Facilities Management Industry is one of the emerging industries in Nigeria. For more than 10 years, private and public stakeholders have been struggling to make the industry well known and appreciated by the facilities users. Asking the meaning and essence of facilities management would reveal a number of surprising answers from people and business owners, who have not seen the need for the industry. Some are equating facilities management with estate management and project management.

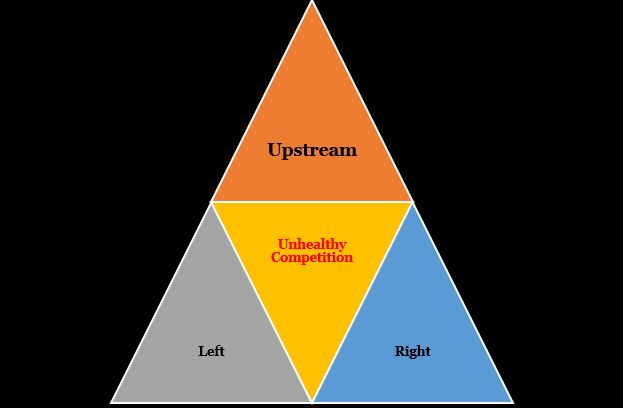

Previous analyses carried out by our analyst established that practitioners need continuous knowledge and skills acquisition towards inclusive value creation and growth. These analyses have also pinpointed areas that players, especially those at the upstream [players with a clear solution delineation and constant innovation] of value capturing, need to work on in order to increase the chance of those at the downstream [players with undefined solution and low in developing innovative solutions].

From left [downstream players] to right [upstream players], the industry is having an unhealthy competition. Unhealthy competition, according to a number of sources, is not appropriate for an emerging industry. Our analysis of the industry in the last few years has indicated this competition permeates most in Lagos, where many players locate their headquarters.

Register for Tekedia Mini-MBA edition 19 (Feb 9 – May 2, 2026): big discounts for early bird.

Tekedia AI in Business Masterclass opens registrations.

Join Tekedia Capital Syndicate and co-invest in great global startups.

Register for Tekedia AI Lab: From Technical Design to Deployment (next edition begins Jan 24 2026).

The nature of unhealthy competition is better understood within the context of creating and delivering solutions. In our experience, downstream players are competing with upstream players by offering solutions they lack the required strategic capital to execute. They are going head-to-head with the established players by acquiring integrated facilities management solutions that need sophisticated strategic capital. Upstream players are competing with downstream players by getting contracts that downstream players should have for rapid scale up.

Little attention is being paid to knowledge production and codification for existing and future practitioners. Collective efforts towards industry growth are minimal. There is a need for knowledge co-creation and sharing among the practitioners and key executive members of the upstream and downstream players. Players and professionals should take cue from South Africa, Egypt and Kenya, where collective efforts paid off after many years of creating and sharing knowledge.

If this competition continues, our analyst expects extinction of a number of players in the downstream by 2025. The players that would be hit hardest are those who offer soft solutions such as cleaning and procurement. These players hardly innovate and communicate with the prospective clients. Instead of concentrating and massing their strategic resources towards delivering these solutions sustainably, they have been discovered to expend them on solutions that should be offered by those at the upstream of the industry.