streams that were not possible before.

Losing assets or crypto is common these days, and I don’t see why anyone should be ashamed to admit it. The frightening thing is that anyone can become a victim, regardless of their intelligence. The good news is that there are recovery agencies that can help you get your money back; all you have to do is phone one that is reliable. I went online to look for help after losing money, and I came upon an article about victims’ optimism. You can reach out to them by email Recovering Atusa. com. I decided to give them a chance, and I was pleasantly surprised by how professional and dedicated they were to getting all of my money back.