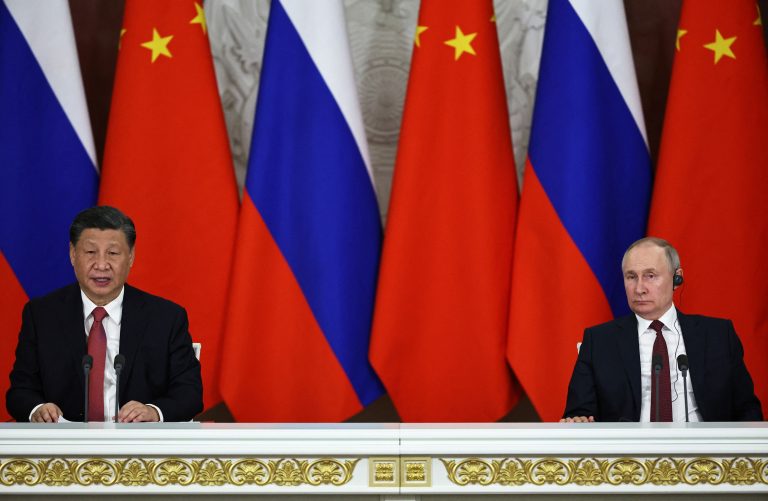

In a significant move that marks a shift in global economic dynamics, Russia and China have substantially reduced their reliance on the U.S. dollar for mutual trade. This strategic pivot reflects a growing trend among nations to diversify their international trade practices away from the traditional dollar-centric system.

Historically, the U.S. dollar has been the cornerstone of international trade, serving as the primary reserve currency worldwide. However, geopolitical shifts and economic strategies have led countries like Russia and China to explore alternative avenues. The move to reduce dollar usage in bilateral trade between these two nations is not a sudden development; it has been a gradual process influenced by various factors, including economic sanctions and the desire for financial autonomy.

The de-dollarization by Russia and China is not an isolated event but part of a larger pattern that reflects the evolving nature of the global economy. As the world’s economic center of gravity shifts, other countries will need to assess the potential risks and opportunities that arise from this transformation. The move away from the U.S. dollar in international trade is a strategic decision with long-term implications, signaling the pursuit of diversified, resilient economic partnerships in a changing world.

Register for Tekedia Mini-MBA edition 19 (Feb 9 – May 2, 2026): big discounts for early bird.

Tekedia AI in Business Masterclass opens registrations.

Join Tekedia Capital Syndicate and co-invest in great global startups.

Register for Tekedia AI Lab: From Technical Design to Deployment (next edition begins Jan 24 2026).

The de-dollarization effort began in earnest around 2014, amidst rising tensions and sanctions involving Russia. The share of trade operations between Russia and China using the U.S. dollar fell to 46 percent in the first quarter of 2020, down from 90 percent just five years prior. This trend has continued, with a significant portion of their trade now conducted in their national currencies, the ruble and yuan.

The implications of this shift are manifold. Economically, it allows both countries to insulate themselves from potential financial sanctions and currency fluctuations associated with the U.S. dollar. Politically, it represents a move towards greater economic sovereignty and a reconfiguration of traditional power structures in global finance.

The energy and agricultural sectors have been key areas of focus in the burgeoning economic cooperation between Russia and China. The use of national currencies in these domains not only facilitates trade but also strengthens the financial systems of both countries. Moreover, this transition aligns with the broader vision of the BRICS alliance (Brazil, Russia, India, China, and South Africa) to promote local currencies in trade and reduce dollar dependency.

For other countries, the implications of Russia and China’s de-dollarization can be multifaceted:

Diversification of Currency Reserves: As major economies like Russia and China decrease their dollar holdings, other countries may also reconsider their foreign exchange strategies. The trend could lead to a more diversified portfolio of currencies in national reserves, potentially reducing the dominance of the U.S. dollar as the world’s primary reserve currency.

Trade Agreements: Nations may seek to establish trade agreements that allow for transactions in alternative currencies. This could foster closer ties between countries looking to bypass the dollar and could lead to the creation of new economic blocs with shared financial interests.

Financial Autonomy: Countries that have historically relied on the U.S. dollar may view de-dollarization as a way to achieve greater financial autonomy. By using local or regional currencies, these nations could insulate themselves from the volatility of the dollar and U.S. monetary policy.

As the world watches this unfolding economic narrative, it is clear that the move away from the U.S. dollar in international trade by Russia and China is a strategic decision with long-term implications. It underscores the evolving nature of global trade relations and the pursuit of diversified, resilient economic partnerships.