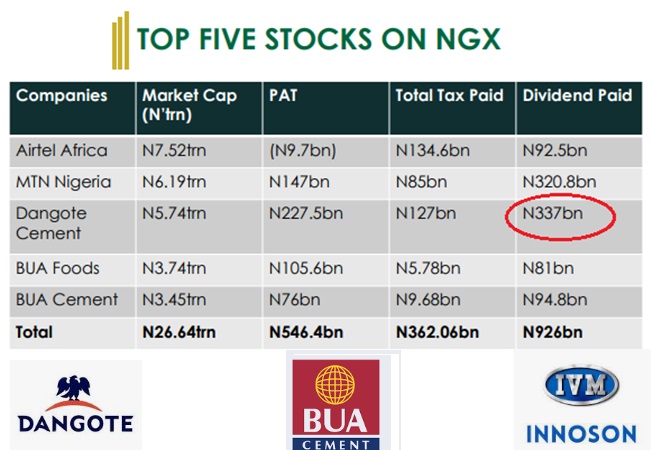

I am reading Bismarck Rewane’s academic tome on Nigeria’s 2024 economic outlook. When I got to this table (on page 12), I paused. If you remove the foreign companies, Aliko Dangote does really well on that chart: the government gets its tax even as investors have tons to share as dividends.

If you model the impact of that dividend, you will see a huge multiplier effect via investors in Dangote Group. As a startup investor, I have this construct that nations must aspire to have BIG companies because they’re usually the ones with capacities and resources to solve huge challenges.

In other words, a place where most people are founders or entrepreneurs is a poor place, as that typically happens because visions cannot scale. And if visions remain punted and stunted, everyone runs his or her show, with no benefits of economies of scale, and efficient utilization of factors of production. Yes, everyone employs himself or herself!

Register for Tekedia Mini-MBA edition 19 (Feb 9 – May 2, 2026): big discounts for early bird.

Tekedia AI in Business Masterclass opens registrations.

Join Tekedia Capital Syndicate and co-invest in great global startups.

Register for Tekedia AI Lab: From Technical Design to Deployment (next edition begins Jan 24 2026).

You may not like those big companies but get it from me: until you have them, your economy will not be redesigned at scale because only them have scale to do really big things. The thousands of “mini-founders” and “mini-entrepreneurs” you have in your village’s open market will not transform that village because at the end of the day, there will be missing columns for taxes and dividends, for governments and investing-public respectively.

Nigeria’s stock market is worth about $50 billion while South Africa’s is about $950 billion. If we extrapolate to parity, we will have 20x Dangote, and if we modulate with our population (3x of South Africa’s), that is 60X. That means, Nigeria should have 60 Dangote Groups and every company listed in our stock market, plus more! That it is not the case is a clear indicator that we’re not firing all cylinders. That must change.

I am reading Bismarck Rewane’s academic tome on Nigeria’s 2024 economic outlook. When I got to this table (on page 12), I paused. If you remove the foreign companies, Aliko Dangote does really well on that chart: the government gets its tax even as investors have tons to share as… pic.twitter.com/5iJ8k250NP

— Ndubuisi Ekekwe (@ndekekwe) January 21, 2024

---

Connect via my

LinkedIn |

Facebook |

X |

TikTok |

Instagram |

YouTube

It takes time to build and grow big companies, and you must be deliberate about it. It behooves on the elite entrepreneurs and founders to separate themselves from the pack, by going on to build big stuff. Nobody needs to be distracted by the noise of treating everyone as equal, there’s no big economy where all the players are treated as equals. To receive some special treatments, you have to distinguish yourself by being very bold when you dream.

When you are building something truly big that matters, at some point, you will qualify for special treatment. It’s always like that.

There’s no time for excuses and complaints, just get on with building, and make sure it’s big and intimidating.

Core capitalists don’t apologize, and they don’t have time for dramas. Just get the job done and enjoy the rewards.

It is interesting the impact that the Dangote Group has had on the economy of Nigeria. The place of big and strong local companies capable of deploying scale to stimulate economic activities and take daring risks within a given economy can not be over-emphasized.

We have seen the developmental and growth roles that big private companies have played in the economies of some Asian nations such as South Korea. Talking about the Samsung, Hyundai, and KIAs of this world.

The Nigerian government must identify key local private companies (national champions) that have shown proven capacity for growth and tactically support them to enhance their growth.

A National Business Competitiveness Council should be set up by the government with the sole aim of identifying and addressing the challenges within the business landscape in Nigeria. This can act as an engine of support for local private businesses to scale up.

Rabo Bank is the second largest bank in the Netherlands and is owned by a co-operative of farmers. Arla Foods of Denmark is owned by a co-operative of Danish dairy farmers. Both entities are huge and global in reach but are owned by what you would have considered “owners too small or fragmented to scale their impact”. The glaring difference is organisation. Nothing stops our Unions or Associations from towing that same path and creating engines of pure growth and scale unmatched by even the largest individual owned companies. Working as a unit, our NURTW can place an order for 10,000 brand new vehicles per annum and distribute same to members. NIPCO PLC is an aggregation in such a manner but they’re struggling to make the sort of impact I suspect you refer to. Organisation is the key.

Secondly, if all the taxes and levies (legal and illegal) paid by these small economic agents are aggregated, I suspect the numbers will amaze us all. Can anyone imagine the efficiency with which road transport union operatives vacuum levies off the operators? Of course, the shadowy figures benefiting also in turn spend it in the economy stimulating demand. It will be interesting to put some numbers and impact measure Ronit all.