US giant semiconductor and AI chipmaker Nvidia faced a dramatic financial blow on Tuesday, which saw the price of its shares plunge by nearly 10%, wiping out over $280 billion from its market value, the largest single-day value drop in US stock market history.

The sharp decline in Nvidia’s market value has sparked reactions, leaving investors nervous. There are speculations that the sudden decline reported by the chipmaker may have been affected by the US Department of Justice subpoena, probing into whether the tech and AI chip giant violated antitrust laws, as reported by Bloomberg.

The probe is coming a week after Nvidia reported another record-breaking quarter report, which sparked the U.S. Department of Justice to issue complaints that it is violating antitrust laws. The Justice Department has also subpoenaed other companies for evidence after initially sending questionnaires about Nvidia’s business practices, Bloomberg reported, citing unnamed people familiar with the matter.

Tekedia Mini-MBA edition 16 (Feb 10 – May 3, 2025) opens registrations; register today for early bird discounts.

Tekedia AI in Business Masterclass opens registrations here.

Join Tekedia Capital Syndicate and invest in Africa’s finest startups here.

Reports revealed that the Department of Justice reached out to Nvidia’s competitors, including Advanced Micro Devices and AI chip startups, to gather information, including allegations of threatening customers who buy products from competitors, as well as Nvidia’s recent acquisitions of AI software startups,

Also, the Justice Department officials were investigating whether the chipmaker had pressured some of its customers, including cloud providers that rent servers powered by Nvidia’s chips to developers. In response to the DoS probe, Nvidia on Tuesday defended its tactics in the hot market for chips to power artificial intelligence in the face of reports the US is probing whether it abused its market dominance.

A spokesperson at Nvidia said,

“Nvidia wins on merit, as reflected in our benchmark results and value to customers, who can choose whatever solution is best for them”.

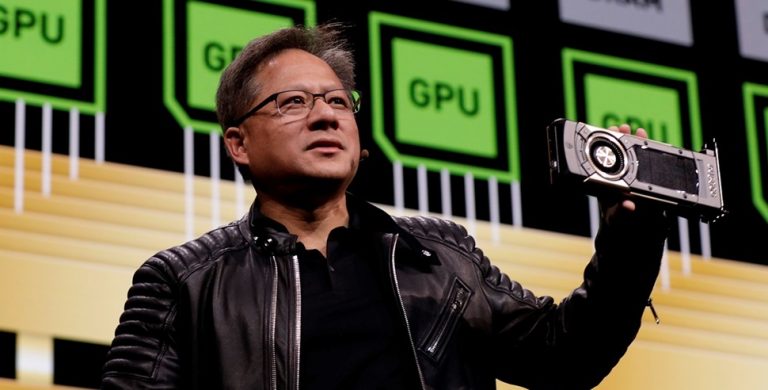

Nvidia’s huge rise in recent years has been directly tied to its dominance in Al chips for data centers, established years before competitors AMD and Intel started taking the category seriously. Nearly a decade ago, Nvidia developed a programming language for its chips, called CUDA, which is a key tool for engineers who train advanced Al models like the one at the heart of ChatGPT.

The antitrust probe comes at a critical time for Nvidia, which has been at the forefront of the Al revolution, powering breakthroughs in machine learning, autonomous vehicles, and cloud computing. The company’s future growth prospects, heavily tied to its dominance in the Al chip market, are now under a cloud of uncertainty as it faces the prospect of lengthy legal battles and potential penalties.

Market analysts are closely watching how this situation unfolds, as the outcome of the antitrust investigation could have far-reaching implications for the tech industry at large. If Nvidia is found to have violated antitrust laws, it could lead to regulatory changes that impact the entire semiconductor industry, reshaping the competitive landscape and influencing the strategies of other major players.

However, the company will remain committed to navigating the legal challenges ahead while reassuring investors and stakeholders that it can weather the storm and continue to lead in the rapidly evolving Al market.