By Samuel Nwite

When Facebook announced its ambitious plan on June 18 to create Libra, an alternative crypto financial system that it has been secretly working on for more than two years, it was received with mixed reactions of concern and acceptance. The acceptance came with a force of financial backup from companies and individuals who can’t wait to see Libra become a reality. Uber, Mastercard, Visa, Paypal, Spotify and 22 others threw their weight on it with $10 million each. (73 more companies are expected to join before it kicks off in 2020.) The news and the excitement that it was commanding spread like virus, hitting even those with little or no idea what Libra is all about, or why it should matter to them.

But not for so long, the concerns soon took its turn. On the 3rd of July, the US congress asked Facebook to suspend the implementation of Libra until the ramifications are investigated. Maybe there is more to it than the details are telling. But what could be wrong in such digital alternative financial system? What is the US government scared of?

Register for Tekedia Mini-MBA edition 19 (Feb 9 – May 2, 2026): big discounts for early bird.

Tekedia AI in Business Masterclass opens registrations.

Join Tekedia Capital Syndicate and co-invest in great global startups.

Register for Tekedia AI Lab: From Technical Design to Deployment (next edition begins Jan 24 2026).

Facebook’s planned Libra cryptocurrency faced further opposition on Monday when the US treasury secretary warned about its potential criminal use.

Steven Mnuchin told a press conference it could be used by “money launderers and terrorist financiers” and said it was a national security issue.

He was “not comfortable” about Libra, joining President Donald Trump and the US central bank in voicing concern.

Facebook executives will appear before a congressional committee on Tuesday.

David Marcus, who will oversee Libra, is expected to tell the Senate Banking Committee that Facebook will not launch the currency until regulatory concerns are addressed.

While there is high hope that Libra could become the future power house that Crypto currencies have ever needed, and the foundation for a new financial system not controlled by central Banks or power brokers on Wall Street, the government is seeing a potential threat.

On Friday July 12, the Federal Trade Commission (FTC) handed Facebook approximately $5 billion in fines over the Cambridge Analytica privacy breach that involved the private information of over 50 million Facebook users. That has been the highest sum levied against a tech company, and it set a ‘breach of trust’ precedent that will hunt future innovative initiatives of Facebook, and Libra is becoming such an example. To set the record straight, Facebook has kept a distance from the management of Libra, which is to be run by a nonprofit entity in Switzerland, called the Libra Association, which will be made up by the pioneer members of Libra. (Switzerland was chosen to host Libra because of her neutrality) Facebook’s involvement will be handled through the subsidiary called Calibra. And according to Facebook, Calibra would not be allowed to share users’ financial data with other divisions of Facebook unless there is a case of fraud or other specified instances like for research or adoption measurement. However, such personal data must be shared anonymously, and it’s not compulsory to have Facebook’s social media accounts for you to use Libra. That means, you can easily sign up on Libra or calibra without Facebook or Whatsapp accounts.

This privacy plan should have toned down the volume of curiosity that Libra has generated so far if not that there are loopholes. For instance, while Libra appears to be independent, Facebook has plans for making money from it. Libra wallet is going to be released to the billions of people on Facebook’s platforms, Whatsapp and Facebook Messenger. If there is positive response from them, Facebook will offer financial services such as lending and investing. People are worried that it’s only a matter of time before the status quo is secretly compromised and their privacy will once again be sold or used without their consent.

Reacting to this concern, the head of Libra, David Marcus said in a statement: “we realize that people don’t want their social data and financial data commingled. The reality is, we will have plenty of wallets that will compete with us and many of them will not be in social, and if we want to successfully win people’s trust, we have to make sure the data will be separated.”

This is the reason Facebook created calibra, so that people’s financial data could be handled separately, and their financial information not used for target ads. The Libra currency structure is built on the Blockchain technology, just as Bitcoin. This means that any software Engineer can develop a wallet on the Libra structure that will work for currency transactions. So there will be competition and risk. Shady developers could built an app on the platform (in the guise of financial transactions) but solely to steal people’s information and probably fund.

Is Libra a threat to Fiat?

One of the factors that separate Libra from Bitcoin and other digital coins is that it will have Fiat backing. An idea that will foster the stability of the coin unlike the fluctuating Bitcoin and the rest of the Cryptocoins. But there is a disgruntling murmuring from Banks and other financial institution who stay in business by charging percentages off transactions, especially international transactions. Annually, these financial institutions rake in over $50 billion from charges on transactions. Libra is poised to change that system by creating a very low or no charges on transactions. Moreover, it’s designed to enable micro-transactions worth just a few cents, which is not practical with fiat.

That’s a perceived threat, and to make things worse, financial institutions like MasterCard, PayPal, Visa etc. have signed up to Libra Association. Peter Hazlehurst, head of payments and risks at Uber, said in a statement. “Libra has the potential to bridge the gap between traditional financial networks and new digital currency technology while reducing the costs for everyone, especially consumers.”

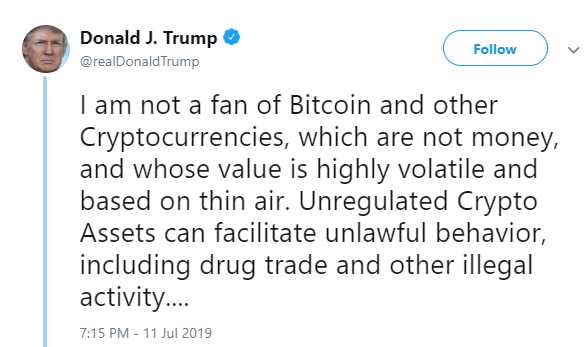

Members of Libra Association also released a statement explaining the aim of Libra, it said: “our hope is to create more access to better, cheaper and open financial services – no matter who you are, where you live, what you do or how much you have.” These statements are explanatory, and should clear some doubts if there is sustainable measure of trust. But there are other concerns, the FTC and other financial regulators are curious about the impact of Libra on money laundering, drugs and illegal arms sales. President Trump isn’t different on this. He tweeted on the 12th of July, “I am not a fan of Bitcoin and other Cryptocurrencies, which are not money, and whose value is highly volatile and based on thin air. Unregulated Crypto Assets can facilitate unlawful behavior, including drug trade and other illegal activities.”

That was a bold statement from a fan of the conventional system, and he echoed the sentiment of so many people who are yet to get even with the digital world, especially when it has to do with money. Although there are answers to these concerns, this people have known the traditional system for a long time to let Libra ruin their relationship. Not even when there is a rule to dismiss such sentiment. The criteria for carrying out a transaction with Libra is a government provided ID, that way, there is identity attached to every transaction, which will make it difficult for it to be used in black market for illegal activities.

The Power Tussle

Another concern that has been expressed about Libra is government’s inability to regulate or control it. President trump added this to his tweet: “Facebook Libra’s ‘virtual currency’ will have little standing or dependability. If Facebook and other companies want to become a bank, they must seek a new banking charter and become subject to all banking regulations, just like other banks, both National and International.”

“We have only one real currency in the USA, and it is stronger than ever, both dependable and reliable. It is by far the most dominant currency anywhere in the world, and will always stay that way. It is called the United States Dollar.”

These tweets suggest two things:

- The President of the United States believes that Libra will usurp the US Dollar from its dominant position and have a far more reaching influence.

- People are concerned that Facebook is acquiring more power with every innovative step it takes. And that, if not curtailed, could pose a danger the US may not be able to contain in the near future.

The deliberation on the ramifications of Libra by the house committee on finance is billed to take place on the 17th of July. The approval of Libra may depend not on its reliability, dependability or privacy issues, but on the premonition of usurpation of power and the US Dollar dominance.

If any of us here head a government or run a central bank, I am not sure if you could see it differently. No government anywhere in this world gives up an inch of its territories, especially when there’s legitimacy to exercise control over these things. This we must understand and appreciate.

Not every innovation is favourable to a Nation State, no matter how beneficial it could be to ordinary citizens, this we must also recognise. Both technology and freedom are still subjects to laws of the land, to believe otherwise is an invitation to chaos.

So let those running governments take all the time they believe is necessary, in order to ask all the questions and investigate where necessary. Humans haven’t reached the level where each individual becomes a government; so there is only one government per defined jurisdiction.

Libra may be useful, but the fellas holding power need to know how useful it is, without posing any serious threat or making them irrelevant.

Many innovations look great on their face value, until you are in government, then you begin to see things differently.

“Not every innovation is favourable to a Nation State, no matter how beneficial it could be to ordinary citizens, this we must also recognise”. That is a new perspective on looking at commerce. We have always extrapolated that what is good for consumers will be fine for nations.