Nigeria has witnessed a remarkable surge in capital importation, recording an impressive 210.16% increase in the first quarter of 2024, according to the latest report from the Nigerian Bureau of Statistics (NBS).

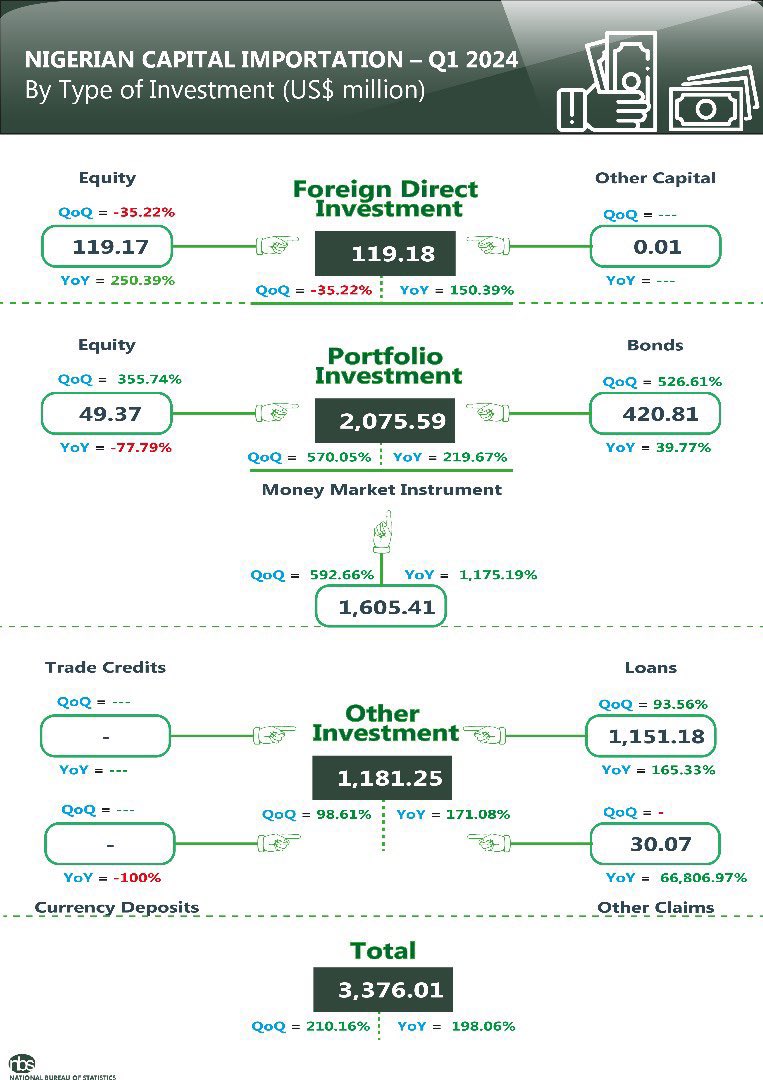

This jump, from $1.08 billion in the last quarter of 2023 to $3.37 billion in the period under review, has caught the attention of both local and international economic observers. According to the NBS capital importation report, this figure also represents a 198.06% rise compared to the corresponding quarter in 2023.

Capital Importation Breakdown

Tekedia Mini-MBA edition 16 (Feb 10 – May 3, 2025) opens registrations; register today for early bird discounts.

Tekedia AI in Business Masterclass opens registrations here.

Join Tekedia Capital Syndicate and invest in Africa’s finest startups here.

The surge in capital imports is predominantly driven by Portfolio Investment, which accounted for $2.07 billion, representing 61.48% of the total. Other Investments followed with $1.18 billion (34.99%), while Foreign Direct Investment (FDI) trailed with a modest $119.18 million, making up just 3.53% of the total capital importation in Q1 2024.

The Banking sector emerged as the most attractive, pulling in $2.06 billion, or 61.24% of total capital imports. The Trading sector garnered $494.93 million (14.66%), and the Production/Manufacturing sector received $191.92 million (5.68%). Among financial institutions, Stanbic IBTC led the charge with $399 million in capital import inflow, surpassing its full-year total of $384 million in 2023.

Sources and Destinations of Capital

The United Kingdom topped the list of sources for capital importation, contributing $1.81 billion, or 53.49% of the total. This was followed by the Republic of South Africa, which brought in $580 million (17.25%), and the Cayman Islands, with $190 million (5.52%).

Lagos State stood out as the prime destination for these capital inflows, attracting $2.78 billion, which is 82.42% of the total. Abuja (FCT) followed with $590 million (17.58%), while Ekiti State recorded a nominal $0.01 million. Interestingly, only three out of Nigeria’s 36 states, along with the FCT, recorded any capital imports during this period, leaving a significant portion of the country with zero capital inflows in the first quarter.

Financial Institutions Leading the Charge

Stanbic IBTC Bank Plc emerged as the top recipient of capital importation, receiving $1.26 billion, or 37.24% of the total. Citibank Nigeria Limited and Rand Merchant Bank Plc followed, with $0.55 billion (16.22%) and $530 million (15.66%), respectively.

Reasons Behind the Surge

The dramatic rise in capital imports, particularly in portfolio investments, can be attributed to several key factors. The Central Bank of Nigeria’s (CBN) decision to hike the Monetary Policy Rate (MPR) by 600 basis points and the high returns from Federal Government of Nigeria (FGN) bonds and CBN Treasury bills played a significant role. Investors were drawn to these securities due to their attractive yields, leading to a substantial inflow of short-term capital.

However, the minimal inflow of foreign capital into the real economy through FDI remains a concern. Economist Kalu Aja remarked on the superficial nature of the surge, noting that while the increase in portfolio investments is significant, it does not provide the long-term stability needed for economic resilience.

“But look beyond the headline figure; almost all of the $3b is from short-term investors (Portfolio) seeking the higher yields offered by the Nigerian government (OMO Bills).

“FDI, which is $ flowing to Nigeria to buy tangible assets like land or other assets, is longer-term job inflow and is essentially flat from last year,” he explained.

Aja further emphasized the transient nature of portfolio investments, warning that they can be withdrawn quickly, unlike FDI, which tends to be more stable.

“All inflow is good, but FPI (portfolio) because of its short-term nature, can be pulled out quicker from Nigeria. FDI is more sticky,” he explained, highlighting the risk that quick capital flight poses to the economy.

Considering this argument, the impressive rise in capital importation, though a positive sign in the short term, underscores the need for Nigeria to focus on attracting more stable and long-term investments. To attract and retain FDIs, the government has been advised to create a conducive environment for such investments, moving beyond short-term gains to build a robust and resilient economy through sound fiscal policies.