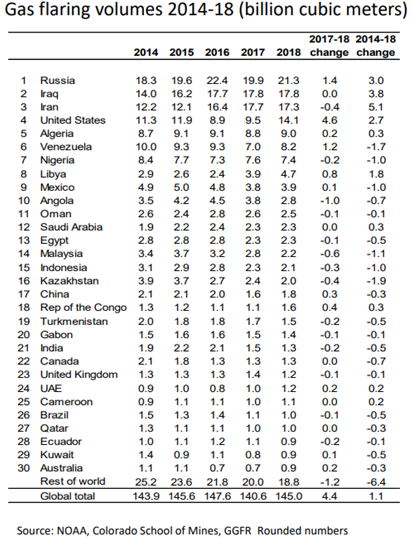

There is huge potential in the commercialization of Nigeria’s Flared Gas resources. This can easily be seen from the sheer magnitude of gas flared and the huge gap in domestic gas utilization in Nigeria. According to data from the world bank Global Gas Flaring Reduction Partnership (GGFR) Nigeria is ranked 7th place in the global gas flaring space.

As a signatory to the Paris Agreement, United Nations Sustainable Development Goals (SDGs) and the Zero-Routine Flaring Initiative by 2030, the Nigerian Government obviously committed to charting a new course in the global climate effort, initiated a plan that will disincentivize the flaring of gas through encouraging the commercialization and monetization of flare gas, by providing access and title to third party companies that will process the gas and sell the end products to the domestic market.

Aside from the environmental impact of gas flaring, there is also the commercial side to it in terms of lost resources that would have amounted to revenue from export, gas-to-power or industrialization. For instance, over a 12 months Period (August 2017-August 2018), Nigeria flared 11% of the total Gas produced within this period: see the chart and table below

Nigeria Gas Utilization Chart (August 2017-August 2018)

Tekedia Mini-MBA edition 16 (Feb 10 – May 3, 2025) opens registrations; register today for early bird discounts.

Tekedia AI in Business Masterclass opens registrations here.

Join Tekedia Capital Syndicate and invest in Africa’s finest startups here.

- Export: 1325.26bcf (43%)

- Reinjection and Fuel: 970.86bcf (31%)

- Flared Gas: 331.76bcf (11%)

- Gas for Power: 292.63bcf (9%)

- Industries: 173.23bcf (6%)

Source: Nigeria Gas Utilization Chart (NNPC Monthly Financial Operations report August 2018)

A whopping 74% of the Gas produced in Nigeria are exported and used as reinjection fuel at the production fields.. Gas flared in Nigeria is 20% more than gas available for power generation and over 50% more than gas available for industrial use. The commercialization of flared Gas in Nigeria if done well, can make more gas available for Nigeria’s fledgling domestic industries and power generation companies.

THE NIGERIA GAS FLARE COMMERCIALIZATION PROGRAM

The NGCFP was launched to give a commercial framework for the development of flared gas by 3rd party companies/investors on behalf of the Federal Government of Nigeria. The NGCFP defined procedure for the implementation of the programme.

There are 12 steps associated with the completion of this program.

1. Registration of Interested parties on the NGFCP portal

2. Access to Request for Qualification (RFQ) by registered parties

3. Submission of Statement of qualification (SoQ), confidentiality Agreement and payment of SoQ submission fees

4. Evaluation of SOQ, selection of qualified applicants and execution of confidentiality agreements.

5. List of qualified candidates to will be published on the NGFCP portal

6. Access to flare gas site data upon payment of Data prying/Data leasing fees by qualified applicants

7. Submission of proposal by bidders, payment of processing fee and bid bond

8. Evaluation of proposals and selection of preferred bidders

9. List of preferred Bidders published on the NGFCP portal

10. Execution of commercial agreements, payments of award fee and milestone bond

11. Issuance of Permit to access Flare Gas

12. Execution of Gas Utilization project and performance bond.

The NGFCP is at the fifth stage now with 203 companies/consortium (out of 240 companies that submitted SoQs) chosen as successful SOQ candidates see list . The next steps from here onwards will be the real hard facts for the qualified companies. Let’s delve into a description of what the next steps will look like and the key challenges that companies will face in order to make this process a business success, after all they are all in it to make profit right? Let’s go….

A. Access to flare gas site data upon payment of Data prying/Data leasing fees by qualified applicants (step 6)

The beauty of this program is the flexible structure which allows selected bidders to bid for their preferred sites according to data that will be provided to them by DPR at this stage. A selected bidder has the privilege of comparing data across various flare gas sites before selecting which sites amongst all the flare gas sites to submit a proposal for.

B. Submission of proposal by bidders, payment of processing fee and bid bond (step 7)

i. Successful participants in the SOQ stage are not required to be Nigerian entities before the bid process, upon a successful bid, foreign entities will be required to be incorporated in Nigeria to be granted the Permit and to enter into the necessary Commercial Agreements. Only companies incorporated in Nigeria can be Permit Holders.

ii. Bidders that qualified for a flare site or multiple sites will or may be granted access to the flare site by the Department of Petroleum Resources (DPR), to make physical inspection of the flare site and related infrastructure of the Upstream Producer.

iii. An interested entity may submit a singular proposal for a flare set or a set of flare sites, entities can also submit multiple proposals for different flare sites or different sets of flare sites.

iv. The proposals shall be evaluated based on pre-established criteria in the RfQ, to ensure transparency in the evaluation process.

v. An entity or individual barred by the Economic and Financial Crimes Commission (EFCC), Independent Corrupt Practices and Other Related Offences Commission (ICPC), World Bank Debarred list and US Treasury Office of Foreign Assets Control, shall be ineligible to participate in the bid process.

vi. Access to flare gas site data upon payment of Data prying/Data leasing fees by qualified applicants

The Bid Bond: 1% of the estimated project capex capped at US$1,000,000 posted by a bidder upon submission of its proposal

C. Evaluation of proposals and selection of preferred bidders (step 8)

The NGFCP team will look through the bid documents, details of the equipment’s, project viability, business bankability, the technology to be deployed; and their targeted end-use market or gas product. Bidders first qualify on technical grounds before they are considered to be evaluated on financial requirements.

The proposal will be evaluated with the joint team of officials from the Ministry of Petroleum, Department of Petroleum Resources (DPR) and the Nigerian Petroleum Corporation (NNPC).

D. List of preferred Bidders published on the NGFCP portal (step 9)

The NGFCP team will publish the preferred bidders on her website just like the way the successful SOQ participants were listed on the portal.

E. Execution of commercial agreements, payments of award fee and milestone bond (step 10)

A Preferred Bidder will be mandated to sign some agreements as a condition before the grant of a permit by the Minister as a condition precedent to the grant of a Permit by within sixty (60) days from the date of award of preferred bidder status:

i. Milestone Development Agreement with the FGN, by which the chosen bidding company/consortium agrees to develop the flare gas sites according to laid out timelines s to the developments of the flare gas sites according to agreed timelines

ii. Gas Sales Agreement with the FGN to purchase flare gas. The gas prices start at a minimum price of US$0.25/Mscf,

iii. Connection Agreement with the Upstream Producer to provide access and connection to the facilities of the Upstream Producer.

iv. Deliver or Pay Agreement with Upstream Producer by which the Upstream Producer guarantees to supply an agreed quantity of flare gas to the Preferred Bidder

NB:

Milestone Bond: 2% of the estimated project capex capped at US$2,000,000 posted by the preferred bidder for agreed milestones under the milestone agreement

F. Issuance of Permit to access Flare Gas (step 11)

Upon satisfactory signing of all agreements and issuance of the milestone bond, the FGN will issue permits to the successful preferred bidders to have unhindered access to the flare sites to start project development.

G. Execution of Gas Utilization project and performance bond (step 12)

The deployment of equipment and Flare gas processing infrastructure. The successful preferred bidder will also have to execute a performance bond at this point.

NB:

Performance bond: Advance payments covering three months gas delivery payments for the take-or-pay flare gas quantity in the Gas Sales Agreement. a bidder upon submission of its proposal

THE KEY PERFORMANCE FACTORS THAT SUCCESSFUL SOQ PARTICIPANTS SHOULD TAKE INTO CONSIDERATION

For this investment to be profitable, companies will have to get their strategy from top to the bottom to get it straight.

The major things to look out for while packaging the bidding documents are

1. The technology/Equipment to be deployed

2. Contractual Structure of Project Agreements

3. Joint venture partnerships

4. Technical and Commercial Partnerships.

5. Target Market and Offtake agreements with prospective buyers.

6. Technical and Financial Capability

7. Location of the Flare/Project Sites

8. Nigerian Content Development

9. Extent/history of hostility/stability of flare gas host community and developing conflict management strategies for smooth engagement with host communities.

This is the first of a series of articles on the Nigerian Flare Gas commercialization program to guide investors, bidding companies, equipment manufacturers, service providers to understand the value points in this program, the opportunities to be taken and the expected challenges and how to avert them.

Follow this space for the next expository on this exciting opportunity.

References:

- Financial Nigeria Magazine – http://www.financialnigeria.com/commercializing-flared-gas-in-nigeria-part-1-feature-258.html

- World Bank Global Gas Flaring Reduction Partnership – https://www.worldbank.org/en/programs/gasflaringreduction

This article was prepared in association with Kiakiagas.com