On January 19th, the US- Security and Exchange Commission ‘SEC’ charged Nexo Protocol with failing to register its retail crypto lending product before offering it to the public, bypassing essential disclosure requirements designed to protect investors, said SEC Chair, Gary Gensler.

Following the developments Nexo was fined by SEC along with other State regulatory agencies and has agreed to Pay $45 Million in Penalties and Cease Unregistered Offering of Crypto Asset Lending Products.

The North American Securities Administrators Association (NASAA) said in its statement that the settlement in principle comes after investigations into Nexo’s alleged offer and sale of securities after the past year of investigations. “During the investigation, it was discovered that EIP investors could passively earn interest on digital assets by loaning those assets to Nexo.”

Register for Tekedia Mini-MBA edition 19 (Feb 9 – May 2, 2026): big discounts for early bird.

Tekedia AI in Business Masterclass opens registrations.

Join Tekedia Capital Syndicate and co-invest in great global startups.

Register for Tekedia AI Lab: From Technical Design to Deployment (next edition begins Jan 24 2026).

Nexo maintained total discretion over the revenue-generating activities utilized to earn returns for investors. The company offered and promoted the EIP and other products to investors in the U.S. via its website and social media channels suggesting in some instances that investors could obtain returns as high as 36%,” NASAA stated.

In a January 19 tweet, Nexo had tweeted to its 290k followers that they had reached a final landmark resolution with the SEC and NASAA. The statement further clarified that U.S. federal regulators did not allege that the company had engaged in any fraud or misleading business practices.

Nexo has reached a final landmark resolution with the U.S. Securities and Exchange Commission (SEC), the North American Securities Administrators Association (NASAA), consisting of all 50 U.S. States & 3 territories and the Attorney General of New York.?https://t.co/modjbPsOdV

— Nexo (@Nexo) January 19, 2023

The SEC stated that in the settlement negotiations, the commission took into consideration the level of cooperation and the remedial acts promptly undertaken by Nexo in addressing their shortfalls.

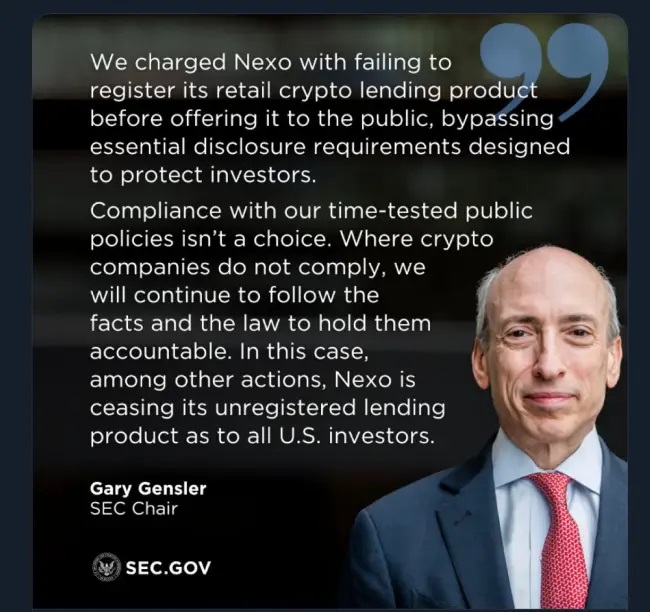

SEC Chairman Gary Gensler said:

We charged Nexo with failing to register its retail crypto lending product before offering it to the public, bypassing essential disclosure requirements designed to protect investors.

Gensler, went on to say “Compliance with our time-tested public policies isn’t a choice. Where crypto companies do not comply, we will continue to follow the facts and the law to hold them accountable. In this case, among other actions, Nexo is ceasing its unregistered lending product as to all U.S. investors,”

While the firm didn’t admit or deny the findings from the SEC’s investigation, the Nexo settlement came on the back of a cease-and-desist order prohibiting the firm from violating any provisions of the Securities Act of 1933.

NASAA explained that the investigation was conducted by at least 17 separate state securities regulators, who agreed to the terms set out in the settlement.

Jeremy Hogan Partner at Hogan & Hogan said; The SEC charged NEXO for its “lending product,” and settles with them the same day. A $45 million collection. But isn’t NEXO an exchange? What about the numerous “securities” that NEXO is unlawfully selling to U.S. citizens? That’s okay now??