Act 1, Scene 1: Nigeria floats its currency and removes fuel subsidies. A village boy from Ovim cautioned: “Nigeria’s floating of its currency, while progressive, will cause severe perturbations in the economy – and a stable state may not come as most experts have predicted”.

Act 1, Scene 2: Manufacturing companies are rattled, banks book unreal profits.

Act 2, Scene 1: Economic activities froze, factories went down, and governments lost massive tax revenue.

Register for Tekedia Mini-MBA edition 19 (Feb 9 – May 2, 2026): big discounts for early bird.

Tekedia AI in Business Masterclass opens registrations.

Join Tekedia Capital Syndicate and co-invest in great global startups.

Register for Tekedia AI Lab: From Technical Design to Deployment (next edition begins Jan 24 2026).

Act 2, Scene 2: The nation’s lender of last resort, NNPCL, booked strategic losses to decouple deteriorating floated Naira from the vagaries of escalating imported energy costs. By doing so, it paused any strong correlation between the exchange rate and petrol prices.

Act 3, Scene 1: The press accused the lender that it was owing partners more than $6 billion due to the strategic subsidies, as fuel scarcity hit the land. The lender rejected the claim.

Act 3, Scene 2: The lender then came clean and wrote: “This financial strain has placed considerable pressure on the Company and poses a threat to the sustainability of fuel supply”.

Act 4, Scene 1: With the lender’s purse dry, the government updated the petrol price to N855 per liter from about N650/liter.

The Play Ends.

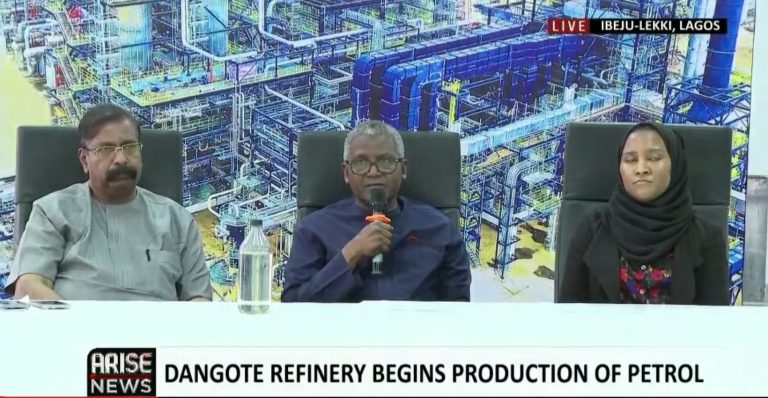

The next Play will begin soon since this N855/liter is still below the landing cost of petrol. However, this next Play could be amazing since Dangote Refinery is expected to commence the supply of petrol to local filling stations. Also, the government did the right thing by selling the crude oil in Naira to the refinery.

Yet, if you sell the crude oil in Naira, the nation’s foreign earnings will go down, and those foreign loan interests which must be paid in US dollars will still be serviced. So, when a bird flies from the land and perches on the ant-hill, it is still largely on the ground. In other words, Nigeria still needs US dollars in American banks to pay its debts.

With all said, the next Play will begin once we know what price Dangote Refinery and NNPCL will sell petrol at. That information is still classified but we expect it in days!

Indeed, the next Play will begin soon since this N855/liter is still below the landing cost of petrol. But wait: Dangote Refinery will begin to sell petrol soon and NNPC will be the sole buyer: “Dangote Refinery has reportedly started processing petrol after delays, with NNPC set to be sole buyer. Dangote Oil Refinery has commenced petrol processing following delays caused by recent crude shortages, a Reuters report which quoted an executive said on Monday”. The price it will sell is still classified but we expect it in days!

What a nation!

---

Connect via my

LinkedIn |

Facebook |

X |

TikTok |

Instagram |

YouTube