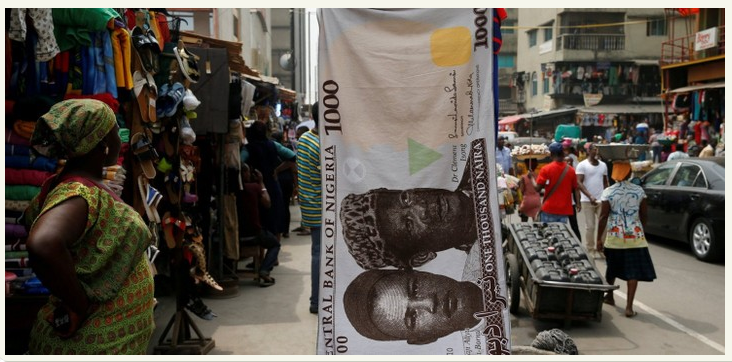

Great comments on my postulation on the new playbook from the Central Bank of Nigeria and my position that we must follow the new strategy with rate reduction. From all the comments, this is the core theme: If the Central Bank of Nigeria reduces interest rates to boost supply towards taming inflation, you cannot guarantee that the demand side will remain the same.

My Response: Sure, I cannot guarantee that Demand will remain the same but note that interest rate changes do not affect consumer demand that much in Nigeria since we have a limited consumer lending system. In other words, when we change rates, we are merely affecting companies as they’re really the entities which actually borrow in Nigerian banking. (Also, my assumption is that the new CBN policy of focusing on strategic advisory over mindless injection of cash via Ways and Means will be implemented, taking out government spending along with it.)

Yes, the irony is that only companies can actually drive production (which boosts Supply) and that is why using the increase of rates to fight inflation in Nigeria has not been effective. Contrast this with say the United States where consumer lending is massive via credit cards, etc. There when rates go up, you influence Demand significantly, making it possible to cool down inflation.

Register for Tekedia Mini-MBA edition 19 (Feb 9 – May 2, 2026): big discounts for early bird.

Tekedia AI in Business Masterclass opens registrations.

Join Tekedia Capital Syndicate and co-invest in great global startups.

Register for Tekedia AI Lab: From Technical Design to Deployment (next edition begins Jan 24 2026).

Our strategy cannot mirror the US or economies with developed consumer lending because higher rates punish those who are to boost Supply which is vital for us to reduce inflation. It is social science and I challenge the central bank to try this for 6 months, at least in Oriendu Market Ovim.

How Do You Implement These New Rates?

To avoid abuse where people get cheap money and indulge in new SUVs and yachts, go through trade unions, making it clear that only members of say Manufacturers Association of Nigeria can get those cheap loans. Also, the lower rate funds should be used for financing equipment & machinery, and working capital, and not frivolities like first class air tickets, SUVs, and golden parachutes. The end goal here is to boost Supply which is necessary if we hope to tame inflation.

Today, our strategy through rate hikes is to reduce Supply even when we have minimal impact on consumer Demand which is a critical component of inflation especially food inflation.

---

Connect via my

LinkedIn |

Facebook |

X |

TikTok |

Instagram |

YouTube

Simply put: lower interest rates targeted at financing production, and not consumption. Most of what we do in Nigeria is to finance and subsidize for consumption, that is why we keep getting poorer. The minds are twisted, and it’s impossible to make progress where twisted minds abound.