Every month, when I look at my company bank statements from different jurisdictions, I always notice one obvious anomaly in the Nigerian ones. Banks charge you fees for banking and doing business with them. In U.S., banks actually pay you money for banking with them. In other words, if you want to open an account in most U.S. banks, they give you free bonus. If you are aggressive, you can get up to $400 just for opening an account and setting up direct deposits in some banks.

U.S. banks want you to send your money to them. And at the end of the month, in most great banks like M&T Bank, no one will charge you a fee. No single debit in your account. In some bigger ones like Bank of America and Chase, they may require a minimum daily balance (say $1,500) or a direct deposit of say $750 to avoid about $10 monthly fee. If you maintain either, you will not have any fee penalty.

But in Nigeria, there are many entries on all kinds of fees. I used to work in the bank in Lagos. But then, it was Commission on Turnover (COT) – this is the fee, the bank imposes on your account for actually withdrawing your money. I have called it one of the most ingenious products that propelled the new banking era in Nigeria. Without COT, there will not be many new generation banks. They offered better services than the dinosaurs of the older banks, but needed to monetize the obvious preferences of their services in order to invest in technology and new operational models. Customers knowing the value in better service did not complain. The COT provided easy cash and they triumphed, took market share from old banks. So, even if they do not make loans to earn interests, provided that customers are coming and withdrawing money, they would make money. That is a setup that will never fail. They bring the customers with efficient services and then charge fees on their accounts as they do transactions.

Register for Tekedia Mini-MBA edition 19 (Feb 9 – May 2, 2026): big discounts for early bird.

Tekedia AI in Business Masterclass opens registrations.

Join Tekedia Capital Syndicate and co-invest in great global startups.

Register for Tekedia AI Lab: From Technical Design to Deployment (next edition begins Jan 24 2026).

To illustrate how critical COT was to most new generation banks, some were closing accounts of customers who had money with them but were not moving them in and out. For instance, if you have N100,000 in your account for a year without touching it, some of the banks would make a bank draft, informing you that the account has been closed. They have no need for that money because they were not necessarily interested in the money. They wanted the COT only. Yes, no need to invest your money to earn interest fees. But have N10,000 in the account and tomorrow you withdraw it and the next day you put it back, you become a damsel as that movement will generate COT for banks. That is why banks like traders because they generate so much volume and that means COT: say N3 per thousand, you can see massive income when people deal on millions of Naira.

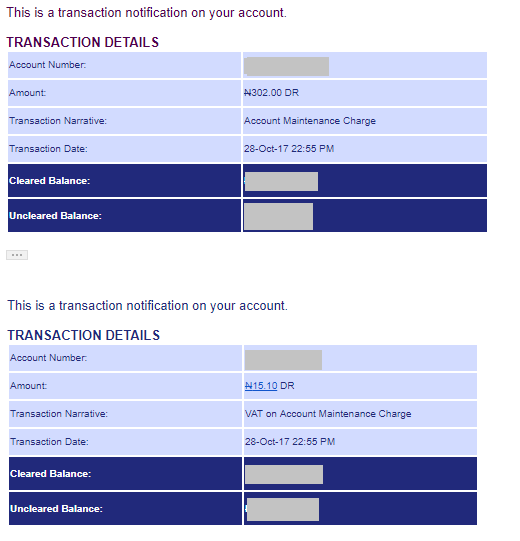

The Central Bank of Nigeria killed COT. But quickly, we saw new types of charges – Account Maintenance Charge. That charge also comes with a VAT. So, the banks charge you a fee and then ask you to pay VAT on it. That is the law of the land.

Then as you are dealing with bank maintenance charges, there is another one – the Stamp Duty. That one annoys me terribly because the duty is simply designed to make money from customers. All the transactions are done digitally and yet banks have to buy stamps! Sure, the cost of the stamps is irrelevant. It is an inherited nonsensical tradition from the British Empire which thinks that unless you stamp a document, it may not have full legality. Visit Corporate Affairs Commission, High Court etc and you will see stamps in action: if they do not put those stamps, some of the documents may not be completely valid. This means that you have to pay the stamp duty for that digital-based bank transfer to be legally binding!

Yes, I must note that some of these new fees are imposed by the Central Bank of Nigeria (CBN) on bank customers. So, it may not necessarily be banks’ money: they share with CBN.

The Implications

There are people that do not want to bank in Nigeria simply because of the fees. For a citizen that makes a minimum salary of say N18,000 per month and has to withdraw money four times, you will see that at the end of the month, the person may be losing close to N500 especially if the individual has SMS alerts which attract another fee class (The SMS fee is expected, banks have to cover their costs on that one. They do make Internet banking free.)

Nevertheless, there could be a bank that can waive the SMS fees since by regulation banks are required to prepare monthly statements for their customers. Of course, having real-time information on payment via alert is priceless. People will prefer to pay for that instead of waiting for the monthly statements which the law expects from banks. SMS is good and customers can ask for it to be deactivated; it is an optional service. In technology, Nigerian banks have made progress.

But for the poorest citizens in Nigeria we are trying to bring into the banking fold, we need to think how other core non-optional fees can discourage them. I do not see how some of these citizens will embrace the banking sector with these fees. Either you want them to keep the money in the pillows or you reform the banking fee charges to make them attractive for extremely cost-sensitive people to bank. Without that, CBN may not be addressing the root cause of the issues before us on financial inclusion.

I must note that Savings Account in most Nigerian banks do not attract fees. However, some require a minimum balance which technically you cannot even draw below. In Union Bank, the amount is about N1,500 and that means unless you close the account, that minimum must be there. For some poor citizens, that balance is a huge burden.

All Together

To accelerate financial inclusion, the Central Bank of Nigeria should reform the varying levels of fees in the banking sector. Those fees could be discouraging the very people it wants to attract into the banking sector. For someone making N18,000 monthly and having to part with N300-N500 on fees and associated SMS charges, it could be a disincentive to bank. People are smart and when there is a burden via fees for extremely cost-sensitive people, any policy will collapse. CBN needs to revisit bank fees and work with our banks to find better ways to offer products that can reduce cost burdens on poor citizens. This is not a problem that technology can fix because the fintech companies do not take customer deposits. So, it is only policy that can solve this, and only the central bank has the capacity to make that happen. Yes, banks are not charities and are there to make money. So CBN needs to balance its policy.

---

Connect via my

LinkedIn |

Facebook |

X |

TikTok |

Instagram |

YouTube

I like your post always, more knowledge.

Awesome – thanks

Everytime I read ur post, I find myself one step ahead of my contemporaries. Thank you!

Thanks Michael for the kind comments