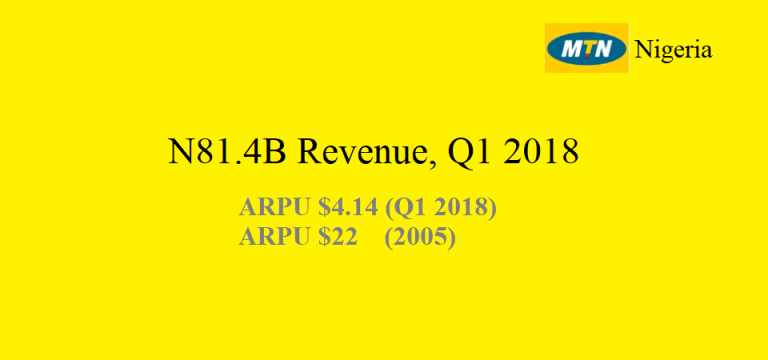

Here, relying on the Q1 2018 MTN Group financial reports, I present the extracted numbers for MTN Nigeria. MTN Nigeria made N81.4 billion (about $225.7 million using reported exchange rate) in the first quarter of 2018 on its 54.5 million subscribers.

(You are reading this post as I am doing my research to decide if MTN Nigeria is a good deal when it begins to trade on the Nigerian Stock Exchange. I will not make that call public here as it would be irresponsible.)

MTN NIGERIA – SUMMARY (From the Report)

MTN Nigeria continued with the positive momentum of 2017, increasing service revenue by 14,4% YoY, led by a 73,2% increase in data revenue and 15,2% growth in voice revenue. While the increase in voice revenue was encouraging, it was supported by the lower customer spend on VAS. As growth in our digital services is expected to resume in the latter part of the year, this may impact growth rates in voice revenue.

Register for Tekedia Mini-MBA edition 19 (Feb 9 – May 2, 2026): big discounts for early bird.

Tekedia AI in Business Masterclass opens registrations.

Join Tekedia Capital Syndicate and co-invest in great global startups.

Register for Tekedia AI Lab: From Technical Design to Deployment (next edition begins Jan 24 2026).

MTN Nigeria reported net additions in the quarter of 2,3 million following on from the 2,0 million adds in 4Q17 as the business benefited from the increase in our SIM registration footprint.

ARPU

MTN Nigeria has ARPU (average revenue per user) of N1500 – about $4.14 – in Q1 2018 [see the second table below, MTN used the black market rate which makes sense as it would have had to buy dollars from the black market to ship any money from Nigeria to South Africa]. Currency fluctuation is a big issue when you look at the USD table where even though MTN Nigeria had better ARPU in Q1 2018, in Naira, the amount in USD was lower than the one recorded for Q4 2017 ($4.14 vs. $4.24)

Total Revenue for Q1 2018

If MTN had ARPU (see above) of $4.14 for the 54,528,527 subscribers it recorded for Q1 2018, the implication is that MTN Nigeria made a revenue of $225,748,101.78 for the quarter. In Nigeria, using the reported ARPU in Naira, the revenue was N81,411,090,811 (simply N81.4 billion) for the quarter. (For comparison sake, GTBank made N44.7 billion on profit before tax [note PBT] in the same quarter, implying that GTBank made more than half of MTN Nigeria’s revenue as PROFIT.)

The WhatsApp and OTT Problem

To help me understand the impact of WhatsApp and other OTT solutions, I pulled MTN Group financial report in 2006. In 2005 (yes 2005), MTN Nigeria was recording ARPU of $22. Today, it is $4.14. Sure, competition has a huge role there but I do think the OTT services are largely to be blamed. When the ARPU dropped to $18 in 2006, we already had Glo and Airtel (you take the name, Econet, Zain, Celtel etc). So, the reduction of ARPU is not just on direct industry competition, the OTT is having a real effect.

Nigeria In an exceptional performance, MTN Nigeria increased its subscriber base by 47% over the prior reported period, recording some 3,9 million net connections for the year with more than 12,3 million subscribers at year-end. In addition, MTN Nigeria recorded market share of 46% and reduced churn levels from 35% to 30%. This performance was largely due to the successful introduction of a segmented value proposition and distributor campaigns. ARPU declined by 18% from US$22 in the prior year to US$18, consistent with increased penetration and reflecting the continued acquisition of subscribers at the lower end of the market.

All Together

The MTN Nigeria numbers are not necessarily great. As they share more financial information for the expected listing on the Nigerian Stock Exchange, we would understand this business better. Honestly, I had expected MTN Nigeria to be closing at least N100 billion per quarter on revenue. This WhatsApp thing is indeed real, I must note. Generating N81.4 billion from 54.5 million subscribers every quarter is not that stellar after all the campaigns, bonuses, promotions, etc. There is something fundamentally missing in the purchasing power in Nigeria. That people spend mere N500 on phone and data services per month (for the total of N1500 quarterly), on average, on MTN ecosystems, means the real talking should focus on economic empowerment. Who knows what is happening in Glo, Airtel and 9Mobile if MTN Nigeria looks this way?

You can download the MTN quarterly result here.

UPDATE

MTN Nigeria responded informing me of this link. In that link, the company made a service revenue of N248.3 billion for Q1 2018. I have asked them to correct what was published in the Johannesburg Stock Exchange financial report as both do not align.

- MTN Nigeria reported strong subscriber net additions of 2,3 million

- Active Mobile Money customers increased to 2,0 million

- Naira service revenue increased by 14,5% to N248,3bn

- Data revenue increased by 73,2% year-on-year

- EBITDA margin increased by 332bp to 41,8%

- MTN Nigeria invested N17,9bn in capex in the period

COMMENTS FROM LINKEDIN FEED.

These are some comments from LinkedIn feed of this piece.

- While I enjoyed reading the dimension you took to explain the financial report, I will add to your piece with my understanding of the issues in relation to the multi dimensional factors. There are many factors that have lead to the decline in ARPU. As at 2005, the competition wasn’t stiff, some of the call rates were over priced, exchange rate of $1/N133.5 and today it’s $1/N375, the subscriber base was actually less, we didn’t have the so powerful smartphones that gave the platform for alternative way of communicating, data subscription wasn’t as high as 2018 and finally the mobile operators network wasn’t even robust enough to support large consumption of data. e.t.c Using one of the indices(exchange rate) you will realize that ARPU should be about $12, and with increase in subscriber base it should be higher, but a downward review in call rates to about less 40/50% has a major role to play. A shift in strategy is required just like declaring a state of emergency. If MTN has about 50m subscriber base(Mobile) what percentage of homes are they connecting or are connected? In relation to the Nigerian population and also the data being published by NCC, you would realize that we have over 120million subscriber base. Page 1

- Too many things to deduce from the piece, but I will keep it simple:Nigeria and Nigerians’ money (or wealth) appears to be imaginary all the time, the ecommerce operators aren’t seeing the numbers, the telcos aren’t seeing them. Bank’s numbers are highly deceptive, because it’s possible that less than 10% of its customers are generating more than half of the revenues and subsequent profits.There is dearth of knowledge and awareness in the land, many people keep thinking that MTN and others are raking in huge (or even YUGE) profits, while forgetting the business environment, security, cost of doing business, and the disproportionate purchasing parity between the rich and the poor here.Huge population figures are only useful when the majority of the citizens are empowered, with decent standard of living and disposable incomes. The illusory belief that our numbers are huge potentials must cease, the country is simply nowhere in terms of productivity and purchasing power. The few wealthy people aren’t enough to compensate for the millions of poor people in the land.This is a country with annual budget of less than $30 billion, and we keep hearing that we are very rich. Simply, Nigeria is way below expectations!

---

Connect via my

LinkedIn |

Facebook |

X |

TikTok |

Instagram |

YouTube