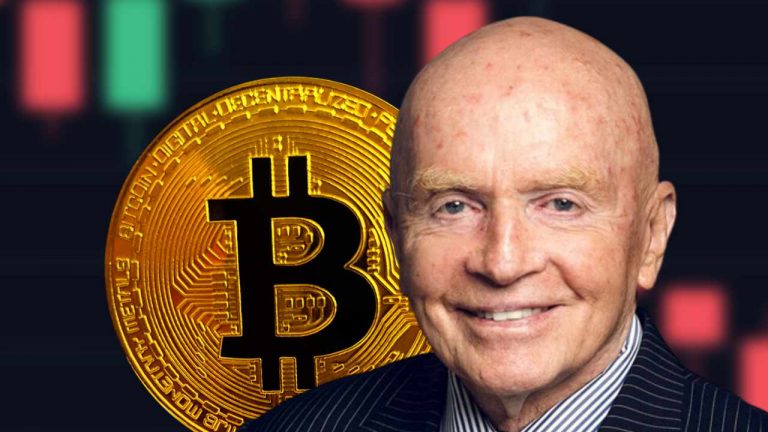

Veteran investor and founder of Mobius Capital Partners LLP, Mark Mobius has predicted that the price of Bitcoin will plunge to an all-time low of $10,000.

He disclosed that the price of Bitcoin will fall more than 40%, adding that he wouldn’t dare invest his cash or client’s asset in the digital asset, due to how dangerous he described it to be.

The veteran investor seems to be spot-on in his predictions concerning the crypto asset, as he had earlier predicted correctly that the price of Bitcoin would drop to $20,000 this year, with his recent prediction of it dropping further.

Register for Tekedia Mini-MBA edition 19 (Feb 9 – May 2, 2026): big discounts for early bird.

Tekedia AI in Business Masterclass opens registrations.

Join Tekedia Capital Syndicate and co-invest in great global startups.

Register for Tekedia AI Lab: From Technical Design to Deployment (next edition begins Jan 24 2026).

In his words, “With higher interest rates, the attraction of holding or buying Bitcoin or other cryptocurrencies becomes less attractive since just holding the coin does not pay interest.

“Of course, there have been a number of offerings of 5% or higher interest rates for crypto deposits but many of those companies offering such rates have gone bust partly as a result of FTX. So as those losses mount people become scared of holding the crypto coin in order to earn interest.”

Mobius also said the boom in crypto was directly related to the Fed’s “printing machine working overtime so that money supply in USD rose by 40% plus in the last few years.

“So there was abundant cash to speculate on the crypto coin,” he added.

Bitcoin is currently trading at $16,845, as the price of the crypto asset has continued to plunge after it fell as much as 3.2% on Monday, a year after it reached a record high of $69,000 in November.

Also, the prices of other crypto assets have declined, as the industry is currently experiencing a massive blood bath.

The massive decline in the price of crypto assets has been attributed to the collapse of the FTX exchange platform, which filed for bankruptcy two weeks ago after it witnessed a massive loss of revenue.

The collapse of the platform has prompted investors to withdraw their assets, which has led to a high decline in the price of crypto assets.

Meanwhile, institutional and retail investors are abandoning crypto in droves, further compounding the industry’s issues. Trust in the industry is currently at an all-time low, and there aren’t enough users to keep every project in the black.

FTX bankruptcy has no doubt sent shockwaves to the industry as major crypto lender BlockFi has filed for bankruptcy.

Also, crypto exchange platform Coinbase halted some trading activity, as well as AAX exchange which suspended withdrawals for seven to 10 days for a scheduled system upgrade to protect users.

The FTX upheaval has been predicted by analysts to affect other cryptocurrency exchanges, as there are speculations that several of them are considering filing for bankruptcy.

As the dust is yet to settle, a far larger question on the mind of every investor is, “Who is next?”

In the past, many had predicted the price of Bitcoin but success has been limited.

Crypto advocate Mike Novogratz dropped his forecast for Bitcoin to climb to $500,000 in five years, citing the Federal Reserve’s interest rate increases.

It will, but “not in five years,” Novogratz said Thursday during an interview on Bloomberg Television. The biggest change that happened is that Fed Chair Jerome Powell found “his central banking superpowers.”

Like most risk assets, Bitcoin has slumped this year because the Fed is raising rates to contain inflation, Novogratz, the chief executive of Galaxy Digital, said.

Bitcoin has tumbled more than 60% this year, dropping to around $17,000. Fallout from the bankruptcy of the FTX exchange last month helped accelerate losses across the cryptocurrency market.

The demise of FTX, along with the collapse of hedge fund Three Arrows Capital and lenders Celsius Network and BlockFi are “certainly hurting the overall confidence in crypto, but that too shall pass,” he said.