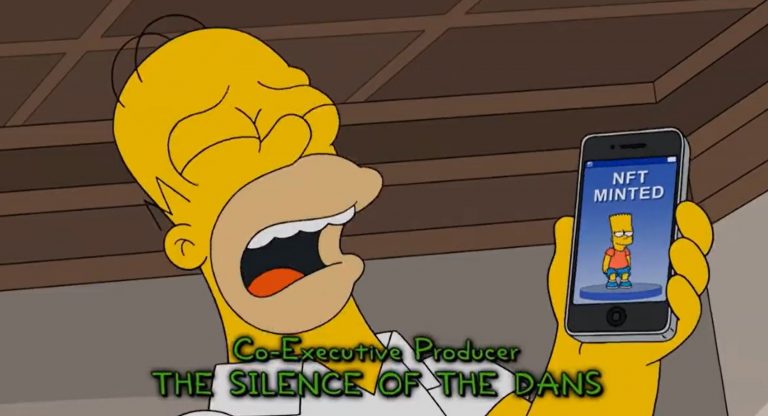

The Simpsons, the longest-running animated sitcom in history, has recently released a new video that features various NFTs themed arts. The video, titled “Crypto in Springfield”, is a parody of the popular Netflix documentary series “Explained”, and it humorously explains the concept and history of cryptocurrencies and NFTs.

The video showcases some of the most famous NFTs in the crypto space, such as CryptoPunks, Bored Ape Yacht Club, and Beeple’s “Everydays”. It also references some of the celebrities and influencers who have been involved in the NFT craze, such as Elon Musk, Snoop Dogg, and Paris Hilton. The video also pokes fun at some of the controversies and challenges that the NFT industry faces, such as environmental impact, security breaches, and legal disputes.

The Simpsons is not the first mainstream media to feature NFTs in its content. Earlier this year, Saturday Night Live aired a skit that explained NFTs through a rap song. The skit also featured some of the iconic NFTs, such as Nyan Cat and Grumpy Cat. Moreover, South Park, another popular animated sitcom, also made an episode that satirized the NFT hype and its social implications.

Register for Tekedia Mini-MBA edition 19 (Feb 9 – May 2, 2026): big discounts for early bird.

Tekedia AI in Business Masterclass opens registrations.

Join Tekedia Capital Syndicate and co-invest in great global startups.

Register for Tekedia AI Lab: From Technical Design to Deployment (next edition begins Jan 24 2026).

The Simpsons’ video is a testament to the growing popularity and awareness of NFTs among the general public. It also demonstrates how NFTs can inspire creativity and innovation in various forms of art and entertainment. As more and more people become interested in NFTs and their potential, we can expect to see more NFTs themed arts in different media platforms and genres.

NFTs in The Simpsons?

NFTs, or non-fungible tokens, are digital assets that represent unique and scarce items such as art, music, videos, or collectibles. They are created and stored on a blockchain, which ensures their authenticity and ownership. NFTs have become a popular way for artists and creators to monetize their work and connect with their fans.

But what if NFTs were introduced in the world of The Simpsons, the longest-running animated sitcom in history? How would the characters react to this new phenomenon? And what kind of NFTs would they create or buy?

Here are some possible scenarios:

Homer Simpson, always looking for a quick buck, decides to sell his famous “D’oh!” catchphrase as an NFT. He hopes to make millions from his loyal fans, but soon realizes that he has to pay a hefty fee to the blockchain network every time he says it. He ends up losing more money than he earns and becomes frustrated with the technology.

Marge Simpson, who loves painting and art, discovers that she can create and sell her own NFTs online. She uploads some of her portraits of her family and friends and is surprised by the positive feedback and bids she receives. She enjoys the creative freedom and the recognition, but also worries about the environmental impact of NFTs and the security of her digital wallet.

Bart Simpson, the prankster and troublemaker, sees NFTs as an opportunity to cause some chaos. He hacks into the Springfield Elementary School’s computer system and creates fake NFTs of Principal Skinner’s embarrassing photos and videos. He then auctions them off to the highest bidder, hoping to expose Skinner’s secrets and humiliate him. However, he is caught by Lisa Simpson, who is an avid supporter of NFTs and blockchain technology.

Lisa Simpson, the smart and socially conscious one, is fascinated by NFTs and their potential to revolutionize the world. She believes that NFTs can empower artists, creators, and activists to express themselves and raise awareness about important issues. She creates her own NFTs of her saxophone solos, her essays on various topics, and her campaigns for animal rights and environmental protection. She also educates others about the benefits and challenges of NFTs, and advocates for more sustainable and ethical practices.

Maggie Simpson, the baby of the family, is too young to understand what NFTs are. However, she accidentally becomes an NFT star when Homer uploads a video of her sucking on her pacifier as an NFT. The video goes viral and attracts many buyers who find it adorable and hilarious. Maggie becomes famous overnight but remains oblivious to her fame and fortune.

Hong Kong evaluating possibility of permitting Spot Bitcoin ETFs and Buy Options for Investors

Hong Kong is considering allowing Bitcoin and other digital assets to be traded on its stock exchange, according to Bloomberg. This would make it one of the first major financial hubs to embrace cryptocurrency ETFs, which are funds that track the performance of a basket of cryptocurrencies.

Cryptocurrency ETFs have been gaining popularity among investors who want to diversify their portfolio and gain exposure to the fast-growing crypto market without having to buy and store the underlying assets themselves. However, they also face regulatory hurdles and challenges in terms of liquidity, security and transparency.

Hong Kong’s Securities and Futures Commission (SFC) has been studying the feasibility and risks of allowing cryptocurrency ETFs to be listed and traded on its platform, Bloomberg reported, citing people familiar with the matter. The SFC has not made any official announcement or decision on the matter yet, but it is expected to consult with the industry and the public before making any policy changes.

Hong Kong to allow regular investors buy Bitcoin and crypto ETF

The SFC issued a consultation paper on November 3, 2023, proposing to amend the existing rules on investment products that track digital assets. The proposed changes would enable retail investors to buy and sell crypto ETFs that are authorized by the SFC and listed on the Hong Kong Stock Exchange (HKEX).

Crypto ETFs are funds that track the performance of a basket of cryptocurrencies or crypto-related assets, such as mining companies or blockchain firms. They offer investors exposure to the crypto market without having to buy, store or manage the underlying assets directly.

Currently, only professional investors with at least HK$8 million (US$1 million) in assets are allowed to invest in crypto ETFs in Hong Kong. The SFC said that the new framework would open up the market to a wider range of investors, while ensuring adequate investor protection and market integrity.

The SFC said that it would apply the same regulatory standards and requirements to crypto ETFs as it does to conventional ETFs, such as disclosure, valuation, custody, risk management and compliance. However, it also said that it would impose additional conditions on crypto ETFs, such as:

The crypto ETF must have at least one market maker to provide liquidity and price discovery. The crypto ETF must use a regulated custodian to safeguard the crypto assets and conduct regular audits. The crypto ETF must have a robust system to monitor the trading activities and prices of the underlying crypto assets and report any suspicious transactions or market manipulation. The crypto ETF must disclose the risks and characteristics of the crypto assets and the ETF structure to investors in a clear and prominent manner.

The SFC said that it welcomes comments from the public and the industry on the proposed amendments until December 31, 2023. It said that it aims to finalize and implement the new framework in the first half of 2024.

The SFC’s move is seen as a positive step for the development of the crypto industry in Hong Kong, as it would increase the accessibility and legitimacy of crypto assets for investors. It would also enhance Hong Kong’s competitiveness as a leading financial hub in Asia, as other jurisdictions such as Singapore, Canada and Switzerland have already launched or approved crypto ETFs for retail investors.

If Hong Kong approves cryptocurrency ETFs, it could boost its competitiveness as a global financial center and attract more investors and innovation to its crypto sector. It could also set a precedent for other jurisdictions that are looking to regulate and legitimize the crypto industry.