Nvidia, a leading technology company specializing in graphics processing units (GPUs) and Artificial Intelligence (AI), has reported its earnings for the second quarter (Q2), which ended July 28, 2024, showcasing remarkable growth fueled by demand for its AI technologies.

The tech giant’s Q2 report, surpassed Wall Street expectations after it posted quarterly revenue of $30 billion, up 15% from the first quarter (Q1) and up 122% from a year ago. For the quarter, GAAP earnings per diluted share was $0.67, up 12% from the previous quarter and up 168% from a year ago.

Non-GAAP earnings per diluted share we $0.68, up 11% from the previous quarter and up 152% from a year ago. Operating Income was $18.6 billion, representing significant growth from the $6.8 billion recorded a year earlier.

Register for Tekedia Mini-MBA edition 17 (June 9 – Sept 6, 2025) today for early bird discounts. Do annual for access to Blucera.com.

Tekedia AI in Business Masterclass opens registrations.

Join Tekedia Capital Syndicate and co-invest in great global startups.

Register to become a better CEO or Director with Tekedia CEO & Director Program.

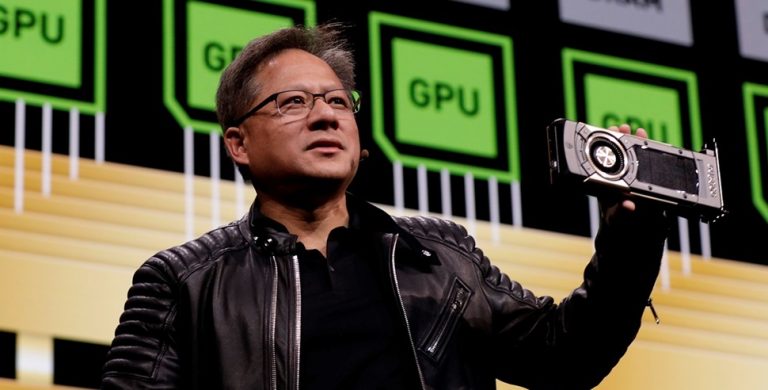

NVIDIA’s CEO, Jensen Huang, attributed the company’s success to the strong demand for its Hopper and the anticipation for the upcoming Blackwell architecture. The company has begun shipping Blackwell samples to partners and customers, further solidifying its leadership in Al and accelerated computing.

The CEO said,

“Hopper demand remains strong, and the anticipation for Blackwell is incredible. NVIDIA achieved record revenues as global data centers are in full throttle to modernize the entire computing stack with accelerated computing and generative Al. Blackwell samples are shipping to our partners and customers.

“Spectrum-X Ethernet for Al and NVIDIA Al Enterprise software are two new product categories achieving significant scale, demonstrating that NVIDIA is a full-stack and data center-scale platform. Across the entire stack and ecosystem, we are helping frontier model makers to consumer internet services, and now enterprises. Generative Al will revolutionize every industry.”

During the first half of fiscal 2025, NVIDIA returned $15.4 billion to shareholders in the form of shares repurchased and cash dividends. As of the end of the second quarter, the company had $7.5 billion remaining under its share repurchase authorization. On August 26, 2024, the Board of Directors approved an additional $50.0 billion in share repurchase authorization, without expiration.

Notably, NVIDIA’s Data Center division reached new heights, reporting a record revenue of $26.3 billion for the second quarter of 2024. This marks a 16% increase from the previous quarter and a remarkable 154% growth compared to the same period last year.

The Data Center division’s success is driven by several key innovations and industry-leading developments in Al and computing, which include the following;

•NVIDIA Spectrum-X Adoption: The Spectrum-X Ethernet networking platform has seen widespread adoption among cloud service providers, GPU cloud providers, and enterprises. This technology is being integrated into various offerings by NVIDIA’s partners, further expanding its influence across the industry.

•NIM Microservices Expansion: NVIDIA released its NIM™ microservices platform to developers globally, with over 150 companies already integrating these services into their platforms to accelerate generative Al application development.

•New Al Services: The company launched an inference service in collaboration with Hugging Face, powered by NIM microservices on NVIDIA DGX™ Cloud. This service enables developers to deploy popular large language models more efficiently.

•Al Foundry and Llama 3.1: NVIDIA introduced the Al Foundry service and NIM inference microservices to accelerate generative Al for enterprises globally, featuring the Llama 3.1 collection of models.

NVIDIA’s Data Center business continues to lead the industry with cutting-edge technology and strategic partnerships, driving significant growth and setting new benchmarks in Al and data center performance.

Nvidia’s Balance Sheet and Cash Flow:

•Total Assets: $85.2 billion, up from $65.7 billion at the beginning of the year.

•Shareholders’ Equity: $58.2 billion, reflecting strong financial health and investor confidence.

•Net Income: $16.6 billion for the quarter, a substantial increase from $6.2 billion a year ago.

NVIDIA’s results reflect the accelerating adoption of generative Al, which CEO Jensen Huang predicts will revolutionize every industry. With strong financial performance and a growing portfolio of innovative products, NVIDIA continues to set the pace in the Al and computing landscape.

Chipmaking powerhouse Nvidia reported second-quarter earnings that more than doubled from a year ago, beating Wall Street estimates and signaling resilient demand from Big Tech customers. Revenue surged 122% to $30 billion, largely driven by the company’s data center business, which includes AI processors. Nvidia’s sales forecast — viewed by some on Wall Street as a gauge of AI spending — also surpassed analysts’ estimates. However, as Bloomberg notes, the outlook missed some of the more ambitious forecasts, raising concern that Nvidia’s “explosive growth is waning.”