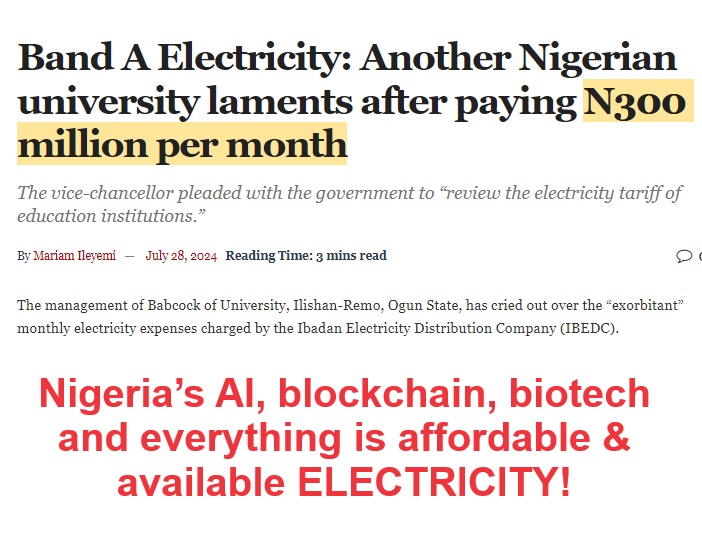

What is going on in Nigeria? Can you imagine a university paying N300 million (about $250,000) in a month? “The management of Babcock of University, Ilishan-Remo, Ogun State, has cried out over the “exorbitant” monthly electricity expenses charged by the Ibadan Electricity Distribution Company (IBEDC). The Vice-Chancellor/President of the university, Ademola Tayo, said the university paid N300 million in May after the increase in tariff of electricity consumers on Band A.” – Premium Times.

Prices of fuel are up; electricity is up. For companies, how do they produce and stay competitive? I challenge our leaders to rethink some of these policies before Nigeria economically folds from within. I cannot see how a small private university (graduated 2,842 students) can afford this type of bill. If you extrapolate, it means ABU Zaria, UNN, UI and peers may need a state budget to pay electricity bills alone.

Respectfully, it is time to revisit some of these policies. It is indeed time because some are delivering negative results. My position remains that Nigeria must subsidize electricity for these A customers even as residential customers pay full rate. There is no economy where you do not have subsidies. Now that we are not subsidizing forex, maybe electricity should be considered.

Register for Tekedia Mini-MBA edition 19 (Feb 9 – May 2, 2026): big discounts for early bird.

Tekedia AI in Business Masterclass opens registrations.

Join Tekedia Capital Syndicate and co-invest in great global startups.

Register for Tekedia AI Lab: From Technical Design to Deployment (next edition begins Jan 24 2026).

I just want to caution the Honourable Minister, you cannot phase out electricity tariff; it would be a bad policy. What you can do is to phase out all for commercial customers, modulate for some residential customers especially in rural areas, but sustain subsidy for industrial customers to make them globally competitive as energy is a huge component of production.

For industrial customers, if a $100m subsidy helps to improve output by $15 billion, when you tax that output and activity associated with it, you can recover that $100m. But if a high tariff makes their products so expensive that the only option is Chinese products, Nigeria loses. Always remember that whenever Nigerian Customs beats annual revenue targets on import duties, we are de-industrializing Nigeria; reverse that for us.

Electricity is our AI, blockchain, etc; we must focus and fix it in Nigeria before the distractions as no economy can leapfrog energy!

We must work on the root cause why electricity is so expensive in Nigeria. In my office in Owerri, we are not connected to the national grid; we run two generators to escape the insane bills.

Significant Losses in Manufacturing Sector

Many factors are impacting the manufacturing sector, and the government is losing a lot of tax revenue.

The Federal Inland Revenue Service (FIRS) has said all manufacturing companies in the country lost about N1.7 trillion last year as a result of the forex exchange crunch which forced many of them to discontinue operations.

Chairman of the FIRS, Zacch Adedeji, disclosed this on Monday during an interactive session with the Senate Committee on Finance at the National Assembly Complex, Abuja.

“I don’t know anybody that followed in the last one year, all manufacturing entity in Nigeria, they declared a total of N1.7 trillion losses just as a result of forex and we are saying that okay, one sector of the economy had declared N1.7 trillion losses and ask me how does that concerns government.

“It concerns the government because by our law, we will not be able to collect any taxes from them until they recover all those losses, till next 10 years, five years. Even when they make a profit next year, they will tell you they have losses they are carrying forward,” he said.

The 70% Windfall Tax on Banks’ FX-related Profits

Added: Apparently, the government lost tax revenue from the manufacturing sector even as banks were cleaning profits due to the forex adjustments. To balance the indices, it decided to retroactively tax the banks which benefited from the FX changes.

---

Connect via my

LinkedIn |

Facebook |

X |

TikTok |

Instagram |

YouTube