I learn today that the IMF have an indicator as part of its 2030 Sustainable Development Goals (SDGs) program. The program came into force in September 2015.

The world economic forum, one month before the launch said: ‘SDGs are likely to fail unless far more attention is given to addressing governance challenges crucial to their implementation.

In the broadest sense, governance refers to how societies make decisions and take action. It is about the mechanisms we use to work together in society to solve shared problems. For the SDGs, this involves considering how government, business, non-governmental organizations, civil society and researchers will work together’

Register for Tekedia Mini-MBA edition 19 (Feb 9 – May 2, 2026): big discounts for early bird.

Tekedia AI in Business Masterclass opens registrations.

Join Tekedia Capital Syndicate and co-invest in great global startups.

Register for Tekedia AI Lab: From Technical Design to Deployment (next edition begins Jan 24 2026).

Economies and socio-political landscapes with challenges, such as Nigeria, can end up chasing their tails bewildered by conflicting requirements.

World Economic Forum goes on to describe potential conflicts: ‘ Biodiversity could be threatened if forests are cut down to expand agricultural production for food security. Food security could be threatened if food crops are switched to biofuel production for energy security. Water security could be threatened by decisions to intensify or expand agriculture, or to build hydropower for energy security and greenhouse gas mitigation’

The newly reported decline in Nigeria’s Sustainable Development Goal (SDG) credentials relates to banking.

According to a News Express Nigeria breaking report, the ‘IMF, yesterday, said that Nigerian banks closed 234 branches and 649 Automated Teller Machines, ATMs, in 2020 leading to a decline in the country’s Financial Access Score (FAS) to 4.44 in the year against 4.78 in 2019…

Target 8.10 of the 2030 SDGs is to improve domestic, i.e. personal/consumer institutions capacity to expand access to banking and financial services.

Now the SDG Fund describes itself as a set of ‘results-oriented and people-centred UN programmes’

‘This is how the SDG Fund brings together UN agencies, governments, businesses and civil society to advance the 2030 Agenda for Sustainable Development. We work on the ground with local partners to maximize our impact…..

We work to improve the lives of people and fight poverty’

A key word here is results-oriented.

This author may not have experience of SDG applications or know how they work, however, any reasonable interpretation of ‘results-orientated’ means that the more a country achieves in SDG, the more it is likely to be favoured for future funding.

Regressing in Target 8.10 metrics is the complete opposite to results.

In many of his articles, for Tekedia Institute and further on LinkedIn, Prof. Ndubuisi Ekekwe monitors, tracks and reports on Nigeria’s Fintechs And Digital Challenger Banks

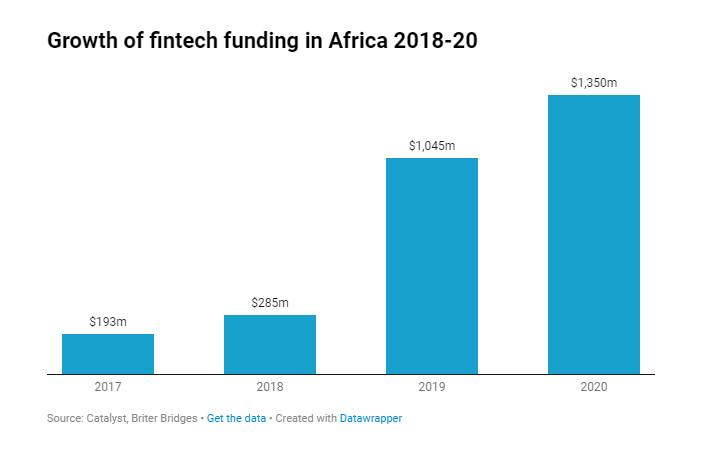

A report published by data research company Briter Bridges and the tech accelerator Catalyst Fund in May concluded that Fintech funding in Africa increased from $1bn in 2019 to $1.35bn last year, with Nigeria leading the way.

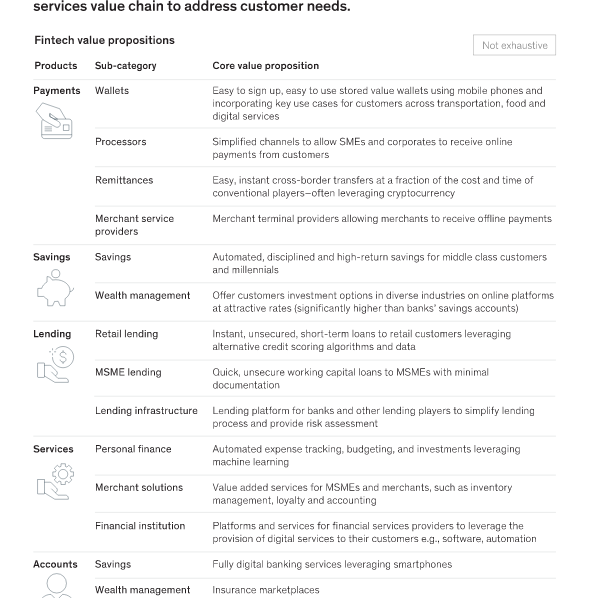

Clearly they have carved out their place in the consumer and personal banking market in Nigeria and the ‘shop front’ and ATM related banking services have had to reduce footprint consistent with transaction contraction.

This mostly impact on Lagos, Abuja, and the GRA and connectivity centric areas of other state capitals where 4G signal is good.

So the over-riding question… Is it fair to Nigeria that Target 8.10 of the 2030 SDGs does not acknowledge and embrace the existence of Fintech and Digital Challenger Banks?

Acknowledgements/References/Further reading:

www.tekedia.com/ways-nigerias-fintechs-and-digital-challenger-banks-can-comply-with-cbn-latest-directive-on-microfinance-banks/

www.weforum.org/agenda/2015/08/3-challenges-facing-the-uns-sustainable-development-goals/

//newsexpressngr.com/news/136691-Nigerian-banks-closed-234-branches-649-ATM-IMF-

www.sdgfund.org/

www.fintechdirect.net/2020/06/04/new-challenger-bank-sparkle-s-in-nigeria/

nigeriafintechweek.org/

www.mckinsey.com/featured-insights/middle-east-and-africa/harnessing-nigerias-fintech-potential

african.business/dossiers/fintech-africa/

Lead illustration is from ‘Capital Monitor’ site featuring Eric Odhiambo, Ecobank’s CRO – Ecobank raised $350m with the first sustainable bond to be issued by an African bank, which was some four times oversubscribed.

While I applaud to exploits of new players on Nigeria’s tech scene, I remain curious as to when these digital startups would begin to be at the heart of these products rather than at the margins of processing transactions for the real actors (and winners). Let me cite just one example that keeps me up at night. Where are the Nigerian or indeed African, streaming services? How long will the continent continue to serve as a vehicle for the majors (e.g., Netflix and Amazon Prime etc.) on their turf? While I await a response can I also ask what African countries engage with PayPal and on what level? Overall, I’m not really in a celebratory mood. Convince me about the real value addition.

Thanks for the comment Nnamdi, though the issue at stake here is Eligibility for SDG funding. There are a wide range of considerations under the SDG targets. One of them is fair access to banking services. ATM and over-the-counter availability has contracted, though this isn’t the full picture as some users have shifted to Fintech. So overall, provision in Nigeria probably has not gone down. The SDG program does not acknowledge the Fintechs existence and Nigerian applicants for funding may be unfairly penalized. Fairness of the SDG Grant program is the thesis of the piece.

There is no requirement that I know of, in the SDG grant program in respect of streaming services.

As to why no streaming services exist, I would say it is probably because of the lack of unmetered data packages. Streaming an average movie at 720p uses about 1.5G of data while at 1080 takes nearly 4G, so in a metered environment, the customer would be paying twice, once for the streaming service, and once for the data to their data provider to support the transfer.

People like MultiChoice and DSTV will always make money while data is metered as they provide the data transport medium themselves.

An announcement today by Nigerian Communications Commission (NCC) said 3.5Ghz 5G spectrum will go on auction on December 13, so if they take their finger out, winners should get 5g in place at least by third quarter next year. Whether their pricing strategy will incorporate an unmetered product in the portfolio will remain to be seen. Thanks