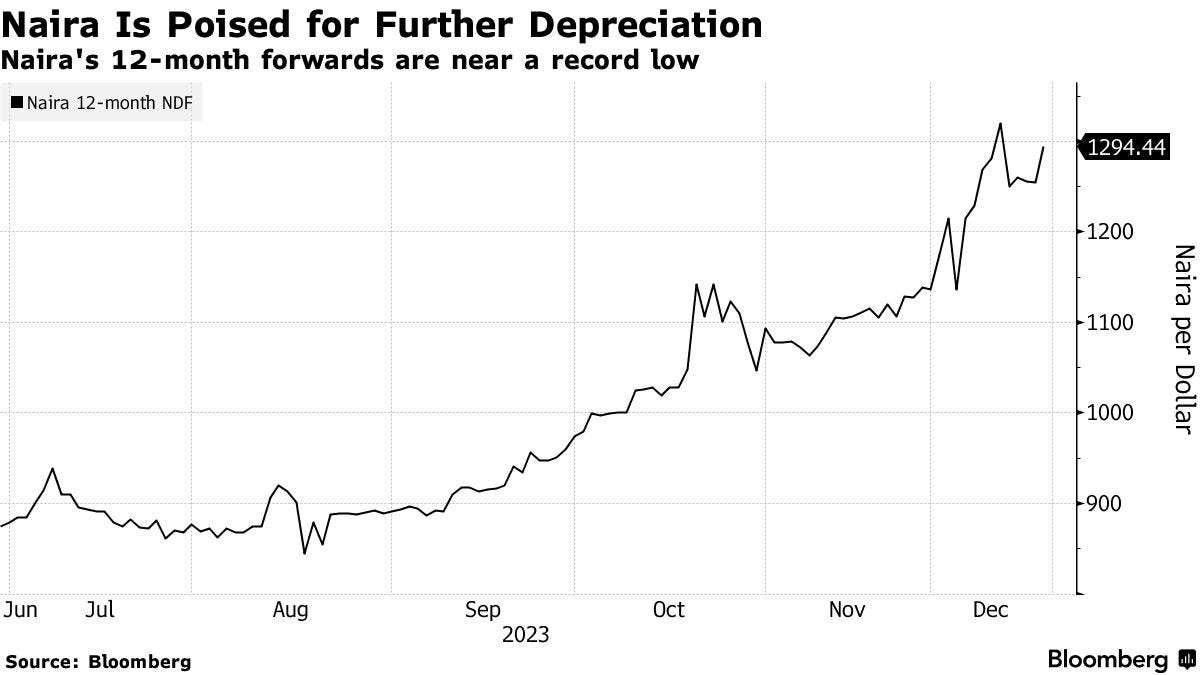

The naira, Nigeria’s currency, has been on a downward spiral since the beginning of the year, losing more than 40% of its value against the US dollar. This is the worst performance of the naira since 1999, when the country returned to democracy after decades of military rule.

What are the causes and consequences of this currency crisis, and is there any hope for a recovery in the near future?

The naira, Nigeria’s official currency, has been on a downward spiral since the beginning of the year, losing more than 30% of its value against the US dollar. This is the worst performance of the naira since 1999, when the country returned to democracy after decades of military rule.

Register for Tekedia Mini-MBA edition 19 (Feb 9 – May 2, 2026): big discounts for early bird.

Tekedia AI in Business Masterclass opens registrations.

Join Tekedia Capital Syndicate and co-invest in great global startups.

Register for Tekedia AI Lab: From Technical Design to Deployment (next edition begins Jan 24 2026).

The naira’s woes are largely driven by the collapse of oil prices, Nigeria’s main source of foreign exchange, as well as the impact of the COVID-19 pandemic on the economy. The Central Bank of Nigeria (CBN) has tried to defend the naira by devaluing it twice this year, but this has not stopped the pressure on the currency.

The CBN also maintains multiple exchange rates, which create distortions and inefficiencies in the foreign exchange market. The naira trades at different rates in the official, parallel, and interbank markets, creating opportunities for arbitrage and speculation.

The CBN has also imposed various restrictions on access to foreign exchange for certain imports and transactions, in a bid to conserve its dwindling reserves. However, these measures have not been effective in curbing the demand for dollars, as importers and investors seek alternative sources of foreign exchange.

The outlook for the naira remains bleak, as oil prices are expected to remain low for the foreseeable future, and the economy is projected to contract by 4.3% this year, according to the International Monetary Fund (IMF).

The IMF has urged Nigeria to unify its exchange rates and adopt a more flexible exchange rate regime, as well as implement structural reforms to diversify its economy and boost its competitiveness.

However, the CBN has resisted these recommendations, arguing that they would lead to further inflation and hardship for Nigerians. The CBN governor, Yemi Cardoso, has said that the naira is “appropriately priced” and that there is no need for further devaluation. He has also vowed to continue to intervene in the foreign exchange market to support the naira.

However, analysts and observers doubt that the CBN can sustain this strategy for long, given its limited reserves and the persistent gap between the official and parallel rates. They warn that unless Nigeria addresses its underlying economic challenges and adopts a more market-driven exchange rate policy, the naira will continue to depreciate and erode Nigerians’ purchasing power.