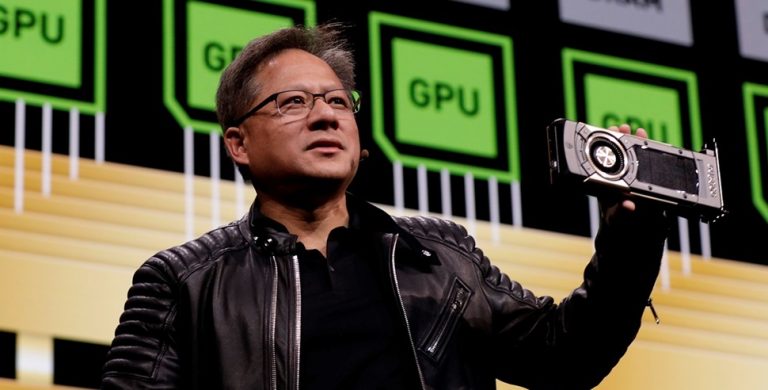

Jensen Huang, CEO of Nvidia, publicly retracted his earlier skepticism about the near-term potential of quantum computing, acknowledging that he didn’t know his past comments had unintended consequences—most notably, a decline in quantum computing stocks.

Speaking at Nvidia’s “Quantum Day” event during the GTC Conference on Thursday, Huang admitted that his statements from January had been misinterpreted and that he had underestimated the impact they would have on the market.

“This is the first event in history where a company CEO invites all of the guests to explain why he was wrong,” Huang said in an attempt to lighten the situation.

Register for Tekedia Mini-MBA edition 17 (June 9 – Sept 6, 2025) today for early bird discounts. Do annual for access to Blucera.com.

Tekedia AI in Business Masterclass opens registrations.

Join Tekedia Capital Syndicate and co-invest in great global startups.

Register to become a better CEO or Director with Tekedia CEO & Director Program.

Back in January, Huang’s comments at another conference sent ripples through the quantum computing industry. He had expressed doubt about the timeline for useful quantum computers, stating that 15 years was “on the early side”, while suggesting that 20 years was a more realistic expectation.

This remark triggered a sell-off in quantum computing stocks, as investors interpreted it as a vote of no confidence in the industry from one of the most influential figures in computing. Some publicly traded quantum computing firms saw their stock prices dip, further reinforcing the idea that quantum breakthroughs were not as imminent as some had hoped.

Huang later admitted that he was surprised by the reaction, joking, “How could a quantum computer company be public?”—a comment that further underscored his skepticism about the commercial readiness of the technology.

How Public Figures’ Comments Move Markets

Huang’s experience highlights a broader phenomenon: the power that public figures hold over financial markets. In the tech sector especially, comments from high-profile CEOs, government officials, or industry pioneers can trigger market fluctuations, investment shifts, and even changes in corporate strategies.

Elon Musk is perhaps the most well-known example of this effect, with his tweets about cryptocurrency, Tesla, or even random meme stocks often leading to wild swings in market value. Other executives, like Amazon’s Jeff Bezos or Meta’s Mark Zuckerberg, have also seen their words directly influence stock prices.

In Huang’s case, his January remarks on quantum computing’s future were interpreted as a signal that the industry was not progressing fast enough to be commercially viable in the near term. This led to reduced investor confidence in quantum startups, causing a market correction that likely impacted funding and business decisions across the sector.

Nvidia’s Quantum Pivot

However, Nvidia is now fully embracing quantum computing—not as a direct competitor to its GPU-powered computing business, but as a complementary technology.

The company has announced a new research center in Boston that will focus on collaborations with Harvard and MIT to advance quantum computing research. The facility will include several racks of Nvidia’s Blackwell AI servers, emphasizing Nvidia’s role in quantum simulation and hybrid computing.

Since its conceptualization in the 1980s by physicist Richard Feynman, quantum computing has been seen as a potential game-changer in fields requiring immense computational power, such as cryptography, logistics, weather simulation, and chemistry.

Unlike classical computers that use binary bits (0s and 1s), quantum computers operate with qubits, which can exist in multiple states simultaneously due to quantum superposition. This makes them theoretically capable of solving problems far beyond the reach of traditional computers.

However, despite decades of research and billions in investments, quantum computing has yet to achieve a real-world breakthrough. No quantum computer has outperformed a classical system in solving a practical, commercially viable problem.

Even Google’s 2019 quantum supremacy claim—where it said its quantum processor solved a problem faster than a classical supercomputer—has been met with skepticism. While Google reported advancements in error correction last year, truly scalable error-free quantum computing remains a distant goal.

Why Nvidia is Betting on Quantum Despite the Challenges

While fully functional quantum computers may still be years away, Nvidia sees strategic opportunities in the space. The company’s GPUs and AI-driven simulations are already being used to model quantum computing behavior, making Nvidia an essential partner in quantum research and hybrid computing.

Some quantum architectures may also require classical computing components to manage and interpret quantum calculations—an area where Nvidia could play a crucial role.

Microsoft and Amazon Web Services, both of which have made major investments in quantum computing, joined the discussion at Thursday’s event, highlighting the growing intersection between traditional computing giants and emerging quantum players.

Huang’s Final Take

During a panel discussion, Huang reflected on his own past miscalculations about computing trends, acknowledging that he had previously believed GPU-based accelerated computing would completely replace traditional computing architectures.

“I was wrong,” he admitted, adding that quantum computing could follow a similar trajectory of gradual adoption rather than a sudden overhaul of existing systems.

Nvidia is now firmly positioning itself as a key enabler of quantum advancements. While the quantum computing industry still faces technical and commercial hurdles, Nvidia’s latest moves suggest that Huang and his company are betting on the technology’s eventual breakthrough—whenever that may be.

Nvidia CEO Jensen Huang admits he missed the mark on quantum computing’s future. He backpedaled comments he made in January, when he said “useful” applications for the technology are 20 years away. His remarks at the time sent quantum computing stocks tumbling. But during Nvidia’s “Quantum Day” event on Thursday, Huang revised his projected timeline and said “this is the first event in history where a company CEO invites all of the guests to explain why he was wrong.”