Nvidia Corp. reported unprecedented growth for its fiscal third quarter, with surging revenue and profit driven by the explosive global demand for AI-focused GPUs.

The Santa Clara-based company announced revenue of $35.08 billion for the quarter ending October 27, a 94% year-over-year increase from $18.12 billion. Its net income more than doubled, reaching $19.31 billion compared to $9.24 billion during the same period last year.

Adjusted for one-time items, Nvidia reported earnings of 81 cents per share, surpassing Wall Street’s expectations of 75 cents per share on revenue of $33.17 billion, according to FactSet.

Tekedia Mini-MBA edition 16 (Feb 10 – May 3, 2025) opens registrations; register today for early bird discounts.

Tekedia AI in Business Masterclass opens registrations here.

Join Tekedia Capital Syndicate and invest in Africa’s finest startups here.

Despite the stellar performance, Nvidia’s stock dipped 1% in after-hours trading, a modest decline given its staggering 195% rise this year. The company’s market capitalization now exceeds $3.5 trillion, positioning it as the most valuable publicly traded company and a bellwether for the booming AI sector.

Driving Forces Behind Nvidia’s Growth

Nvidia’s GPUs are at the heart of the AI revolution, powering the large language models and generative AI applications that underpin a global shift toward artificial intelligence. These chips are integral to AI data centers run by tech giants such as OpenAI, Google, and Microsoft.

The company’s data center segment posted revenue of $30.8 billion in Q3, representing a 112% increase year-over-year. This growth was driven by the success of the Hopper computing platform, which supports generative AI applications and recommendation engines.

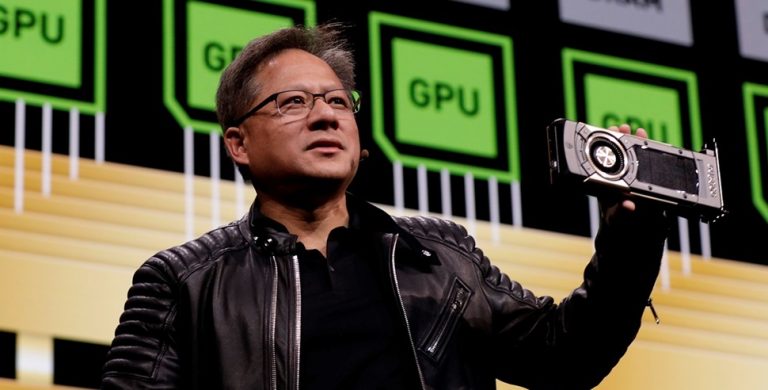

“The age of AI is in full steam, propelling a global shift to Nvidia computing,” CEO, Jensen Huang, said.

Nvidia’s next-generation Blackwell GPUs are poised to become the company’s next growth driver. Blackwell production shipments are scheduled to begin in fiscal Q4 2025, with demand expected to exceed supply well into fiscal 2026, according to CFO Colette Kress.

“Every customer is racing to be the first to market,” Kress said. “Blackwell is now in the hands of all of our major partners, and they are working to bring up their data centers.”

The strong demand for Blackwell chips signals the continued appetite for advanced AI hardware, further cementing Nvidia’s market dominance. Huang noted that Nvidia would deliver more Blackwell units than initially anticipated in the current quarter, reflecting robust interest from enterprise customers.

Nvidia’s legacy gaming segment also showed impressive gains, with revenue rising 15% year-over-year to $3.3 billion. The company’s graphics processors remain a top choice for PC gaming enthusiasts, even as AI dominates its revenue streams.

Nvidia’s invention of the GPU in 1999 revolutionized computer graphics and laid the foundation for its leadership in AI hardware today.

In addition to gaming and data centers, Nvidia is expanding into automotive and edge computing markets. Revenue from its automotive segment grew 15% year-over-year, reaching $500 million. Nvidia’s AI platforms for autonomous driving and advanced driver assistance systems (ADAS) are gaining traction among automakers.

The company is also pushing into edge computing, where AI chips process data locally rather than in centralized data centers. This shift is critical for applications in robotics, industrial automation, and smart cities.

Supply Constraints and Other Challenges

While Nvidia’s growth story remains compelling, it faces significant supply constraints. Both Hopper and Blackwell GPUs are in high demand, and production capacity is expected to lag behind market needs.

“The demand for Blackwell is expected to exceed supply for several quarters in fiscal 2026,” Kress acknowledged.

These constraints highlight the ongoing global semiconductor shortage, which has impacted industries ranging from consumer electronics to automotive manufacturing.

Mixed Stock Performance

Despite its strong quarterly results, Nvidia’s guidance for Q4—revenue of $37.5 billion (plus or minus 2%)—fell slightly short of some analysts’ expectations. This tempered guidance contributed to a minor pullback in Nvidia’s stock, though analysts view the dip as temporary.

Dan Ives, an analyst at Wedbush Securities, described the earnings as a testament to Nvidia’s leadership in the AI revolution.

“We view this as a Nvidia earnings press release that should be hung in the Louvre,” Ives said.

Path to $4 Trillion Valuation

Nvidia’s market cap now exceeds $3.5 trillion, and analysts predict it could surpass $4 trillion by 2025. The company’s dominance in AI hardware positions it to capture a significant share of the growing market for AI-enabled technologies.

David Volpe, senior fund manager at Emerald Insights Fund, noted that Nvidia’s growth remains unmatched.

“There’s nothing touching it in terms of the growth,” Volpe said.

As demand for generative AI tools continues to grow, Nvidia’s chips are becoming essential for companies building AI-driven applications. The company’s leadership in AI hardware has turned it into a cornerstone of the tech industry, driving investments from major players like Microsoft, Google, and Amazon.

“The age of AI is upon us,” Huang said. “And it’s large and diverse.”

Nvidia is doubling down on its AI strategy while expanding into new markets. The company’s ongoing investments in R&D, coupled with its partnerships across industries, means it will remain a leader in the rapidly evolving AI industry.