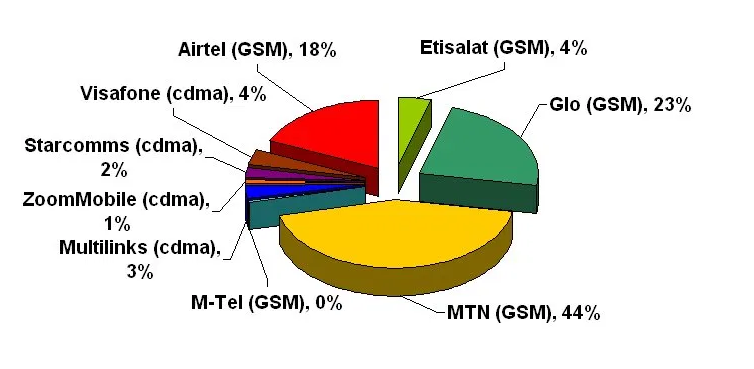

The mobile telecommunications industry in Nigeria existed in the last millennium with limited reach Code Division Multiple Access (CDMA) network operations by companies like Multi-Links, Mobitel and Intercellular. However, it was not until 2001 when a limited number of Global System for Mobile Communication (GSM) licenses were made available though deregulation of the industry that a federal alternative to the prohibitively expensive, managerially dysfunctional and technically impotent state enterprise NITEL became credible.

CDMA MNOs (Mobile Network Operators)

CDMA operators were confined to a number of very inflexible operational specifications, including geographical reach at point of initial licensing, so obtaining license/permit changes to allow expansion and service variations was inflexible, time consuming and costly. CDMA operators therefore remained confined to a fairly short operational reach. The licenses under which GSM companies operated offered far more freedom, especially concerning geographical expansion.

Many of the technical aficionados are of the opinion that CDMA was a superior and more cost effective protocol and Central Bank of Nigeria advocated this protocol for use with ATMs.

Register for Tekedia Mini-MBA edition 19 (Feb 9 – May 2, 2026): big discounts for early bird.

Tekedia AI in Business Masterclass opens registrations.

Join Tekedia Capital Syndicate and co-invest in great global startups.

Register for Tekedia AI Lab: From Technical Design to Deployment (next edition begins Jan 24 2026).

By the time 4G/LTE technology became available it was realistically only GSM MNOs were in a position to roll a service out federally.

CDMA MNOs continued to operate with limited reach for many years to come, alongside GSM, and offering cheaper rates – other well known providers were for instance, Zoom and Starcomms. The last surviving was Visafone, which was acquired by MTN in 2016, and the CDMA services it provided, closed down.

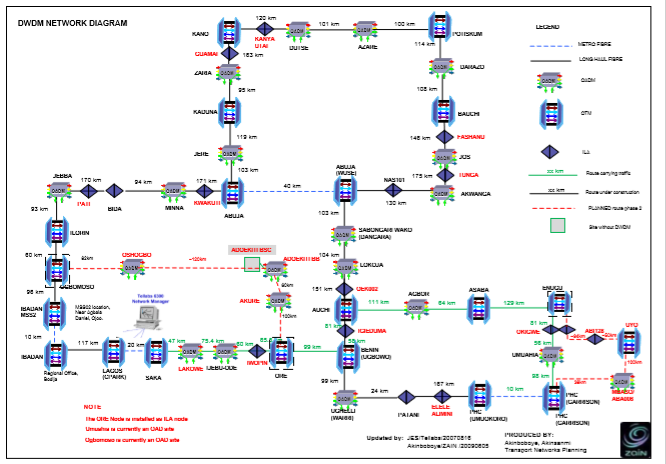

The Nigerian Infrastructure Ecosystem and ‘Wholesale MNO’ concept

No Infrastructure company in Nigeria owns complete end-to-end capacity to provide end user services. Most started in one niche area and expanded their reach through a combination of leasing capacity from complimentary providers, and expanding their own infrastructure beyond their core product. Examples of Infrastructure can be ‘mast and shelter’ sites, collocation/data centre sites, metro mesh networks (fiber and/or microwave) Federal fiber backbone (high capacity fiber trunk inter-connecting cities and large towns), International Submarine Cable (connectivity to the world and to Tier 1 ISP’s), Satellite capacity leasing, and ‘Last Mile’ service providers.

‘Last Mile’ service providers rarely own infrastructure. ‘Mile’ is a metaphor for the last ‘hop’ of service from an infrastructure node or PoP (Point of Presence) to a customer or end user. It can take many forms. For an MNO, it can involve a rigger climbing a mast and mounting the equipment that will reach Smartphones within a given service radius. It may involve equipment installation or recalibration in the shelter. For other types of users and customers, it may involve microwave radio installation at mast, and also at customer side, with additional cabling and CPE (Customer Premises Equipment). If there is a JB (junction box) roadside to which fiber can be patched, it can involve digging a trench, laying short distance customer fiber and again, additional cabling and CPE. If the service is over satellite it may involve the installation of a VSAT antenna or adjustment of the Elevation and Azimuth to re-provision an existing one, and of course, cabling and CPE. When a DStv technician visits a location, installs equipment and gets it up and running, this is probably the simplest implementation of a ‘last mile’ service. While DStv and MNO’s last mile implementation is fairly ‘rinse/repeat’, when it comes to innovative solutions and first-to-market deployments for VIP customers, technical challenges almost always arise at the ‘last mile’ end rather than at the backbone side. While many established players in the Nigerian Infrastructure Ecosystem have their own Field Operations Units, even those frequently need to engage a third party provider for ‘last mile’. Most Infrastructure Companies have a field team in Lagos and maybe Abuja and one other, but for distant deployments like Zaria, Jalingo or Gombe, it’s cheaper to partner with ‘Last Mile’ providers locally. Even the largest MNOs however, experience field service spikes driven by promotions, expansions or technology upgrades so some contracting out for them is also inevitable.

For many companies also, word of mouth, extremely powerful in Nigeria, brings more remote business as a result of the work of their ‘Last Mile’ contractor. Many ‘Last Mile’ service providers also become resellers in a region, to local ‘enterprise clients’. ‘Last Mile’ technicians are some of the most resilient, tenacious and undaunted of individuals in Nigeria. They operate in challenging remote and urban environments and are accustomed to conflict with touts, bandits, area boys, armed robbers and political militants through the ordinary course of their work.

Often under acknowledged, it is important to record the ‘last mile warrior’s’ contribution to the infrastructure ecosystem.

Wholesale MNOs – don’t sell sim card based services direct to consumers. They are infrastructure companies with carriers as one of their customer segments, either new to market, or MVNOs or for redundancy. Companies in Nigeria that may consider themselves to have a Wholesale MNO Profile, have ranged from Netcom Africa, to Gateway Communications, for a period, while partnered with the SA Vodacom, and Multi-Links while partnered with the SA Telkom. Phase 3 Telecom could be considered a unique Wholesale MNO Service Provider which operates on the Federal Electricity Grid. It is almost infinitely redundant due to the mesh nature of the grid.

Data over 4G/LTE is now getting more important than voice. Main One (Submarine Cable provider and a route to overseas Tier 1 Internet Peering with people like AT&T, Lumen Technologies, Tella Carrier and Cogent) has been digging up roads and laying fibre everywhere over the last decade. If WACS and ACE get in on it too… they might enter the Wholesale MNO arena end to end, making MVNO (see below) more feasible.

MVNOs

Mobile Virtual Network Operators (MVNOs) are companies who purchase capacity on circuits wholesale from MNO’s to then retail that capacity via the services they offer through consumer end sim cards to users. True MVNO’s can really only sustain operations in mature markets where there is lots of competition and a saturation of capacity on MNO circuits that goes beyond a few key urban areas. MVNOs generally pick up substantial business by targeting niche customers the typical MNO cannot or choose not to prioritize in terms of offering competitive rates. Examples of this would be Lyca Mobile and Lebara in the UK who target the immigrant market by providing calls to distant locations at a fraction of what typical UK MNOs charge. Probably the only true UK MVNO offering competitive standard services nationally would be Virgin Mobile, whose name was changed to Virgin Media after being purchased by NTL Telewest in 2006. Virgin Media now rides on EE networks, a company formed from the merger of Orange UK and T-Mobile UK in 2010. In Nigeria at the moment, it is difficult to sustain an MVNO long term.

Any plan to ROI for an MVNO start-up in Nigeria would probably be making some porous assumptions. It would be very difficult right now to make a profitable case for sustained operation as an MVNO, for a number of reasons:

Limited numbers of MNOs with strong pan federal footprint. It is likely MNOs would collectively guard their networks against an MVNO bringing products to market cheaper than them while operating on their networks. It is unlikely they would try to compete with each other for MVNO business to allow a Virgin Media MVNO business model to become successful in Nigeria.

Insufficient carrier agnostic MNOs circuit owners (Wholesale MNOs) and other service providers through which it would be possible to roll out a pan Nigeria carrier independent service to support a Virgin Media MVNO business model in Nigeria.

Too expensive to source separate carrier independent managed ‘lastmile’ connectivity solutions to customer devices to support a Virgin Media MVNO business model in Nigeria.

No mass immigrant or foreign diaspora population. Bureaucratically, routes to Nigerian Citizenship through naturalization are arduous and impregnable. The conditions for the development of a mass foreign diaspora population customer base with a globally distant ancestry are not favourable in Nigeria. These are the customer bases that support the sort of business model that has made Lyca Mobile and Lebara successful in the UK. Additionally, Nigerians with family abroad expect to be receiving their calls, not making them. Revenue potential from the social interactions between Nigeria based individuals and those in non-African countries is not a lucrative untapped market a Nigeria based MVNO can exploit.

When distinguishing between textbook MVNO and MNO models, an ex Core Engineering Department Head at Netcom Africa Ltd once suggested: ‘Sometimes we have to be careful about what we are willing to consider a REAL ‘Mobile Network Operator’…. Just because a company can put SIM Cards with their brand on it, into a mobile device, and it will work, doesn’t necessarily make them a Mobile Network Operator…. Just because a company does not, doesn’t mean it isn’t! If a company owns, manages, maintains, upgrades and innovates……. end-to-end physical infrastructure….. without which mobile devices cannot work, then they are a Mobile Network Operator. If they do not… they are just another retailer!’

Top Management and the Technical Leadership Team in Mature Market MVNOs don’t translate well to MNO management in an emerging economy like Nigeria. A CEO who had previously lead an MVNO in the UK was hired to head up a major player in a Sierra Leone MNO with the usual infrastructure roll out challenges typical of this kind of market and the disaster presided over was fairly spectacular.

When looking at traditional models of product/service creation and distinguishing this from distribution and retailing, it is easy to consider an MVNO simply a retailer or distributor of the infrastructure communities capacity. Nevertheless, navigating the statutory and licensing landscape in Nigeria can be challenging, and with all credit to the view of the Core Engineering Department Head, having the operators license and control over assigned spectrum may be the elephant in the room.

MNOs > Global System for Mobile Communication (GSM) license path (now 4G/LTE) The Big 5: MTN, Glo (Globacom), Econet (Bharti Airtel, Etisalat (now 9Mobile), ntel (former NITEL).

MTN came to market almost instantaneously with Econet from the licenses made available since 2001. It was criticized in the early days for having prohibitively high charges to purchase sim cards, and for failing to have per second billing. Both these issues became naturally resolved over time by market drivers. MTN still remains the network with the broadest pan Nigeria reach and resilience, and has managed to create a perception of federal reliability. Following a brush with the regulator, MTN Group has moved significantly towards divesting itself of Nigerian investment. It is difficult to now consider MTN Nigeria a ‘South African’ company. There is some plurality of investment between stakeholders in MTN, 9Mobile and IHS.

Airtel have a substantial network. They were also criticized in the early days for failing to have per second billing. Econet has been plagued with a variety of funding, stakeholder support and management dynamics challenges since inception. It has held five different names, Econet, Celtel, Zain, Airtel and Bharti Airtel.

Glo/Globalcom/Glomobile is the only indigenous company that rose from the GSM license issuance, founded by the Nigerian serial entrepreneur Mike Adenuga. The company is the most independent MNO in Nigeria owning almost all of its backbone and last mile infrastructure and significantly, owning its own Submarine Cable. This means it can peer directly with Tier 1 internet providers abroad. There is currently no internet mirror on the African Continent. With services like Whatsapp, Viber, Skype etc (OTT) starting to become favoured over traditional voice services, in addition to all the typical browsing and apps requiring smartphone based internet, this gives Globacom Group a huge advantage.

Etisalat was a latecomer to the GSM (now 4G/LTE) party only arriving in 2008. It has been rebranded 9mobile. It is quite vulnerable in some ways, being the second most reliant on third party networks to deliver services to some consumers. This limits the portfolio of services as it needs to focus on VAS as reselling of physical layer infrastructure services wouldn’t be competitive. But infrastructure ownership is a double edged sword. Etisalat had been in the market for a buyer. Bharti Airlines (parent of Airtel), owned the most federal network of the bidders, so technically for them it would have a mass migration of customers to their networks. However, Airtel at the time was muted to have over extended its liquidity. Orange isn’t a player in the Nigerian market right now, but was the only bidder to have landed fibre. This was through ACE in Lagos in which it has part ownership. Since the closure of that process, Orange instead took up an investment in Main One, giving them additional submarine cable options and their position has changed. Vodafone, another interested party had no footprint at all, and was additionally battling poor image issues in its core markets. Since the withdrawal from market, a new CEO, Alan Sinfield has been appointed, who is resurrecting the fortunes of the carrier.

A table below indicates how the five compare approximately on a range of indicators:

| % infrastructure ownership | Redundancy provision | Federal reach | Independent Cable to Tier 1 | |

| MTN | 2 | 1 | 1 | No |

| Glo | 1 | 3 | 2 | Yes |

| Bharti Airtel | 3 | 2 | 2 | No |

| 9 Mobile | 4 | 3 | 4 | No |

| ntel | 5 | 3 | 5 | ? |

ntel is a company raised from the privatization of the former state enterprise NITEL. It was previously branded ‘Natcom’. The infrastructure it has in Nigeria (Federal Backbone) as a starting point was practically nonexistent so it continues to have challenges with achieving a comprehensive new federal infrastructural roll out. It can probably succeed in the short term as an MVNO but the race is on to get its own solid infrastructure. It currently claims to have quality services in Lagos, Abuja and Port Harcourt. It has the same challenges Etisalat had in 2008, but this is 2020 and things will have to be done faster, more efficiently, cheaper, for it to contest this market. ntel experienced some leadership challenges following the departure of CEO, Kamarr Abass some years back.

One of the big plusses for ntel was the jewel in the crown of NITEL architecture: the Submarine Cable SAT-3. It had integrity issues, and though ntel claim to have refurbished it, it is unclear what the technical details of this are. ntel for a period went on a price war offering STM1, 4 and 16 capacity over SAT 3 at a huge reduction to Main One which were not sustainable. Two CEOs later from Kamarr, Babatunde Omotoba is now the force driving ntel to work towards a more impactful presence in the market.

Other MNO Infrastructure players in Nigeria

Medallion Communications

Own the ‘preferred’ co-location sites for the industry at Saka Tinubu, Victoria Island, Lagos and off Durban Street, Abuja. Everybody that is anybody in the industry co-locates with them. They are the melting pot where anybody credible can hand off connectivity to anybody else. However, in particular Saka Tinubu is over-congested. A case can be made for a new defacto central point for co-location in Lagos. The dynamics of getting a seismic shift on this is as much pseudo political as it is technical. Ikechukwu Nnamani, Medallion Communications CEO and founder has been elected the new President, Association of Telecommunication Companies of Nigeria (ATCON).

The Tower Companies

Since IHS did a deal some years back to take all Helios Towers stock in Nigeria, Federally, for a while, they were really the only show in town. The biggest player in the arena historically was Alan Dick West Africa Limited, who handled most of the MTN roll out within their scope in the early days, and went bankrupt muted by difficulty regarding timely MTN payments. Even a decade later, liquidators for Alan Dick were still in court in Nigeria with MTN. In the early part of the millennium, the only alternative appearing to show promise was MTI but this company has now adopted a more contracted footprint since being purchased by Worldwide Ventures, and only a few sites around Lagos ‘islands’ now remain The enlarged IHS saw liquidity challenges to support payments to keep the network fit for purpose. Shifts in foreign exchange rates haven’t helped, nor has an investment dynamic that links IHS with MTN and 9Mobile. Parts of planned upgrades to the e-site product by a Swedish company ‘Flexenclosure’ were put on the ‘slow train’ and other parts have been put on hold indefinitely. IHS towers is a critical element of the carrier agnostic Wholesale MNO network, and if they are in trouble, then any company with MVNO aspirations for the Nigeria market may be in trouble, and any company with long term MNO plans but needs to hit the ground running with MVNO model may also be in trouble. Gaps in markets don’t stay indefinitely and since then two significant players, American Tower Company (Nigeria) and Pan African Towers arrived. ATC acquired Airtel’s towers mid way through the last decade, though the deal has Airtel getting tariff waiver up to 2025. Pan African Towers, an indigenous telecom infrastructure company has won big at the 4th Nigeria Tech Innovation and Telecom Awards (NTITA) earlier this month (November 2020). CEO of Pan African Towers, Wole Abu has been elected as the new Publicity Secretary for ATCON. Independent sources vary on infrastructure capacity but both are muted to have somewhere between 2000 and 5000 sites. This is significantly below the 25000+ towers IHS have in their portfolio. If IHS sneezes, a lot of the community will catch colds.

The battle of the datacentres

Rackcentre: Rackcentre is a Tier 3 standard datacentre facility provided by a Lebanese-Nigerian family business – The Jagal Group. It was built by Jagal Construction, which this author partnered with on the Netcom AIS Project. It is MNO agnostic, so its owners are not in any other part of the industry that might give them a conflict of interest for any particular customer. They promote this point heavily on their website.

Rackcentre was one of Jagal Groups efforts to diversify income streams to reduce exposure to Oil and Gas. Maher Jarmakani made what was intended to be a ‘groundbreaking’ speech to a packed audience at Nigerdock 2015, though the group as a whole struggled the next year and dropped employees from around 4000 to 500. ntel were one of the first to have a presence at Rack Centre through SAT 3. WACS followed, and so did Dangote. Rackcentre has since received a major shot in the arm from PE company Actis (a privatization of the former UK Commonwealth Development Corporation), to the tune of $250m USD. Actis has a strong focus on Africa and South America and regularly sniffs around big markets like Nigeria. In 2018 following the demise of Pakistani tycoon Arif Naqvi’s Abraaj Group, Actis snapped up all its African holdings which included its stake in Austin Okere’s CWG. In the same year, Rackcentre, was named the winner in the Best Data Centre Innovation category of Capacity Europe Global Carrier Awards in London, beating competition from UK, US, Canada and Sweden.

MDX-i: A data centre with a plethora of services on par with Rackcentre. Not as neutral as Rackcentre as they are owned by MainOne. This is a double edged sword . Main one owns its own Submarine Cable over which it achieves Tier 1 peering. It has also built up an intercity fibre backbone in Nigeria and has several metro fibre networks in key cities, principally Lagos.

When we see that Funke Okeke’s Main One is also achieving an MDX-i standard facility in Accra. Ghana’s Silicon Valley – Appolonia City, we know that this is fast becoming a Pan African footprint. Ok – MainOne doesn’t have a tower company and doesn’t have licensed MNO spectrum. But they can easily barter, (common in Nigerian Wholesale MNO/Infrastructure community) to get the former, and with Orange now having a significant investment in Main One, they can leverage them to achieve the latter. But while they can almost be a one stop shop for everything, in the early days Main One simply sold submarine cable capacity to all comers, with no interest in the downstream business. As it diversified its own infrastructure it began to gradually drill down to reach different user communities which had been the sole bread and butter of its most ardent and long standing customers. For to reduce competitor visibility on a network, avoid adding business capacity to a potential competitor, and in some cases, reacting to the experience of owning ‘the hand that fed which got bitten’ some customers may be reluctant to use MDX-i, preferring instead for service from a company that so far has stuck to solely offering datacentre services, such as Rackcentre.

However, the rate at which Main One is building out on its network and showing signs of moving beyond a vision for Nigeria, but a vision for Africa, MDXi may ultimately find its business dominated by one internal customer (Main One), with customers from the external market reduced to being the icing on a very deep layered cake.

As Orange further develops its regional infrastructure, nothing is beyond possibility. And remember… Orange OWNS a Tier 1 facility – ‘Open Transit’

21st Century Limited (21CTL): 21CTL has recently built the very first Tier 4 compliant Datacente in Nigeria. This puts it technically on a different plane to competitors in the category. The company was originally founded in 1997 and by the early part of the new millennium had the best fibre metro network from the original business hub around Marina Lagos to the newer commercial buildings and fashionable urban residences of Ikoyi and Victoria Island. They extended to GRA Ikeja and evolved the network in tandem with construction development of the Lekki Peninsula While 21CTL provides an enviable array of enterprise services, it is unclear to what extent it has succeeded in expanding its network beyond metro coverage of Lagos business districts. It is equally unclear what the difference between Tier 4 and Tier 3 will mean as monetizing impact for the current customer landscape.

It’s therefore difficult to compare the potential of 21CTL with the extensive infrastructure MDXi can leverage through Main One, on the one hand, and the impartiality and independence from enterprise offerings claimed by Rackcentre on the other. . 21CTL received Fiber Optic Company of the Year at BoICT Awards, 2015. Its founder and CEO is Wale Ajisebutu.

Others:

Galaxy Backbone is intended to be the appointed provider of communications solutions to FGN, its civil services, devolved agencies and quangos. It is located in Abuja. In reality it has very little of its own infrastructure and invites external providers to tender for opportunities issued to it. It is supposed to have a mandate as the ‘required’ route to such opportunities and act like a gatekeeper. This author however has executed multiple proposal presentations to for instance: NNPC, NLNG, Nigerian Police High Command (including the IG) and in 2009, even the ex Nigerian Minister of Information and Communications herself, the late Professor (Mrs.) Dora Nkem Akunyili. Were it, that peer agencies in and associated with Civil Service, were in full acceptance of Galaxy Backbones’ supposed ‘Gateway’ mandate, these kinds of direct business development approaches would not have been possible.

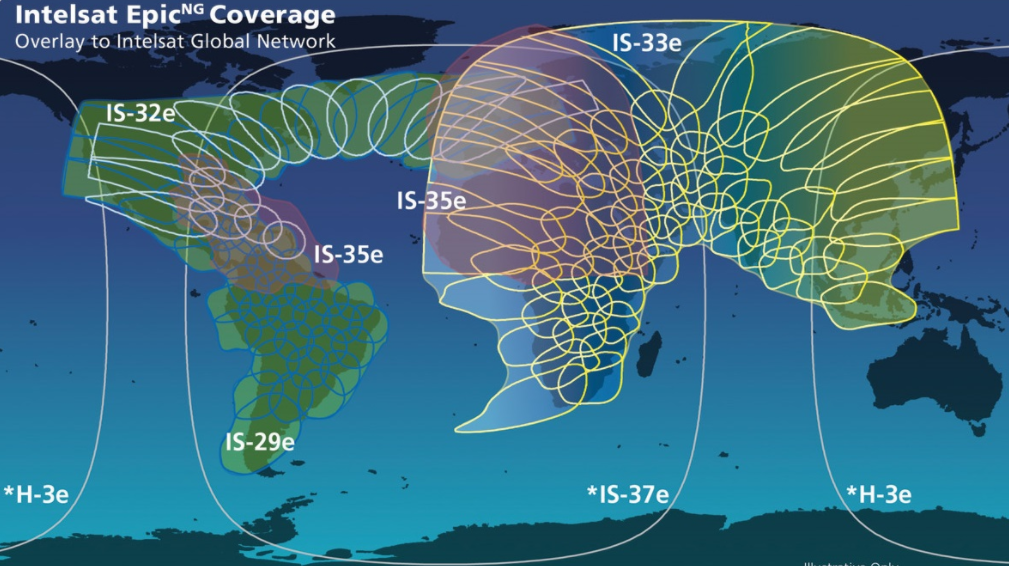

Submarine Cable Owners (Needed to get international access and peer with Tier 1 internet providers) – SAT-3 Suburban, (ntel) Main One Cable, WACS, ACE (Glo has its own). Google and Facebook both have Submarine Cable in development.

Broadbased Telecom. – Metro Lagos fibre networks. Nigeria Tech Innovation and Telecom Awards 2020 awarded Broadbased Telecom ‘Wholesale Telecom Provider of the Year ‘ ( see section higher up on The Nigerian Infrastructure Ecosystem and ‘Wholesale MNO’ concept.) and ‘Metropolitan Fiber Infrastructure Company of the Year’. Separately the award for ‘Outstanding Contribution to the Telecom Industry was awarded to its MD/CEO, Prince Henry Iseghohi, for the third time.

Bitflux : A current license holder of Nigeria spectrum for 4G/LTE, muted to be interested in MVNO, but no movement to market as yet.

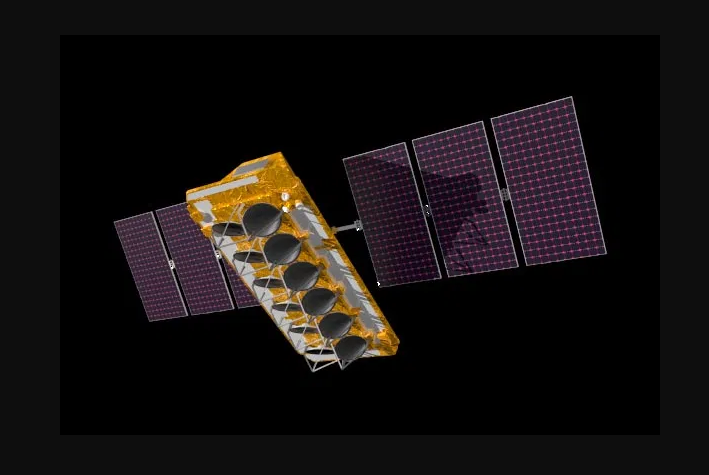

VSAT Services available to Nigeria

Operators in Nigeria can supplement their terrestrial networks and submarine cable access through the use of VSAT technology to access foreign teleports, as well as providing connectivity solutions to remote locations. The following are examples of providers who have a footprint that can serve Nigeria:

Intelsat : C Band VSAT service footprint over Nigeria.

SES: Aside from C Band VSAT service footprint over Nigeria, SES also purchased O3b a medium orbit VSAT provider which while less vulnerable than fibre, has lower latency than service from a typical VSAT satellite because of its proximity to earth. It is a constellation of 20 at an altitude of 8,062 kilometres (5,009 miles), less than one quarter of the altitude of typical geostationary satellites. The low orbit reduces latency to the point it is comparable with fibre.

Cost can be an issue here as a lower orbit means thicker air, which causes greater headwinds and thus greater friction, having a knock on cost to operational maintenance.

Space-X. Elon Musk currently has a plan involving a medium orbit of around 1000 satellites to cover Africa. However, there isn’t sufficient detail at this stage to compare it with SES/O3b 20 unit constellation on either total space segment available or what proportion of the service will cover Nigeria or what its performance will be.

Gilat – Ku Band VSAT service footprint over Nigeria. They also provide Ka – band customer hubs and terminals for O3b VSAT services.

A parting word MNOs vs. MVNOs

No provider has full network independence. In Nigeria, Glo probably comes closest. Where is the line drawn that distinguishes between when a Telecoms Services Provider has enough of its own infrastructure to be labelled an MNO rather than an MVNO? This is akin to the proverbial ‘how long is a piece of string’!

It is really down to the business model, objectives, strategy, and the operators’ term business plan, and, at commencement of operations, if all this is realistic in the context of the venture capital available.

A new MNO while it is in the process of rolling out infrastructure will almost certainly be an MVNO to start with but has genuine intent to become a network independent MNO as per the business plan. This is different from a company which always intends to have an MVNO operational model.

Redundancy, Redundancy and Redundancy.

When circuits fail, data in transit needs to find an alternative path. ‘Redundancy’ is the term for ensuring these paths exist, and are operationally fit for seamless migration of moving data in real time.

Most of the fully fledged independent infrastructure MNO’s will go to Wholesale MNOs to get redundant circuits on their backbones. Sometimes they will even swap capacity on circuits with each other. If the mother of all melt downs scenario is considered, the one with enough leased capacity to support their networks, at least on the short term, will be the one least likely to go down.

Link Redundancy and Path Redundancy: If fibre passing through underground ducting is achieving redundancy through cores in two cables, or worse, two cores in the same cable, and some activity perforates right across the duct, both the link and redundancy are lost and the connection goes down. If two microwave radios are put on two poles on the same high rooftop, or worse, both on the same pole, and a new high rise building is constructed blocking the primary link, again, both the link and redundancy are lost and the connection goes down (They will have identical Fresnel Zone). Path redundancy involves validating that the redundant link takes a completely different physical route than the primary link. In Nigeria, fully resilient path redundancy end to end is difficult to achieve and expensive.

Another issue is that MVNOs in mature market are accustomed to managing their deals with their wholesalers, and performance outages through SLAs, but in Nigeria it will be the company with their name on a sim card in use by a customer that will suffer brand damage. If a person wants to wish their aged grandmother in a village happy birthday and there is network failure.. even if they are on a post-paid tariff, a 100 Naira re-credit doesn’t restore that moment.

Currency exchange rates are also an issue. Specialist infrastructure hardware is not made in Nigeria. While the Naira is far from being in freefall… the overall prevailing trend is down. If capital reserves for overseas purchases are already abroad, it isn’t relevant, however if the reserves are in local currency then executing the overseas purchase process or interim solutions for capital reserve management need to be looked at.

Finally, while infrastructure is an asset, it’s important to acknowledge this asset isn’t dynamically realizable. Few predicted the fall of Murmar Gadaffi in Libya in 2011 and the ensuing chaos. Even less the end of the rule of President Hosni Mubarak in Egypt later the same year, and a level of civil disobedience that saw what was the second country by GDP on the continent, drop like a stone to number six. It is established that unsecured Libyan light arms found their way to Boko Haram. Without over-reacting, it is important to acknowledge potential risk regarding political stability when making investment decisions. Additionally, many feel Nigeria has moved beyond ‘Biafra’, but less than two years ago, there has been incidents around the incarceration of the protagonist for Igbo self-determination, Nnamdi Kanu. We have also seen unease around the rise of Oodua Action Movement and Reformed Niger Delta Avengers and most recently, the uncertainty around #ENDSARS. Elsewhere in the region there is instability with the genocide involving school children in Cameroon, Military Rule in Mali, election unrest in Guinea and Cote D’Ivoire, and most recently, the escalation in Burkina Faso.

Towers cannot be folded up and put in a neat little suit case. Fibre can’t be dug up out of the ground, magically translated into its value in hard currency, and sent by electronic transfer to a bank account at a secure foreign location or converted to Crypto currency!

OTT and the Tariff Future

‘An over-the-top is a streaming media service offered directly to viewers via the Internet. OTT bypasses cable, broadcast, and satellite television platforms, the companies that traditionally act as a controller or distributor of such content. It has also been used to describe apps for phones that transmit data in this manner’ – Wikipedia.

Examples :

Kik, Viber, WhatsApp, Apple’s iMessage, Skype, WeChat, Google Allo – smartphone messages

Netflix, HBO, Hulu, YouTube, Amazon Video or Apple TV – video streaming

Facetime, Viber, WeChat, WhatsApp and Skype – video or voice calling World of Warcraft, Google’s Twitch, Xbox 360 and YouTube – gaming

While adoption of OTT for some services has been strong, usage has only reached a fraction of its full potential. The main obstacle has been metered data services to smartphones. While many in Nigeria will claim they, their family, friends and colleagues use OTT by preference all the time, the reality is the Nigerians that will get the chance to read this article are not fairly reflective of the general population.

It is a bit like modern trade in Nigeria. Regular patronage of a Mall is only possible for a few million out of a population that is headed for the 250 million mark. These are probably the same people that get to use OTT services on demand. The rest use open air markets, kiosks and localized small vendors for food and household. They don’t get Wifi access through work or social movement, and they have to be fairly frugal with the intermittent purchase of pre-paid credit that can have some data allowance bundled.

On July 26 this year, the day after National Nigerian Diaspora day, President Buhari thanked the Diaspora for the $25bn sent to relatives. The Annual Diaspora Remittance Exceeds 80% of the Yearly Budget

This correlates roughly to the magnitude of regular overseas diasporas contact with Nigerians many of which are in need. Those overseas will generally be too busy to take calls on demand and will then want to call at a time of their choosing, at which time, the Nigerian side will invariably have insufficient data left to accept the call over OTT.

This then forces the overseas caller down the MNO network route, which triggers punitive International Termination Rates (ITRs.) These punitive ITRs have been preventing Nigeria from being included in unmetered packages offered by SME MVNOs and third party access card operators in North America and Europe. Nigeria is one of the least ‘bundleable’ countries for call deals.

In September this year, the EVC of NCC, Prof. Umar Danbatta committed to reviewing the ITR regime, saying ‘where ITR is not properly regulated, it tends to have a negative effect on a market like Nigeria with major supply-side challenges and associated socio-economic implications’

Clearly the Nigerians locally that hail the perceived eclipse of normal calls by OTT, are not one of the masses with dependency on overseas help.

The Minister of Communications and Digital Economy, Dr Isa Ali Ibrahim Pantami, during an address at a Webinar organised by Lead Inspire Network also committed to a new National Policy on zero rating on educational websites which would allow the consumption of contents without charges to normal data plan.

These are all measures heading in the right direction, and with the headway made earlier this year in securing positive response from different state governors on reducing ROW (Right of Way) charges, also championed by former President of ATCON, Olu Teniola, the pressure is now on the big 5 MNOs to make something happen for economically disadvantaged and hitherto poorly serviced rural communities. There is however, a considerable journey between headline announcements and actions that are seen to work.

In the meantime, MNOs seem addicted to the practice of selling metered data as a painkiller for their revenue challenges. Yet this is the one obstacle that stands in the way of a mass explosion to over 200 million users in Nigeria.

While MNOs will be keen to move forward to deliver 5G to their most lucrative and demanding of customer geographies, the political debate will continue to ramp up on ensuring that all of Nigeria has at least some form of service. These two competing demands for investment may become a double whammy pressure on revenue. MNOs need a ‘third way’.

Perhaps the MNOs need to send their brightest minds to Tekedia Institute, where Ndubuisi Ekekwe can introduce them to the concept of building category-king brands by mastering how evolving business models like One Oasis, Double Play and Aggregation Construct can be effectively deployed in the industry to create leverage-able anchors to unlock opportunities and growth.

Through this, perhaps they can develop a strategy with a uniquely Nigerian flavour, to give unmetered access to users willing to on-board some kind of service app, either MNO owned or third party partnership? This can then be the new revenue stream to compensate for the loss of metered sales. This way everyone wins.