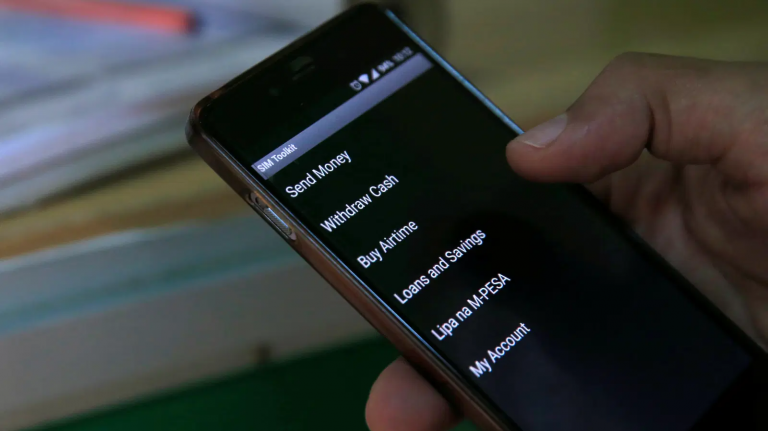

The big revelation: “according to research done by The Fletcher School and Mastercard Center for Inclusive Growth, of the $301 billion of funds flows from consumers to businesses in Nigeria, 98 percent is still based on cash”. That data is of course dated (2018). But the deviation will not be double digit yet, if you visit open markets in Nigeria, where cash remains king for consumer transactions. So, if cash is king, it means digitizing payment is a massive opportunity. This is the core element why fintech is booming in Nigeria and broad sub-Saharan Africa.

In the first half of 2021, African fintech startups raised $330.5 million, more than double the amount raised in entire year 2020, according to Disrupt Africa. Payment and remittance remain the hottest sub-sectors.

Higher geopolitical and currency-related risks, as well as the fragmented nature of the continent, have historically deterred non-African VCs from entering the region, according to Suhrcke, but the sheer size of the market and recent success stories like Nigeria-born payments startup Flutterwave—which achieved unicorn status in March with a $170 million round, according to PitchBook data—have made the continent more attractive.

You know what? Without waiting for the experts who collate these datasets, I can write that with OPay’s $400 million raise from SoftBank at a valuation of $2 billion, that Nigeria will eclipse the total fintech funding in other African countries in 2020 and 2021 combined.

Tekedia Mini-MBA edition 16 (Feb 10 – May 3, 2025) opens registrations; register today for early bird discounts.

Tekedia AI in Business Masterclass opens registrations here.

Join Tekedia Capital Syndicate and invest in Africa’s finest startups here.

Sure, the risks remain but what these investors are doing is evident: Nigeria is one of the three countries (others are South Africa and Kenya) in sub-Saharan Africa where a consumer-based tech-anchored business can flourish. Most other countries are very small for consumer business. For investors, the playbook is to begin in Nigeria, ramp-up, and then pick those other countries as secondary markets.

That is why I will not invest in Rwanda for a consumer business, but will surely do so for an enterprise business on clocked contracts, just by looking at the population.

So, when you look at the indicators, three countries – Nigeria, Kenya and South Africa – will continue to drive this continental payment and financial services digitization. And the redesign is just starting because there are many opportunities ahead. For continental Africa, Nigeria will lead this amazing future.

---

Register for Tekedia Mini-MBA (Feb 10 - May 3, 2025), and join Prof Ndubuisi Ekekwe and our global faculty; click here.