The President Buhari administration has been described as incompetent, as the nation’s currency, the Naira, is currently a mess, among several other problems.

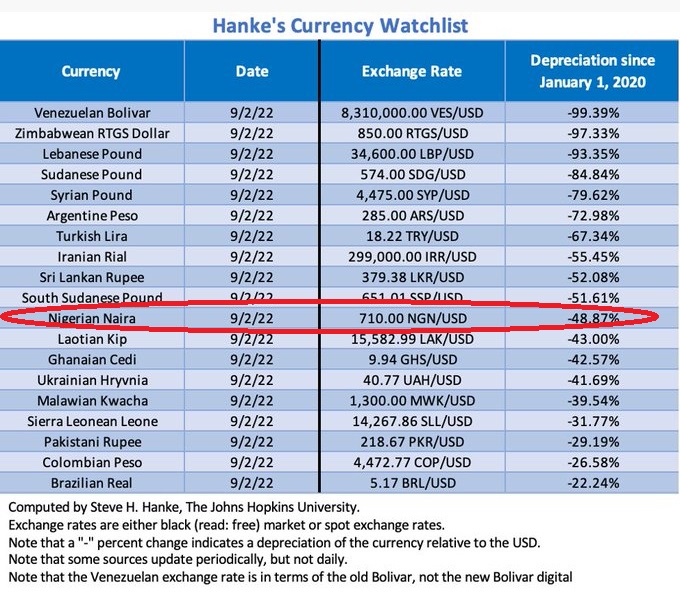

According to Hanke’s Currency watchlist, compiled by Steve Hanke and John Hopkins University, it revealed the Naira ranked as the 11th worst-performing currency in the list of 19 worst performing currencies in the world and the fourth worst in Africa.

According to the data, the Naira had lost 48.87% of its value against the US dollar as of September 2, 2022, compared to its value in January 2020.

Register for Tekedia Mini-MBA edition 19 (Feb 9 – May 2, 2026): big discounts for early bird.

Tekedia AI in Business Masterclass opens registrations.

Join Tekedia Capital Syndicate and co-invest in great global startups.

Register for Tekedia AI Lab: From Technical Design to Deployment (next edition begins Jan 24 2026).

Steve H. Hanke a professor of Applied Economics expressed his displeasure about how the Nigerian government is handling the Naira.

The Laotian kip is yet another central bank junk currency. In this week Hanke’s #CurrencyWatchlist, #Laos takes the 12th place. Since Jan. 2020, the Laotian kip has depreciated against the USD by 43%. pic.twitter.com/R8kixCJfS5

— Steve Hanke (@steve_hanke) September 5, 2022

He said;

“In this week’s Hanke’s #CurrencyWatchlist, Nigeria takes the 11th place. The naira has depreciated against the USD by 48.87% since Jan 2020. With Sleepy Buhari at the helm, the Nigerian naira is tanking.”

The exchange rate between the naira and the US dollar has plummeted from N565/$1 to N705/$1, representing a N140/$ loss year to date in the black market.

Amid double-digit inflation, Nigeria’s foreign reserves are dwindling as the government races to shore up a swooning currency.

Despite the numerous attempts by the Central Bank Of Nigeria CBN, to make the naira stable, the currency has continued to decline.

To defend the Naira, the Apex Bank introduced a slew of regulations, from barring the sale of dollars to BDCs to the RT200 scheme, which is designed to provide an N65 rebate on export revenues.

Nonetheless, its intervention comes at a cost in terms of Nigerian foreign reserves, which have not been growing at the expected rate despite high oil prices.

However, the CBN has maintained artificial stability in the official forex window by selling foreign exchange from its reserves.

The official exchange trades at around N430/$, expanding the gap between the official market and black market Consequently, Nigeria’s external reserves shrank by $1.496 billion year to date.

On a year-to-date basis, the reserve has reportedly lost $1.37 billion from $40.52 billion in December 2021 to $39.16 billion in June 2022. In the month of June, the external reserve gained $671.63 million, following a $1.1 billion decline in the previous month.

The drop in reserves is even more concerning given the recent spike in crude oil prices. International organizations have continually advised the CBN to abolish the official window.

Recall that the Vice President of Nigeria held a meeting with the World Bank Group President, David Malpass who advised Nigeria on the exchange rate unification.

President Malpass emphasized to the VP that a unified exchange rate will significantly improve the business-enabling environment in Nigeria, attract foreign direct investment, and reduce inflation.

He also discussed the importance of increasing domestic revenues through broadening Nigeria’s tax base and increasing the efficiency of tax administration.

What Countries Listed In The Worst Performing Currencies Should Expect

Financial experts believe that countries with worst performing currencies should expect the following;

-

Reduction in foreign direct investment.

-

Massive capital flight

-

Increase inflation

-

Reduced economic growth

-

Reduced GDP (gross domestic product)

-

Increase graduate unemployment

-

Reduction in government’s expenditure on infrastructure projects

-

Unstable prices of commodities make it difficult for any meaningful planning

-

Reduction in trade volume

-

Increase hardship in countries coupled with increasing crime rate etc.