ApeCoin [$APE], the in-house token created to power Yugalabs’ ecosystem for the ApeDao community, has been oscillating between $5.386 and $6.000 range since 22nd of January. But it broke above the range and reached a 24 hours ATH of $6.410 after BTC surged to $23.8K.

However, BTC fell below the $23.8K mark, prompting APE to drop. At press time, APE’s value was $6.110 indicating that bears were calling the shots. However, APE could oscillate in this range if BTC maintains the $23K zone.

The On Balance Volume (OBV) and the Relative Strength Index (RSI) indicated downticks on the three-hour chart. This suggests that trading volumes dropped, leading to a drop in buying pressure.

Register for Tekedia Mini-MBA edition 19 (Feb 9 – May 2, 2026): big discounts for early bird.

Tekedia AI in Business Masterclass opens registrations.

Join Tekedia Capital Syndicate and co-invest in great global startups.

Register for Tekedia AI Lab: From Technical Design to Deployment (next edition begins Jan 24 2026).

But the RSI value was 61, thus within the bullish threshold, indicating that bulls could gain control anytime. Therefore, APE could oscillate between $5.900 and $6.410, especially if BTC maintains the $23K zone. If BTC moves to the $24K zone, APE could break above $6.410 and retest the $6.793 level.

Alternatively, bears could drop $APE further into the demand zone around $5.900. But a break below the zone’s lower boundary of $5.695 would invalidate the above bias. The drop could stop at the 50-period EMA (exponential moving average) or $5.386.

As per Santiment data, APE’s Exchange Flow Balance was negative (-4833) at press time. A negative Exchange Flow Balance shows that more APE flowed out of exchanges than in, indicating a short-term accumulation. Put differently, APE’s price decline offered discounted buying opportunities for other investors.

However, the drop in trading volumes, as suggested by falling active hourly addresses, could undermine an immediate price reversal or recovery. Thus lending credence to a potential price consolidation within the $5.900 – $6.410 range.

In addition, APE’s weighted sentiment was negative at the time of publication. But the negative sentiment didn’t prevent the recent price rally and could be negligible in the short-term price action direction. Therefore, investors should track BTC price performance to gauge APE’s price action.

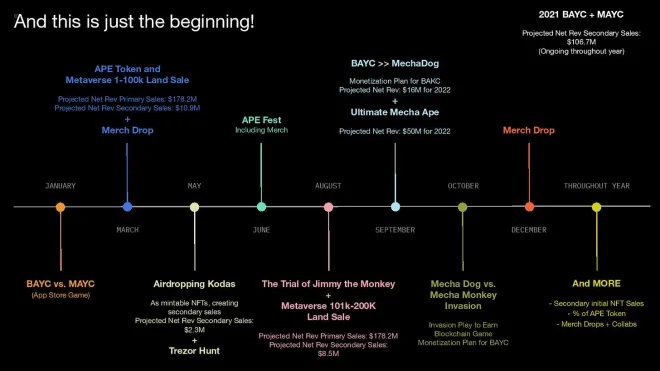

Relatively, The Yugalabs/BoredApeYC team is on pace to bank $6M-$8M from the Sewer Pass secondary sales and $1.5-$3M USD worth of Apecoin in the duration of the Dookey Dash game. And this is just part one of the Trial of Jimmy the Monkey.

On the Yugalabs pitch deck, originally they planed on a public sale for trial of jimmy. But even more interesting they projected 8 million dollars in secondary sales. Dookey Dash is an innovative Web3 game, its an ambitious addition to the Yugalabs universe, adding value for existing holders and providing an onramp for newcomers.